While Reg BI stopped short of imposing a full fiduciary duty on broker-dealers, it did materially lift the standard of conduct that applies to them.

Now, the rule requires greater disclosures of their business practices, a requirement to take active steps to mitigate conflicts of interest and an outright ban on certain sales contests, quotas and similar problematic incentives.

The largest impact for RIAs, however, may not be Reg BI itself, but simply the difficulty that RIAs will face differentiating themselves in a world where broker-dealers can legitimately state they, too, have a best interest standard when providing recommendations to their clients.

The ripple effects of Reg BI are likely to continue for years to come, which makes grasping the key provisions, changes and implications for our industry deeply important.

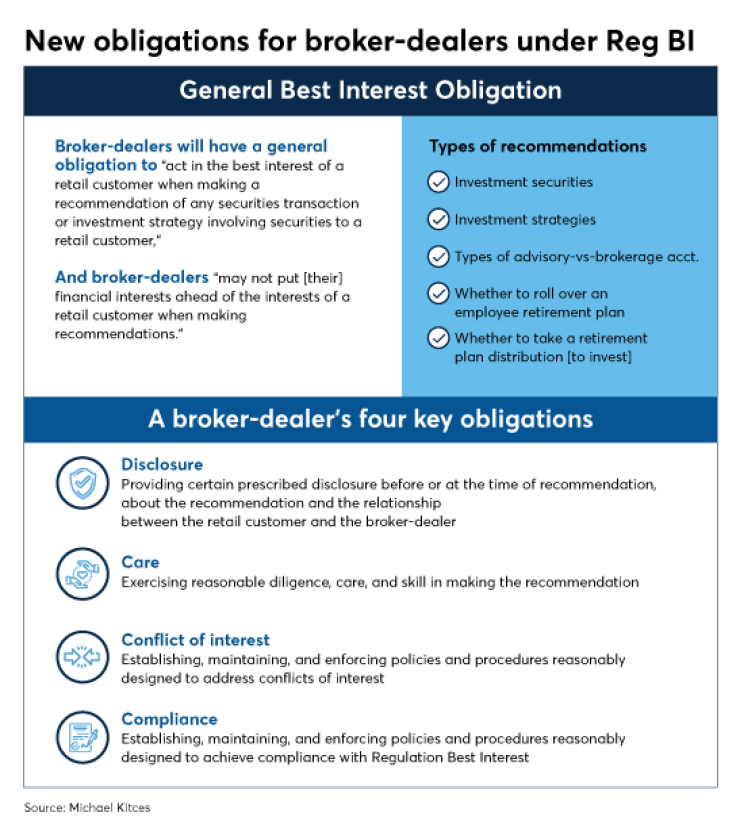

The SEC’s final rules and interpretations prescribed that:

- Under

Regulation Best Interest (Reg BI) , broker-dealers will have a general obligation to “act in the best interest of a retail customer when making a recommendation of any securities transaction or investment strategy involving securities to a retail customer,” and broker-dealers “may not put [their] financial interests ahead of the interests of a retail customer when making recommendations”;

- Both broker-dealers and RIAs will now be required to create and deliver a new

Form CRS (Customer/Client Relationship Summary) before or at the time that advice is provided, which explains the types of client/customer relationships and the services the firm offers, the fees, costs, conflicts of interest and required standard of conduct associated with those relationships and services, and whether the firm and its financial professionals currently have any reportable legal or disciplinary history;

- A reinterpretation of an

RIA’s obligations as a fiduciary to clients, specifically with regard to when/whether it’s sufficient for RIAs to simply acknowledge they may have a conflict of interest — versus more concretely explaining conflicts and their potential impact — and how RIAs should disclose their conflicts of interest pertaining to the allocation of investment opportunities among their clients;

- A reinterpretation of the

“solely incidental” exemption for broker-dealers to avoid the requirement to register as fiduciary investment advisers, stipulating that “a broker-dealer’s provision of advice as to the value and characteristics of securities or as to the advisability of transacting in securities is consistent with the solely incidental prong if the advice is provided in connection with and is reasonably related to the broker-dealer’s primary business of effecting securities transactions.”

