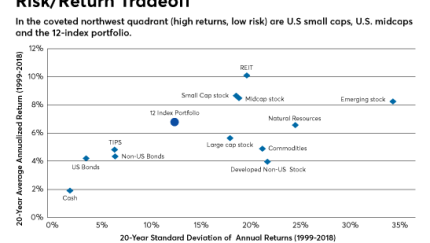

Clients who check their portfolios every 15 minutes — or every 15 days — may not be good candidates for the moderate-growth performance of a broadly diversified portfolio.

The most up-to-date news, trends and resource on global investing you need to stay ahead of the curve

-

Do stock market swings mean new opportunities for financial planners?

August 14Momentum Advisors -

-

“Pretty much every central bank is now talking about global downside risks, and that’s helped bonds rally,” a portfolio manager says.

February 8 -

-

Clients who check their portfolios every 15 minutes — or every 15 days — may not be good candidates for the moderate-growth performance of a broadly diversified portfolio.

February 7 -

Multiple rate hikes by the Fed last year contributed to less-than-stellar results.

February 6 -

Fresh doubts about whether star managers can deliver consistently superior returns have been raised following Bill Gross’ retirement.

February 6 -

Trade tension and a record-long government shutdown have left many in the “more defensive parts of the market,” one TD Ameritrade strategist says.

February 5 -

At Pimco, the fixed-income giant he co-founded, Bill Gross racked up one of the longest winning streaks of any money manager.

February 4 -

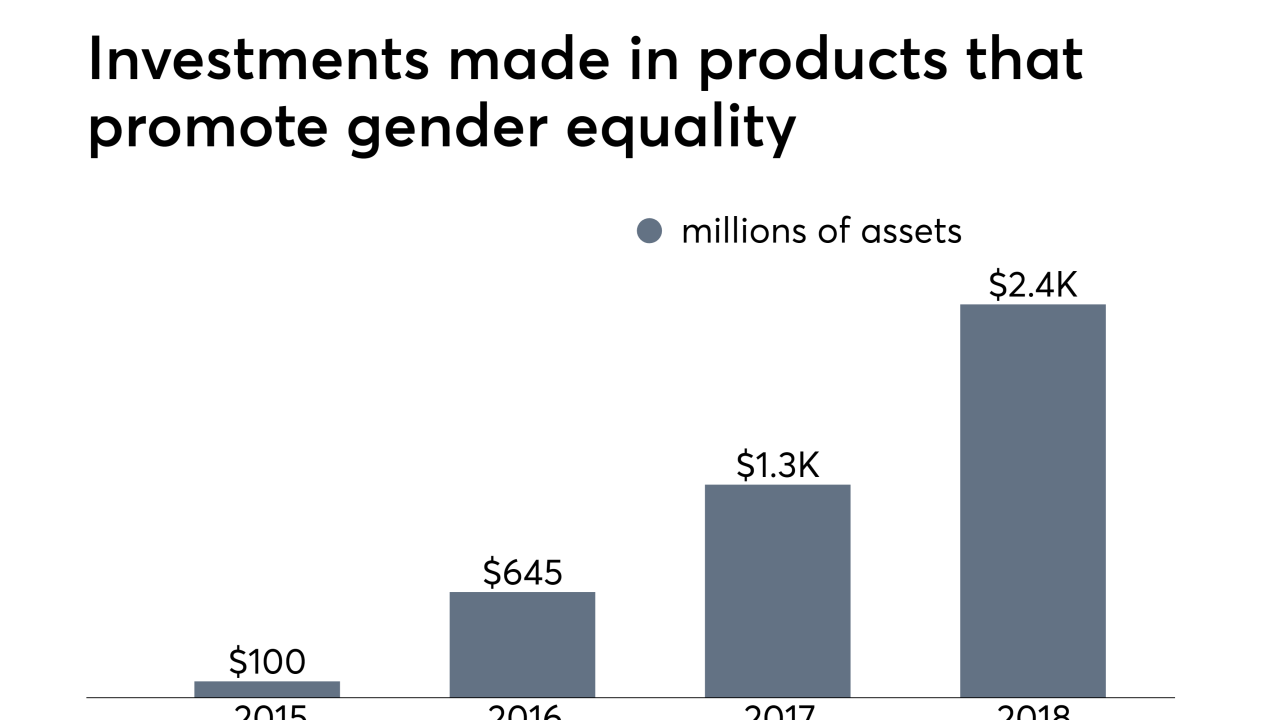

A new research company from the rock frontman and TPG Investments will gauge the effectiveness of sustainable investments.

January 25 -

All 20 funds posted losses over the last year.

January 23 -

The technology could make collecting more appealing to investors.

January 23 Capco

Capco -

It’s often hard to know just what is driving investor decisions.

January 22 Wealth Logic

Wealth Logic -

-

Brexit, worries about trade wars and rising interest rates have prompted a selloff in developed country stocks.

