DISRUPTIVE FORCES SEEN SHAPING THE 2019 INVESTMENT LANDSCAPE

Volatility creates risk but also strategic investing opportunities

Key Insights

- Although the odds of a downturn appear above average given where we are in the economic cycle, we believe a global recession is a relatively low risk in 2019.

- We believe markets will face disruption stemming from diverging monetary policies, technology amplifying valuation disparities, and geopolitical uncertainty.

- Correctly identifying the winners and losers in this era of significant change will be key to investment outperformance.

Disruption in its various forms—technological, political, economic, and monetary—is likely to determine the direction of global financial markets in the coming year, T. Rowe Price experts predict.

With the U.S. moving into the later stages of the business cycle, the U.S. Federal Reserve raising interest rates, and monetary and credit conditions diverging widely across the other major global economies, the potential for renewed volatility in both equity and fixed income markets remains high.

Political risks are adding to the uncertainty. These include the trade dispute between the U.S. and China, the possibility of a disorderly Brexit in March, and renewed fiscal conflict between Italy’s populist government and European Union (EU) officials.

These are among the key observations offered by three leading T. Rowe Price investment professionals—David Giroux, chief investment officer (CIO) for U.S. equity and multi‑asset and the firm’s head of investment strategy; Justin Thomson, CIO, equity; and Andy McCormick, head of U.S. taxable fixed income. McCormick takes over as head of fixed income effective January 1, 2019.

Disruption is shaking markets

The global corporate landscape continues to be transformed by a revolutionary combination of technological innovation and changing consumer preferences, which is upending established business models. Although disruption creates risk, it also can generate potential opportunities for investors with a disciplined strategic approach. Correctly identifying the winners and losers in this competitive struggle will remain the key to portfolio outperformance, Giroux contends.

“I’d argue that the disruptive environment we’re in is why active management will be well positioned over the next decade,” he says. “High‑quality active managers can benefit from having a longer‑term horizon, which allows them to make the kind of investments that potentially will add value in our clients’ portfolios over the next five to 10 years.”

Over the shorter term, however, global investors may need to buckle up, as political, monetary, and trade uncertainty could generate more of the sudden spikes in market volatility seen in 2018. In recent discussions, Giroux, Thomson, and McCormick have identified six key disruptive forces that they believe will play out in 2019 and beyond.

GLOBAL GROWTH MOMENTUM IS SLOWING

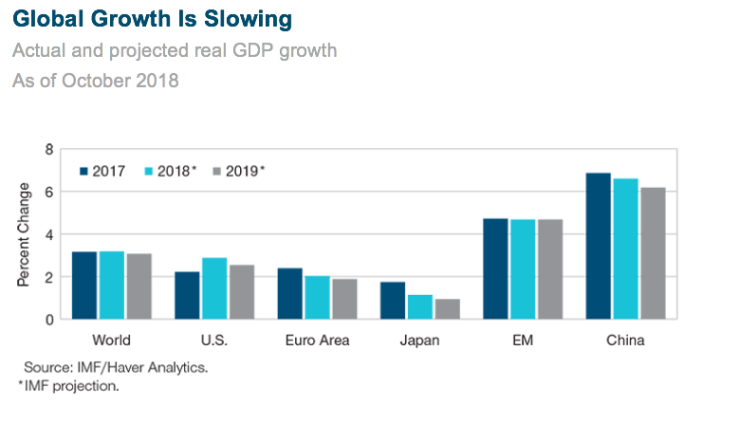

October 2018 forecasts by the International Monetary Fund (IMF) projected that growth will slow across the developed markets and in China in 2019.

While the U.S. is farthest along in the economic cycle, and the risks to growth are tilted to the downside, a healthy private sector, strong consumer demand, and the lingering effects of the 2017 tax cut stimulus should continue to sustain the expansion through the first half of 2019, T. Rowe Price economists say.

European economies are earlier in the cycle, but growth has been slowing since the fourth quarter of 2017, Thomson notes. The UK economy continues to suffer from Brexit uncertainties.

In the eurozone, the German labor market shows some signs of overheating, but unemployment is significantly higher in most other continental economies, curbing inflation pressures but also limiting income gains. Efforts by European households to rebuild savings could dampen eurozone growth in 2019.