Ultimately, the SEC emphasized that its goal was deliberately to not harmonize broker-dealers and RIAs, recognizing instead that

WHAT’S A RECOMMENDATION?

To the extent that Reg BI will be triggered when a broker makes a recommendation to a customer, it’s crucial to understand what constitutes a recommendation in the first place.

Determinations will be based on the facts and circumstances of the situation, but the SEC notes that generally, a communication would be subject to Reg BI when it “could reasonably be viewed as a ‘call to action’” to the customer; whether it “reasonably would influence an investor to trade a particular security or group of securities”; and “the more individually tailored the communication to a specific customer or targeted group, the greater the likelihood that the communication may be viewed as a recommendation.”

A recommendation must generally have some level of specificity to the particular client and to a particular action that client would take, as contrasted with general education that is non-specific in nature.

THE FOUR OBLIGATIONS

To comply with Reg BI’s general best interest rules, broker-dealers will be required to meet four key obligations:

- Disclosure: Providing certain prescribed disclosure before or at the time of recommendation about the recommendation and the relationship between the retail customer and the broker-dealer

- Care: Exercising reasonable diligence, care and skill in making the recommendation

- Conflict of Interest: Establishing, maintaining and enforcing policies and procedures reasonably designed to address conflicts of interest

- Compliance: Establishing, maintaining and enforcing policies and procedures reasonably designed to achieve compliance with Reg BI

Disclosure

The essence of the disclosure obligation is to provide “full and fair disclosure, in writing, of all material facts” relating to both the scope and terms of the relationship and the conflicts of interest that are associated with any recommendations provided.

If the broker-dealer is operating solely as such, it will generally be a violation of Reg BI for brokers to use the titles “adviser” or “advisor,” as the SEC states that in most cases, “broker-dealers and their financial professionals cannot comply with the capacity disclosure requirement by disclosing that they are a broker-dealer while calling themselves an ‘adviser’ or ‘advisor.’” However, in the case of dual-registered individuals, the fact that they can legally operate as an advisor wearing the RIA hat means they are permitted to hold out as such.

On the other hand, the SEC’s requirements for disclosure of fees and costs is less stringent in practice. Given the wide range of potential fees and costs, the SEC generally requires under Reg BI that brokers provide disclosure that the nature of the compensation may create conflicts of interest and not the exact levels of all types of commissions and other costs.

