Like squirrels stowing away nuts for a long winter, independent broker-dealers are storing up an expanding cache of assets and revenues. The question is whether they’ll be prepared for a change in seasons.

Thanks to continued bull market equity returns for most of the year along with rising interest rates, the IBD sector achieved double-digit revenue growth in 2018 for the first time since 2014, according to Financial Planning’s 34th annual survey (which this year changed its name to IBD Elite from FP50).

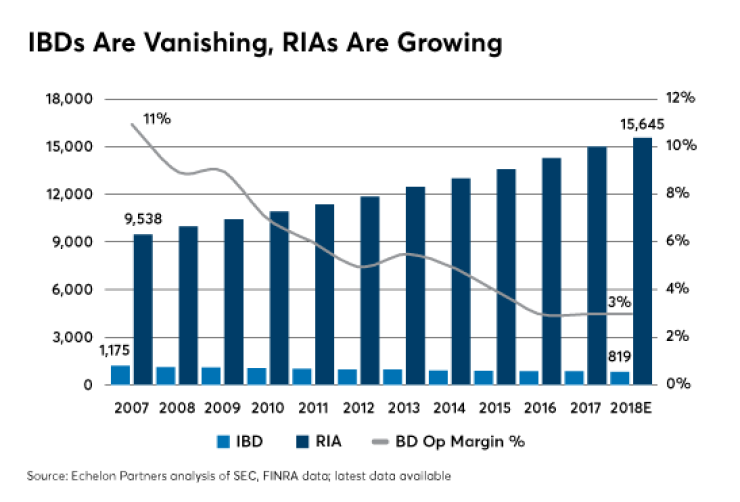

Amid the strong year, the number of IBD firms is falling, along with financial advisor headcounts — even as the RIA channel expands. Traditional IBD revenue sources are drying up and expenses are increasing. Those factors are leading many longtime players to sell to better-positioned and better-capitalized partners.

“We definitely see a lot of instability in the IBD marketplace,” says Carolyn Armitage, managing director at Echelon Partners, an investment bank and consulting firm, which estimates that IBD margins slipped to 3% in 2018 from 11% in 2007.

The number of IBDs has tumbled by 30% to 819 firms in the past 11 years, while the number of RIAs has soared by 64% to 15,645, according to Echelon.

IBDs still enjoy an industry-leading advisor headcount of 86,779 when that tally includes hybrid RIAs, while they have 59,361 representatives when not including hybrids and would be second only to wirehouses, according to research firm Cerulli Associates. Indie RIAs, by contrast, have about 36,000.

The headcount of indie RIA advisors had a compound annual growth rate of 5.2% from 2013 through 2017, Cerulli’s latest available figures show. The IBD headcount had a five-year CAGR of minus 0.4% and minus 1.5% when excluding hybrid RIAs.

Revenue figures are still in the black, however. The top 50 firms submitting data to the IBD Elite survey increased their revenues by 11.8% in 2018 to a combined $28.8 billion. The top 50 firms’ businesses had ticked down for two straight years before a return to growth at a 9% clip in 2017.

To put the scale of those firms in context, their combined annual revenue is

-

The nation's largest IBDs are growing again, but are they innovating fast enough to keep up with the industry's transformation?

June 4 -

A clear path has emerged after historic revenue drops among the top independent broker-dealers.

June 1 -

The independent broker-dealer industry could lose a third of its brokers and many of its smallest firms, experts predict. What does that mean for survivors?

June 1

READ MORE:

The Giants Are Getting Bigger

The giant IBD players are becoming even bigger. Revenue at eight of the top 10 IBDs, and two of the three networks, jumped by double-digit percentages in 2018.

LPL Financial, No. 1 on Financial Planning’s IBD Elite list for almost two decades, retained its top spot and saw its revenue swell by 21% to $5.2 billion — nearly $400 million more than Ameriprise, the No. 2 firm, which had closed the gap with LPL to about $20 million in 2017.

Rich Steinmeier, LPL’s managing director and head of business development, says the firm has learned it “can never move away from the advisor.” He adds, “We’re a publicly traded firm that is focused exclusively on wealth management. … You can see exactly how much we spend, you can see that translated into capabilities.”