The IMF forecasts that Japan, which saw economic momentum slow sharply in 2018, will decelerate further in 2019. On the positive side, Japanese corporate profitability is at an all‑time high, according to Thomson, suggesting the risk of deflation has eased.

Can China Shift Back into Higher Gear?

China’s economic outlook is a particular focus of concern, as official economic reports in late 2018 showed a slowdown in growth. Independent indicators of consumer demand, such as auto sales and Macau casino revenues, also have shown weakness, Thomson says.

“What’s crucial is the extent to which China restimulates,” Thomson adds. “Beijing is trying to reduce indebtedness in its corporate sectors. But they do have scope for selective tax cuts in certain areas, or for reducing banking reserve requirements, which is a way of loosening policy as well.”

Overall, growth in the emerging markets (EM) is expected to remain stable in 2019, the IMF predicts, with the slowdown in China offset by recoveries in some other major EM economies.

Highe Rates, Flattening Yield Curve Create Downside Risk

Although U.S. growth is slowing, T. Rowe Price economists expect the U.S. unemployment rate to continue to fall, putting upward pressure on inflation. Higher interest rates, plus a flattening U.S. yield curve, could increase the risk of a sharper economic slowdown in 2020.

DISPARITIES IN GLOBAL EQUITY VALUATIONS REQUIRE SELECTIVITY

As of the end of October, U.S. equity valuations appeared relatively high compared with those in Europe, Japan, and the emerging markets—especially the latter. However, differing sector weights also need to be taken into account, Giroux says.

The U.S. market, with its large technology, health care, and business services sectors, tends to sell at a higher average price/earnings (P/E) ratio than most European markets, which have smaller tech sectors and tend to be more heavily weighted with financial stocks that typically feature lower P/E multiples.

Adjusted for sector mix, relative valuations between the U.S. and Europe appear to be within historic norms, Giroux adds. “Maybe you can still make the argument that Europe is earlier in the cycle and thus more attractive, but it’s not just because of valuations.”

U.S. Valuations Need to Be Seen in Context

Relative to their own history, U.S. equity valuations do not appear excessively rich, Giroux says. As of mid‑November 2018, the S&P 500 Index was trading at roughly 15.5 times expected forward earnings, within range of the 20‑year historical average of 15.9. However, with the U.S. moving into the later stages of the business cycle, that multiple might be less attractive than the long‑term average would suggest, he cautions.

“What we’ve typically seen is that once you hit an earnings peak, it can take between three and five years to get back to that peak,” Giroux observes. “So, the S&P 500 might actually be selling at 15.5 times 2024 earnings, which is saying something very different.”

Boosting the appeal of EM assets, in Thomson’s view: extremely undervalued EM currencies. “History suggests that you want to buy EM equity and debt when EM currencies are cheap, and we’re certainly seeing that at the moment,” he says.

SECULAR CHALLENGES ARE DISRUPTING GROWTH AND VALUE

Relative valuations between equity styles are also being impacted by disruption, pushing valuations for the winners and the losers in sharply opposite directions.

Although many investors equate disruption with the major technology platform companies, the effects also are being felt in a host of other sectors and industries, Giroux says. Energy markets, for example, are being disrupted by the crosscurrents of shale fracking and the increased competitiveness of solar and wind.

“Our work suggests that about 31% of S&P 500 market capitalization—and up to 35% of S&P revenue—is being impacted by some level of secular challenge,” Giroux says.

Disruption Creates More Value Traps

Challenged companies are likely to experience slower revenue and earnings growth over the next 10 years than they did in the previous decade, Giroux warns. The hit to valuations could be dramatic. “When companies fall into the secularly challenged bucket, what we normally see is that multiples compress even more than earnings growth,” he says. “Those can be horrible stocks to own.”

This same bifurcation is playing out in other global equity markets, Thomson says. Japan is a case in point: Although the MSCI Japan Index sported a relatively low 12.03 P/E ratio as of October 31, 2018, the Japanese market is sharply divided between firms that are increasing shareholder returns and those that are essentially stagnating. “In situations like that,” Thomson says, “the aggregate multiple doesn’t give you much useful information.”