Care

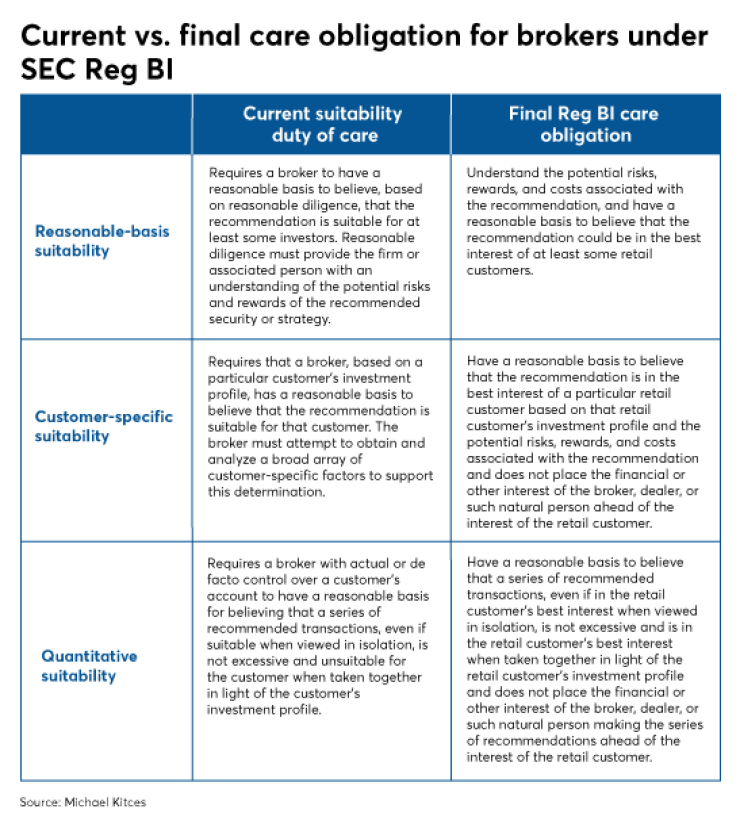

The care obligation for broker-dealers is substantively similar to the existing care obligation under

In fact, a side-by-side comparison of FINRA suitability and the new care obligation reveals that the language is virtually identical, with the caveat that under Reg BI, the standard by which these items are judged is not merely whether they are suitable, but also whether they avoid placing the interests of the broker-dealer ahead of the customer.

The fact that the care obligation aligns to the existing FINRA Suitability framework means broker-dealers will generally be able to use their existing systems and processes, perhaps just lightly adapted, to review the recommendations being made by their brokers. On the other hand, since the ultimate standard by which the actions will be judged is now higher, it remains to be seen how the new standard will be applied when overlaid on the existing FINRA suitability framework.

Note that the SEC did not actually define “best interests” itself, instead suggesting that over time, it will provide examples of what “acting in the customer’s best interests” means. Notably though, the SEC explicitly pointed out that “best interests” is still about understanding a recommendation in the context of a client’s entire situation. It is not about finding the one best product, nor an evaluation of every possible alternative, and solely focusing on the lowest cost alone is not a requirement.

Similarly, brokers will not be obligated to refuse a customer’s order if it’s contrary to the broker’s recommendation, and the care obligation will not apply at all to self-directed or unsolicited transactions by a retail customer.

Conflict of interest

Not only must fiduciaries act in the best interests of their clients, but some conflicts of interest are so problematic that fiduciaries must outright avoid them.

One of the most contentious aspects of the Department of Labor’s fiduciary rule, in particular, was whether and to what extent conflicts of interest would have to be mitigated or eliminated, versus merely disclosed.

In this context, a conflict of interest is defined as “an interest that might incline a broker, dealer, or a natural person who is an associated person of a broker or dealer — consciously or unconsciously — to make a recommendation that is not disinterested. Notably, this is the same definition of conflict of interest as applied to RIAs from the original

The end result of these changes under the conflict of interest obligation under Reg BI is that broker-dealers themselves are not under any obligation to alter their own conflicts of interest, but broker-dealers are required to mitigate a number of conflicts of interest for their own brokers, including any incentives that may cause brokers to put their own interests — or those of their broker-dealer — ahead of those of their clients, and an outright ban on a wide range of sales contests and sales quotas.

In other words, broker-dealers may still be allowed to push proprietary products, revenue-sharing, and shelf-space agreements, or even engage in principal trading around or against their customer, and as long as it’s disclosed to the customer, it’s permitted. However, broker-dealers will be far more limited in their ability to incentivize their brokers toward those behaviors and products.

Overall compliance

The fourth and final requirement under Reg BI is that broker-dealers must “establish, maintain, and enforce policies and procedures reasonably designed to achieve compliance with Regulation Best Interest as a whole.”

Since the conflict of interest obligation already requires broker-dealers to establish and implement policies and procedures regarding their conflicts of interest, the practical result of this fourth compliance obligation is that the broker-dealer must also establish policies and procedures to handle its disclosure and care obligations as well. Per the SEC itself, such policies and procedures might include “controls; remediation of non-compliance; training; and periodic review and testing.”