Record consolidation has shuttered many well-known IBDs, as in

Advisor Group has also been active on that front. Its four IBDs’ revenue jumped by 21% in 2018 to $1.7 billion, and their headcount of producing reps expanded by 30% to 6,518 advisors. Its private equity-led owners agreed in May to sell a 75% stake in the network itself —

Speculation about deals hasn’t been a surprise or a distraction for its IBDs, says Rick Fergesen, CEO of Woodbury Financial Services, which was owned by multiple insurance firms before Lightyear Capital and a Canadian pension manager bought Advisor Group in 2016.

”We definitely see a lot of instability in the IBD marketplace,” says Carolyn Armitage of Echelon Partners.

The structure has resulted in “perfect alignment” at the network, Fergesen says. “We’re all focused 100% of our time and energy on trying to create an environment where our advisors will love it and grow and achieve their objectives.”

More and more PE firms enter the sector each year.

Growing M&A allows insurance companies to focus on their core businesses and gives IBDs with PE owners substantial capital.

The bustling M&A activity also reflects the sector’s challenges. IBDs face higher compliance costs and the “thorny problem” of upgrading technology, according to Tim Welsh, founder and CEO of Nexus Strategy. “The middle market is going to get squeezed as the top-end players gain scale and have private equity in there,” Welsh says.

Traditional IBD business models, which rely on product commissions and payments from assets managers and custodians, are vanishing.

Average load sharing to intermediaries from fund companies shrank for independent BDs to 88 basis points in 2017 from 156 in 2010, and for captive BDs to 25 bps from 89 seven years earlier,

Lower load-sharing payments reflect bolstered regulatory scrutiny in recent years and advisors’ embrace of a planning model aligned with clients’ interests, says Aron Szapiro, Morningstar’s director of policy research.

“As the defined contribution system has matured, what you see is regulators getting much more concerned about advice being given to ordinary people,” Szapiro says.

“At the same time, you have this convergence of business models that exist in different regulatory structures, and that causes a certain amount of tension,” he adds.

The resources that larger firms bring to bear can turn challenges such as advisor tech needs and an encroaching RIA channel into opportunities. Ladenburg Thalmann’s Securities America and Triad Advisors offer alternate corporate RIAs with more custodial options.

KMS Financial Services, another one of Ladenburg’s five IBDs, allows advisors and clients to choose among four custodians on its corporate RIA. The No. 38 firm can pitch advisors on a small-firm culture with large-firm scale.

Erinn Ford, the CEO of KMS, notes that smaller firms “are really going to have to be specialized in their niche,” arguing that, as the big firms grow bigger, the smaller ones will need to find “their hedgehog that’s going to insulate them from the others.”

Major offices of supervisory jurisdiction such as Private Advisor Group, which is LPL’s largest hybrid RIA, with about $17 billion in AUM, also display the mix of big and small. The firm launched an affiliation model this year for wirehouse breakaway advisors who might otherwise go full RIA.

Advisors vary widely in their views of remaining with IBDs in an increasingly RIA world. Independent Financial Partners

IBD stalwarts aim to win back RIAs who left the sector by reminding them how home-office services can ease their growing tech and compliance burden. Raymond James Financial Services, for example, has offered advisors the full range of affiliation options for 15 years.

Cambridge Investment Research rolled out newly enhanced advisor and client portals in February. Two formerly indie RIAs, with a combined $125 million in AUM, joined a group affiliated with the No. 8 IBD in the first quarter, according to CEO Amy Webber.

“This technology offering was a huge key in those independent RIAs opting to leave their own RIA to join this ensemble,” says Webber, noting that the practice uses the corporate RIA.

More than 75 advisors with No. 4 IBD Commonwealth Financial Network dropped their FINRA registrations to go fee-only in the first year of Commonwealth’s RIA Services division. In February, the firm

Advisors and their clients have forged “a whole new way of doing business” at IBDs with the rising demand for full-scale planning, says Carolyn Clancy, head of the BD segment of Fidelity Clearing & Custody Solutions, with about 200 client BDs.

An era marked by record consolidation, thinned revenue sharing and higher costs for compliance and tech requires significant changes, she says.

“You have to have a real well-articulated value proposition to be able to continue to thrive and to continue to show true organic growth,” she says.

The squirrels with nuts stored away have the advantage, in other words.