On the other hand, structural change may have made aggregate EM equity valuations more attractive. As of the end of third quarter 2018, technology accounted for 27% of the MSCI Emerging Markets Index, up from virtually nothing 10 years ago, Thomson notes. This reflects not only the growth of China’s own technology giants, but also the rise of other high‑value EM industries based on intellectual property. “You not only have strong growth potential, but the opportunity set is widening and deepening as well.”

DESCYNCHRONIZED GLOBAL CREDIT CYCLES COULD SPARK VOLATILITY

Since the recovery from the 2008–2009 global financial crisis, global credit cycles have grown increasingly out of step. McCormick says he expects that trend to continue in 2019. “Diverging monetary policy is likely to be another catalyst for volatility,” says McCormick. “Markets were simpler to understand when every force was moving in a similar direction. It’s a little bit more interesting now.”

The low volatility seen in many major markets in recent years wasn’t sustainable without the ample liquidity provided by the world’s major central banks in the wake of the financial crisis, McCormick contends. Now, with the Fed shrinking its balance sheet and the European Central Bank shifting to a less stimulative posture, “markets are searching for a new footing at more sensible valuation levels given less accommodative monetary conditions.”

U.S. Dollar strength will be a key variable

Faster U.S. growth and widening interest rate differentials helped lift the U.S. dollar more than 8% on a broad trade‑weighted basis in the first 10 months of 2018. Whether that trend continues or reverses in 2019 will heavily influence the relative attractiveness of international assets—EM assets, in particular.

“The dollar exchange rate is crucial,” Thomson says. “Not just because of the currency effect on returns, but because in many markets, a strengthening dollar raises the cost of funding in dollars, which is another form of [monetary] tightening.”

Relative growth trends will largely determine the dollar’s course in 2019, McCormick argues. If markets perceive that U.S. growth is slowing, they are more likely to believe the Fed is nearing the end of—or at least a pause in—its tightening program. Stronger growth in the rest of the world also could weaken the dollar.

“If the U.S. economy surprises to the upside, or if Italy turns out to be a bigger problem for the eurozone than we expect, the dollar could stay strong,” McCormick says. However, he adds, “If we do get to a place in 2019 where the dollar stalls, we think that would be an excellent time for U.S. investors to consider moving some fixed income assets into global markets.”

LATE-CYCLE SHIFTS SHOULD FAVOR CERTAIN SECTORS

Historically, bond market sectors have shown varying return patterns over the economic cycle. As the U.S. economy moves into the later stages of that cycle in 2019, McCormick says, some sectors may offer attractive relative value opportunities.

“In the middle of the cycle, the aggregate bond indexes typically have had very positive risk‑adjusted returns,” McCormick notes. “Bond returns tend to decrease in the late cycle. They’re not necessarily negative, but you don’t get paid as much for taking risk.”

McCormick points to several sectors that historically have featured relatively strong late‑cycle performance. These include:

- Floating rate bank loans: In 2018, strong U.S. growth supported credit fundamentals, while U.S. floating rates, as measured by London Interbank Offered Rates (LIBOR), rose in line with Fed rate hikes. As long as credit conditions remain favorable, bank loans should continue to perform relatively well, even if the Fed pauses raising rates. However, the sector’s bull run has stretched valuations and raised concerns about underwriting standards, requiring careful credit analysis by investors.

- Collateralized loan obligations (CLOs): These floating rate instruments typically carry AAA ratings from the major credit agencies and historically have traded at yield spreads over LIBOR comparable to lower‑quality investment‑grade (IG) corporate bonds. Their short-duration profile and structural credit enhancements make CLOs attractive, especially as the end of the credit cycle approaches, McCormick says.

- EM debt: Historically, corporate and sovereign EM bonds both have outperformed late in the U.S. credit cycle, typically because the U.S. dollar has started to depreciate, boosting commodity prices and easing financial conditions in EM economies.

- Short‑duration Treasuries and IG corporates: Investors who did well with riskier assets in 2018 now have an opportunity to earn relatively attractive yields at the less volatile short end of the U.S. yield curve, McCormick says.

Giroux recommends that investors also consider another, relatively battered, fixed income sector: U.S. Treasuries. Although they performed poorly in the strong growth/rising rate environment of 2017 and 2018, longer‑duration Treasuries have reached relatively attractive yield levels, Giroux says, especially compared with comparable sovereign assets, such as German bunds and Japanese government bonds. “Having a little defense in your portfolio with Treasuries makes sense at this point in the cycle,” he says.