As noted, Reg BI only applies to broker-dealers, specifically to raise the standards that apply to them and their registered representatives, and not RIAs. This means not only is Reg BI broker-dealer–specific, but when it comes to dual-registered advisors — i.e., those who are both a registered representative of a broker-dealer and an investment adviser representative of an RIA — the obligations of Reg BI apply only to a broker while wearing their broker hat and not when acting in their capacity as an investment advisor.

The SEC emphasized that a dual-registrant is only an investment advisor with respect to accounts for which he/she actually provides advice and receives compensation — i.e., for advisory accounts. For any brokerage accounts as well as the overall relationship with the client, the dual-registrant remains first and foremost a broker, and therefore is subject to Reg BI.

On the other hand, the fact that the broker has any relationship to an investment advisor does allow him/her to use the advisor/adviser titles and hold out as being in the advice.

UNPACKING FORM CRS

In

In essence, Form CRS is intended to be a simple two-page disclosure document — down from five pages

1.) The services the firm offers and the type(s) of client/customer relationships available;

2.) Fees, costs, conflicts of interest and the required standard of conduct associated with those relationships and services; and

3.) Whether the firm and its financial professionals currently have reportable legal or disciplinary history.

Additionally, Form CRS would also include hyperlinks or similar references on where prospects can go to obtain more information about the firm and its advisors, along with references to

To make Form CRS relatively uniform from one advisory firm to the next, the SEC has prescribed six sections and certain language that each section must address. The section guidelines comprise an introduction; a description of relationships and services; a summary of fees and costs; conflicts of interest and a standard of conduct; disciplinary history; and where to go for additional information.

FORM CRS's INTRODUCTION

The introduction of Form CRS is a standardized template that applies for any/every advisory firm preparing Form CRS, with just slight adjustments to the templated language for RIAs versus broker-dealers.

While the SEC did not precisely prescribe the exact language that firms must use, the Introduction must ultimately contain the following information:

- The name of the broker-dealer or RIA, and whether the firm is registered with the SEC as a broker-dealer, investment advisor or both;

- An indication that brokerage and investment advisory services and fees differ, and that it is important for the retail investor to understand the differences; and

- A statement that free and simple tools are available to research firms and financial professionals at the commission’s investor education website,

Investor.gov/CRS .

Fortunately, many of the

RELATIONSHIPS AND SERVICES

The second section of Form CRS is designed to, as the name implies, summarize the nature of the relationship with and services being offered to retail investors. Using the SEC’s new Q&A format, the section will have the header, “What investment services and advice can you provide me?”

In the original version of Form CRS, the descriptions of relationships and services were based heavily on pre-written text prescribed by the SEC, but in the final version, advisory firms will have more flexibility over the wording they use and how they describe their offering.

Nonetheless, firms will be required to provide responses to several core sections:

Description of services

The firm must explain whether it offers brokerage services, investment advisory services or both to investors, along with the types of services, accounts or investments it makes available — e.g., wrap accounts, execution-only brokerage services, planning — and any material limitations on those services. Broker-dealers will be required to explicitly state that they buy and sell securities in order to clarify their principal services.

Conversation starters

The relationship and services section of Form CRS, along with subsequent sections, will each have a series of required questions that prompt consumers with further questions they should ask for additional clarity about the relationship and services offered.

The conversation starters for the relationship and services section will include:

- “Given my financial situation, should I choose a [brokerage or investment advisory or both] services?”

- “How will you choose investments to recommend to me?”

- “What is your relevant experience, including your licenses, education and other qualifications? What do those qualifications mean?”

FEES AND COSTS

In the original version of Form CRS, the SEC included a series of sections to cover key areas like fees and expenses, conflicts of interest, and standards of conduct, but in the final version of Form CRS they are all consolidated into subsections of a single section.

Specifically, this third section of Form CRS will have three required areas that all firms must cover: fees and costs; standard of conduct and conflicts of interest; and financial professional compensation and related conflicts of interest.

