American financial advisory services clients would flock to Facebook, Google or Amazon if given the opportunity, a new study revealed.

About 46% of U.S. banking, insurance and wealth management customers surveyed by Accenture said they would switch to the tech giants, according to a global study the firm released this month. The results also showed widespread openness to automated advice.

Google, Amazon, Facebook and Apple “are setting the standards in terms of customer experience and the level of personalization consumers expect,” said Stephanie Sadowski, managing director of Accenture’s distribution and agency management division.

“In order for traditional firms to keep their trusted position with consumers, they will need to deliver simple, highly digital experiences that will delight customers, and robo services is one way to do this.”

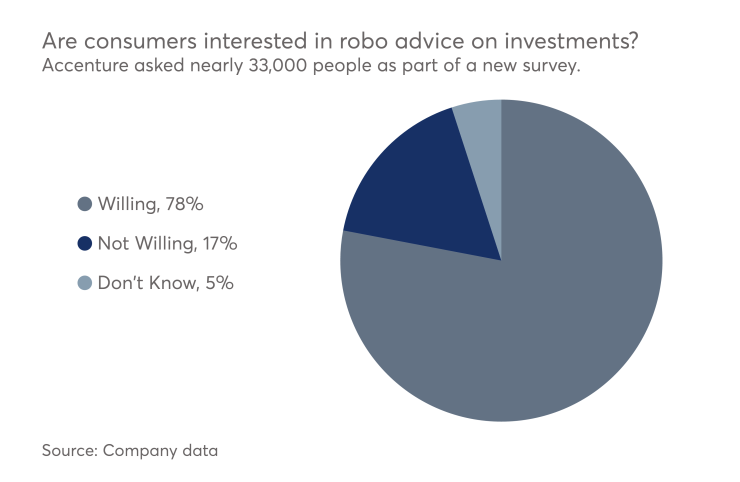

Some 78% of consumers from the 18 different countries covered by the survey said they would welcome robo advice about traditional investing. A smaller but still significant proportion, 68%, said they were interested in robo advice about retirement planning.

Yet advisers eager to add such new technology also must embrace the tech giants’ analytical analysis, according to the study. Companies like Google, Amazon, Facebook and Apple “have become masters of tailoring their services to the customer’s individual needs,” the study said.

-

These firms may actually be the worst positioned to capitalize on the robo trend, Michael Kitces writes.

September 6 -

In a fiduciary world, well-designed digital advice will outperform humans, argues a UPenn legal expert.

June 7 -

Clients will flock to digital advice, but conditions favor incumbent firms, a study found.

September 18

“Financial providers need to learn from this experience, and provide a suite of products and services that are relevant to the customer’s stage of life or immediate financial needs,” according to Accenture.

The firm surveyed 32,715 people worldwide, 9,987 of whom identified as existing financial advisory clients. More than a third of the overall respondents, about 38%, said they would hire the tech firms for financial advice if they could do so.

Advisers shouldn’t worry too much right away about Facebook, Google, Amazon or other tech firms taking their business, though, Sadowski said.

“Banks and investment firms are highly regulated entities; in order to enter this space, a technology firm would have to have the appetite to adhere to those same regulatory restrictions,” she said. “Also, our research shows that investors want a combination of both robo and human advice, which may pose a challenge to tech firms.”