January 16 -

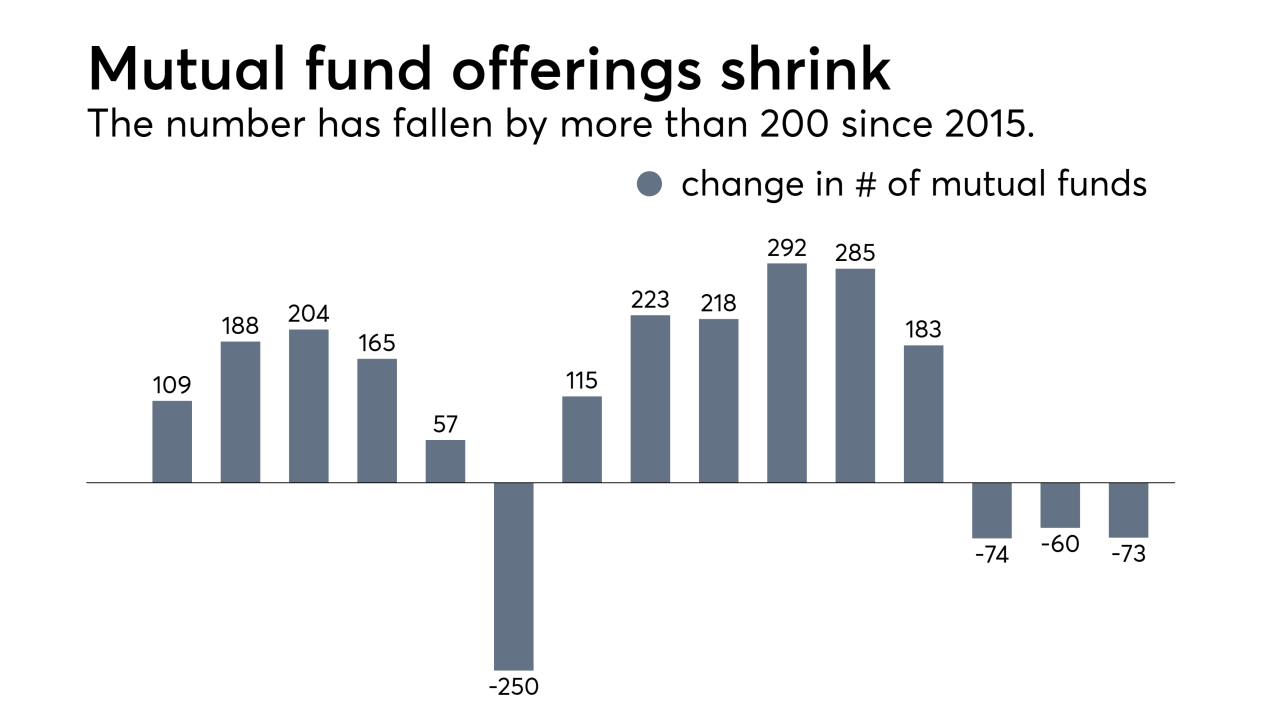

Nearly all of the outflows came from mutual funds and ETFs that posted losses.

January 15 -

The funds include a wide range of offerings from emerging markets to precious metals, multi-strategy and REITs.

January 14 -

BlackRock will see the largest reduction to its workforce since 2016.

January 11 -

The top 20 are now home to nearly $1.2 trillion in combined assets.

January 9 -

This analysis may help calm jittery clients when their portfolios take a sharp downturn.

January 8 -

A member-owned market is the wrong response to rising fees.

January 8 -

A record 186 funds were shuttered last year. What does this mean for the future of the industry?

January 7 -

Beyond U.S. equities, the power balance tilted broadly to index funds in 2018.

December 31 -

Some of the largest and fastest-growing economies in the world are still considered emerging markets.

December 20 -

Even as equities have taken a beating, I haven't received a single frantic call or text.

December 18 Mercer Advisors

Mercer Advisors -

-

U.S. investors normally do a very superficial analysis when considering exposure to the country, an executive said.

December 12 -

Even worse, those at the bottom of the pack averaged higher expense ratios.

December 12 -

Macroeconomic trends and matters of convenience will move advisors, assets and markets next year in the ever-changing wealth management space.

December 11 -

Inversions have occurred seven times since the early 1950s and all but one of those instances preceded equity gains.

December 6 -

In the Treasury market, all eyes remain on the yield curve after three-year yields climbed above those of the five-year bonds.

December 4 -

-

The Global Income Fund slashed its equities exposure by nearly a third in October and moved part of the proceeds into U.S. and European high-yield debt.

November 30 -

Fed Chairman Jerome Powell's dovish comments revived global demand for riskier assets.

November 29 -

Here’s how to prepare your clients, and your own practice, if dark days come and stay.

November 28 Wealth Logic

Wealth Logic -

The partnership gives the world's largest asset manager access to a “growing but fragmented” set of RIAs, says an executive.

November 27 -

LIMRA now predicts VA purchases to increase for the first time in six years while fixed contracts reach unprecedented levels.

November 26 -

Investors have grown cautious following October’s rout in global markets.

November 21 -

There’s now a way to measure whether these products do what they promise.

November 19 -

Although its fees are higher than other thematic offerings, similar products from Ark Investment Management have outpaced their peers. Plus; other launches.

November 16 -

“It’s hard to outrun secular risk,” says T. Rowe Price CIO David Giroux.

November 14 -

The data firm launches a new risk analysis tool, the Global Risk Model, to compete with Riskalyze.

November 12 -

There are at least 200 fewer products available since 2015. Some advisors haven’t noticed. But should they?

November 1 -

-

-

Many U.S. stock funds posted double-digit percentage gains, but international equities fared even better. Which were the biggest winners?

January 10 -

In an industry that’s all relative, sometimes a 14% return puts you near the bottom of the pile.

January 17 -

Multiple rate hikes by the Fed last year contributed to less-than-stellar results.

February 6