Disclosures

The fees and costs section will itself have three subsections:

1.) Principal fees and costs: Under the heading, “What fees will I pay?”, firms will be required to summarize the primary fees and costs that investors will incur for their brokerage and/or investment advisory services — e.g., transaction-based fees for broker-dealers, and asset-based, fixed, wrap or other direct fee arrangements for RIAs — including how frequently fees are assessed and any conflicts of interest they create.

2.) Other fees and costs: Additional fees that investors might incur, directly or indirectly, are included in this section. These would include custodian fees, account maintenance fees, fees related to mutual funds and variable annuities, and other transactional or product-level fees — e.g., platform fees, shareholder servicing fees and sub-transfer agency fees.

3.) Additional information: Firms will be required to state, “You will pay fees and costs whether you make or lose money on your investments. Fees and costs will reduce any amount of money you make on your investment over time. Please make sure you understand what fees and costs you are paying.” In addition, firms in the additional information section can include hyperlinks or similar cross-references to other, more detailed documentation of their fees and costs — e.g., Form ADV for RIAs, additional Reg BI disclosures, product prospectuses, etc.

-

“We are not delaying and we are not changing the standard,” Chairwoman Susan John says of pressure to weaken the board’s tougher guidelines in line with the SEC’s Reg BI.

July 2 -

Think New Jersey’s proposed rule doesn’t apply to you? Think again.

June 24 -

The SEC predictably came up with regulations that can only be described as a win for brokers.

June 24 -

The state regulator says its proposal is necessary after the commission failed to craft a uniform fiduciary standard.

June 14

Notably and somewhat controversially, broker-dealers and RIAs will not be required to provide in the fees-and-costs area of Form CRS any detailed information on their exact and actual fees, commissions and other costs and expenses. Instead, given the practical space constraints of a two-page Form CRS, firms are expected to provide references to the additional and more detailed cost information as a part of the additional information subsection — which investors can delve further into on their own.

Conversation starter

The fees and costs section will also include the conversation starter, “Help me understand how these fees and costs might affect my investments. If I give you $10,000 to invest, how much will go to fees and costs, and how much will be invested for me?”

Notably, without yet knowing where or how the investor will be invested at an early juncture, given Form CRS may be provided before any recommendations are made, the SEC anticipates that advisor may still provide responses about the range or types of fees and costs that may be incurred, and not the exact percentages or dollar amounts.

CONFLICTS OF INTEREST

In the original version of Form CRS, the SEC had prescribed very specific wording that broker-dealers or RIAs would be required to use to describe their standard of conduct to consumers.

“We must act in your best interest and not place our interests ahead of yours when we recommend an investment or an investment strategy involving securities” was prescribed in the case of brokers, while “We are held to a fiduciary standard that covers our entire investment advisory relationship with you” applied to RIAs.

However, in consumer testing of Form CRS, investors had trouble understanding the differences between the two standards, and in particular did not understand the “legal jargon” of the word “fiduciary.”

Consequently, in its final version the SEC is allowing more flexibility in how firms describe their standard of conduct, and is requiring both broker-dealers and RIAs to use the wording “best interest” — either with respect to the recommendations being made for a broker, or for the entire advisory relationship for an RIA — and not the word “fiduciary.” However, notwithstanding

Once the firm’s standard of conduct is described, it will also be required to describe any other ways that the firm or its affiliates make money from brokerage or investment advisory services. This may include disclosing either proprietary products, third-party payments, revenue-sharing or principal trading activities that the firm engages in. Notably, even if none of these conflicts of interest apply, the firm must come up with at least one material conflict of interest to disclose — e.g., that the RIA receiving asset-based fees has a conflict of interest around making recommendations to pay down a mortgage that would reduce the amount of billable assets being managed.

Conversation starter

To encourage investors to delve deeper into potential conflicts of interest and standards of conduct, firms will be required to include a conversation starter, “How might your conflicts of interest affect me, and how will you address them?”

In addition, firms will also be required to include cross-reference links to more detailed disclosures, again most commonly either the RIA’s Form ADV or the broker-dealer’s additional disclosure documents under Reg BI.

