Rather than keeping up with the financial advisor head count of its acquisition-minded rivals, Ameriprise is boosting its productivity through recruiting and new digital advice tools.

Rising productivity matters more to the firm than rising head counts, CEO Jim Cracchiolo says.

“It’s not just the number,” he said in response to an analyst’s question on a call about the firm’s second-quarter earnings. “We could go and bring in independents and merge other firms like others are doing.”

“What we’re really looking for,” Cracchiolo continued, “is strong, quality advisors that will run a really good practice, deliver a strong value proposition, build our brand in that regard and serve their clients well.”

The Minneapolis-based firm, which has a wealth management division consisting of 2,176 employee brokerage advisors and 7,730 independent franchise advisors,

Ameriprise’s head count increased by 3% year-over-year, or 266 advisors, to 9,906 advisors. The firm will maintain that rate, Cracchiolo predicts, but Ameriprise has not expanded its ranks on the scale of LPL Financial’s

Ameriprise added 76 experienced advisors in the second quarter, although most of the rise in head count over the past year came from its

New tech for Ameriprise advisors such as enhanced customer relationship management and goal-tracking capabilities will roll out in coming months, Cracchiolo said, noting training sessions slated through next year. For example, the firm is moving to Salesforce’s CRM tool in 2019, a spokeswoman said later.

Asked by William Blair analyst Adam Klauber about the firm’s rising advisor productivity, Cracchiolo attributed it to a combination of recruiting advisors with more assets, new client acquisition with higher average assets and movement of existing client accounts to put more money to work.

“We are continuing to focus on bringing that advice value proposition to life, because even our best advisors don’t necessarily give the full advice equation to all of their clients. And we want to help them do that in a more efficient way so that they can serve them even more fully,” Cracchiolo said.

“That’s why we’re bringing even more tools and capabilities to bear in an integrated fashion, so that they can engage all of their clients in the same deep value proposition that they provide,” he added.

-

The firm’s headcount declined slightly in the quarter, but advisors’ productivity remains strong and growing.

April 24 -

CEO Jim Cracchiolo says the firm’s headcount is poised for growth again following a stagnant year.

January 25 -

CEO Jim Cracchiolo reported record client assets and a sharpened focus under the fiduciary rule.

October 25 -

The rule has cost the firm tens of millions of dollars in compliance and lost revenue.

July 26

Thirteen of the top 25 companies generated double-digit growth in 2017 as rivals close in on the perennial No. 1 firm.

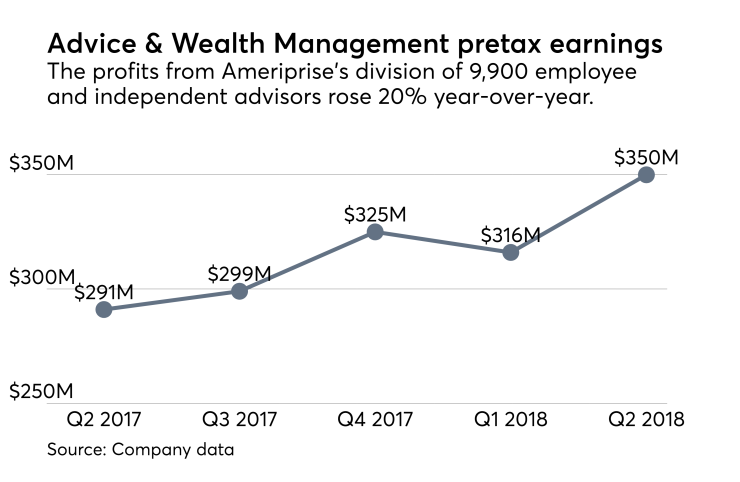

The wealth management unit reported pretax adjusted operating income of $350 million, half the company’s overall amount, on $1.5 billion in revenue. Market appreciation, cash-balance gains and “strong client activity” drove the revenue up 12% over the year-ago period, the firm says.

Retail client assets grew 10% year-over-year to a record $566 billion on the strength of an advisory wrap net inflow of $5.3 billion, as well as client acquisition and market performance, according to the firm. Assets had reached record highs for four straight quarters

The segment’s expenses rose 10% to $1.2 billion, which the company says reflects higher distribution costs for the record client assets. Spending on growth investments, including the new tech tools, also increased general and administrative expenses. The firm doesn't break out the exact numbers of its tech investment, though.

Advisor productivity jumped 12% over the second quarter of 2017 to $599,000 per year, after adjustments for the elimination of 12b-1 fees in advisory accounts. The distribution costs for the higher productivity, which includes fees for advisors, pushed up the parent firm’s expenses by 6% year-over-year to $2.6 billion.

The advice and wealth management unit “remains the growth driver of Ameriprise,” Cracchiolo said, praising the firm’s advisors for gaining more clients, moving upmarket in their bases and deepening their existing clients’ accounts.

“It’s less about number [of advisors] for us and it’s more about what we can deliver that will grow the asset base and the productivity of the advisor,” Cracchiolo said.

The firm’s decision to join other wealth management firms

“It will put more information at the fingertips of advisors and make it even easier for them to engage clients through personalized contact,” Ameriprise spokeswoman Kathleen McClung said in an email. “As referenced on this morning’s earnings call, this is another strategic investment we’re making to help our advisors operate successful, innovative and efficient practices.”

The parent company earned net income of $462 million on $3.2 billion in revenue, with earnings per share of $3.10.

After one-time expenses and revenue including “a lower-than-expected effective tax rate,” the adjusted EPS of $3.60 came in “a few cents ahead of consensus,” Klauber said in an analyst note. The value of Ameriprise’s stock increased 1% to more than $144 per share by the early afternoon in trading after the earnings.

“All in all, it was a fairly in-line quarter highlighted by continued strong performance in wealth management,” Klauber said. “We continue to like the stock, and we believe it looks attractive here at only eight times our 2019 EPS estimate.”