GEOPOLITICAL FLASH POINTS MAY TRIGGER VOLATILITY

A number of political risks have the potential to disrupt global markets in 2019, with perhaps the most serious being the danger of a trade war between the U.S. and China.

Moves by the Trump administration to raise tariffs on Chinese goods, plus Beijing’s retaliatory measures, already have taken a toll on U.S. stocks that rely on China‑related revenues. While the top China‑oriented stocks in the S&P 500 outperformed the index by a considerable margin in 2016 and 2017, much of that return advantage quickly disappeared after trade tensions rose to a boiling point in the summer of 2018. Although President Trump and Chinese President Xi Jinping agreed in early December to a temporary halt to tariff increases set for the end of 2018, the underlying issues remained unresolved.

T. Rowe Price economists estimate that higher tariffs on Chinese exports could do real, but manageable, damage to the U.S. economic expansion. However, they add, the 2019 outlook would turn darker—both for the U.S. and the global economy—if the Trump administration were to follow through on its threats to impose tariffs on all foreign auto and auto‑part imports.

Giroux thinks markets should not underestimate the possibility that the U.S. and China ultimately will be able to settle their trade dispute. Beijing, he argues, has signaled its willingness to accommodate the U.S. in some areas, such as tariff cuts, safeguards for intellectual property, and increased purchases of U.S. goods and services. “The question is whether that will be enough for the Trump administration,” Giroux says.

Some of President Trump’s advisors, Giroux says, may not trust China to comply with any deal. Others may believe criticizing China would be smart politics in the runup to the 2020 presidential election. Still, he adds, given the economic benefits and the boost a successful deal could give to asset valuations, there also are strong political incentives for Trump to compromise.

The U.S.–China trade battle is not the only risk

A number of other geopolitical developments could trigger renewed volatility in 2019, T. Rowe Price investment professionals say. These risks include:

- Brexit: While the UK government and EU leaders have agreed on the technical terms of Britain’s exit from the EU, the narrow path to resolution suggests that the key issues will complicate the UK–EU relationship for years to come. While negative headlines have weighed on investor sentiment, a successful deal would give a considerable lift to UK assets, particularly the British pound, Thomson says.

- Italy: The populist coalition that took power in 2018 has put forward a fiscal stimulus plan that exceeds EU deficit limits, bringing it into conflict with EU authorities. However, market measures of default risk suggest those fears have not—as yet—spread to other peripheral euro countries such as Spain and Ireland. “This tells us the markets believe the tail risk of a dissolution of the single currency is still limited at this point,” Thomson says.

- U.S. politics: Although the Democratic Party regained the majority in the lower house of the U.S. Congress in November’s elections, Giroux calls the result “a nonevent, or at least a neutral event,” since the Senate remains in Republican hands. The main event, he says, will be the 2020 elections, when the House, the Senate, and the presidency all will be at stake.

DISRUPTION COULD YIELD OPPORTUNITIES

The upswing in volatility that disrupted global markets—equity markets, in particular—in 2018 appears likely to persist in 2019, driven by slowing economic momentum, tighter liquidity, monetary divergence, and political risk. Meanwhile, technological innovation and competitive challenges will continue to threaten established leaders in a host of global industries.

In this less supportive environment, McCormick notes, markets have begun to punish bad behavior, taking aim at overleveraged companies, antiquated business models, and inflation‑prone sovereign debtors. As a result, security‑specific risks are becoming increasingly critical. But these same risks also can generate potential opportunities for active investors to buy attractive assets at temporarily depressed prices. In‑depth research and solid fundamental analysis are vital.

“There’s no question that markets tend to get trickier late in the cycle,” McCormick says. “But it also can be a great time to take a strategic approach to investing.”

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of December 2018 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

FactSet—Copyright © 2018 FactSet Research Systems Inc. All rights reserved.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”), and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”), and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by T. Rowe Price. T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

This information is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Investors will need to consider their own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., Distributor.

© 2018 T. Rowe Price. All rights reserved. T. Rowe Price, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

ID0001782 (12/2018)

201812-681359