Disclosures for compensation

In a new addition from the original Form CRS proposal, the SEC added a third item to the section under the header, “How do your financial professionals make money?”

In response, broker-dealers and RIAs are expected to summarize how their professionals are compensated, including cash and non-cash compensation, and the conflicts of interest those payments create. Relevant examples, per the SEC’s own guidance, include disclosing compensation factors such as the amount of client assets the advisor services; the time and complexity required to meet the client’s needs; the product being sold and/or its associated commission; or the revenue the firm earns from the professional’s advisory services or recommendations.

DISCIPLINARY HISTORY

In recent years, there has been a growing regulatory focus on better highlighting the disciplinary history of investment advisers and broker-dealers, especially given

Accordingly, Form CRS will have a dedicated new section specifically to provide disciplinary history disclosures of the RIA or broker-dealer under the heading, “Do you or your financial professionals have legal or disciplinary history?” In turn, Form CRS will either provide a “Yes” or “No,” and then provide a link to

Individuals with a clean disciplinary record will have the option of clarifying that they personally do not have any disciplinary events on their record — but must still answer “Yes” to the section on Form CRS to the extent that any professionals under the firm have had reportable events.

Conversation starter

To close out the disciplinary history section, firms will also be required to include the conversation starter, “As a financial professional, do you have any disciplinary history? For what type of conduct?”

ADDITIONAL INFORMATION

The end of Form CRS will include a section where firms can provide even more information about their firm’s services. Notably the expectation of the SEC is not that firms provide lengthy additional information in the section — given Form CRS is still constrained to two pages — but that instead they include hyperlinks or other means of facilitating access to additional information.

The Additional Information section must also include a telephone number, regardless of whether the information is already maintained and made available via the firm’s website, where retail investors can request up-to-date information and a copy of the relationship summary.

Conversation starter

The closing conversation starter of Form CRS will be, “Who is my primary contact person? Is he/she a representative of an investment adviser or a broker-dealer? Who can I talk to if I have a concern about how this person is treating me?”

-

The regulator disclosed a transformative rule change, sparking outrage among fiduciary advocates and some advisors.

June 12 -

But the new rules may be a boon for some fintech firms.

June 12 -

Concerns arose when the SEC first proposed its package of regulations. Instead of addressing these worries, the agency just codified them.

June 5 -

A group of 11 trade associations plan to ask the state’s securities regulator to reconsider its conduct proposal in light of action by the SEC last week.

June 14

DELIVERING FORM CRS

Once effective, Form CRS must be delivered to prospective clients either at the beginning of a relationship with the firm, following a material change to the details of Form CRS or upon certain events — e.g., when the client re-engages for a new/different relationship or service with the firm.

For broker-dealers, Form CRS will become a new separate disclosure form to provide prospective customers, which is due at the earliest of: 1.) when a recommendation is made regarding an account type, a securities transaction or an investment strategy involving securities; 2.) placing an order for the retail investor; or 3.) opening a brokerage account for a retail investor. Under Exchange Act Rule 17a-14, a broker-dealer’s Form CRS will also be filed electronically through WebCRD.

In the case of RIAs, the new Form CRS will become Part 3 of Form ADV, and under new Rule 204-5 must be delivered alongside the Part 2A brochure to prospects.

In addition, the new Form CRS will need to be delivered to all existing clients of broker-dealers and RIAs after the rules take effect, and posted to the advisory firm’s current website.

Going forward, advisors will also be required to provide an updated version of Form CRS any time clients: 1.) open a new account different from their existing accounts; 2.) receive a recommendation to roll over assets from a retirement account; or 3.) receive a recommendation for a new brokerage or investment advisory service that would not be held in an existing account.

Fiduciary duty clarifications

In

The interpretation is significant because an RIA’s fiduciary duty is not actually defined by the SEC itself, nor within the Investment Advisers Act. Instead, it was the famous 1963 Supreme Court case of

Accordingly, the SEC guidance formally acknowledges that RIAs have both a duty of care and a duty of loyalty to clients.

While nominally, the SEC’s (re-)interpretation of an RIA’s fiduciary duty appears to largely just codify existing common law fiduciary obligations, historically RIAs were expected to both avoid conflicts of interest and, at a minimum, make full disclosure of all material conflicts of interest. In its final interpretive release though, the SEC merely stipulated that an RIA “must eliminate or at least expose all conflicts of interest” instead.

Under the SEC’s new guidance, RIAs can choose to eliminate or merely disclose — perhaps not coincidentally making it akin to the broker-dealer’s own obligation under Reg BI which, similarly, is a choice of whether to avoid or merely disclose conflicts.

‘SOLELY INCIDENTAL’

The lines between broker-dealers and RIAs have become blurred. A

In response to concerns along these lines

In 2005, the SEC released

And now, under its new

“…a broker-dealer’s provision of advice as to the value and characteristics of securities or as to the advisability of transacting in securities is consistent with the solely incidental prong if the advice is provided in connection with and is reasonably related to the broker-dealer’s primary business of effecting securities transactions.”

Notably, in this context the amount (“quantum”) or importance of investment advice that may be provided by a broker-dealer does not determine whether its advice is solely incidental. However, the SEC does emphasize that certain services will “automatically” cause a broker-dealer to be deemed as being in the investment advisory business.

For instance, exercising investment discretion over a client’s accounts generally triggers RIA status for broker-dealers, as they’re no longer merely providing advice in connection with brokerage services, but making investment decisions on behalf of the client on an ongoing basis.

Similarly, monitoring services over an investment account can trigger investment advisory status beyond the solely incidental exemption, though a broker who merely reviews a customer’s account from time to time to identify potential recommendation opportunities will not be deemed to be providing ongoing advice.

Effective date

Regulation Best Interest and Form CRS will technically become effective 60 days after they are published in the

On the other hand, the new interpretations of an RIA’s fiduciary duty and the solely incidental exemption for broker-dealers providing advice will take effect immediately upon publication in the Federal Register.

COMPLIANCE OBLIGATIONS

While Regulation Best Interest was not, in the end, a full fiduciary duty for broker-dealers, it does represent a significant increase in the prior suitability standard of conduct that applied to them and will result in significant changes to the industry in the coming year.

Given the June 2020 effective date for Reg BI and the SEC’s decision to not explicitly define what constitutes best interest for broker-dealers, expect to see ongoing guidance from the SEC both in advance of the effective date and in the years that follow, providing additional information about what types of broker conflicts are deemed untenable and what kinds of conflict-of-interest mitigation broker-dealers are expected to implement for their brokers.

In practice, developing Form CRS for most RIAs will likely not be burdensome, as it will effectively reference material that is already disclosed in greater detail in the Part 2A brochure of Form ADV. In fact, the whole point of Form CRS is to provide a briefer, easier-to-read and scan version of disclosures than the existing Part 2A brochure, with a layered approach to disclosure that allows consumers to delve deeper if they so wish.

However, RIAs may still be taken aback by some of the new disclosures that must be placed front and center on Form CRS. In particular, the requirement to state asset/account minimums, along with a disclosure of how the advisor at the RIA is compensated — and any attendant conflicts of interest the advisor may face because of that compensation — are new. As while it’s not uncommon for RIAs to have minimums — and

Still though, while Form CRS may more directly highlight aspects of the RIA’s business practices than what was once common, most RIAs won’t need to change much to comply.

It’s also notable that because the SEC’s rules are by definition for SEC-registered investment advisors, the new Form CRS requirements technically won’t apply at all to state-registered investment advisers — at least until/unless states ultimately choose to adopt their own conforming disclosure rules in the coming years.

Otherwise, it appears that Regulation Best Interest is here to stay, with ripple effects likely to be felt for years to come.