When it comes to portfolio management, diversification is key. But are advisors diversified enough when it comes to their own client base?

Only 30% of advisors are actively looking for clients under the age of 40, according to Alexandra Cole, co-founder of Purpose Generation, a millennial-focused marketing agency that works with firms including Morgan Stanley and Wells Fargo Advisors, citing 2015 Corporate Insights research.

Considering the

“You should be treating your client base just like you do a portfolio,” she said. “It should be well-balanced. It should be diversified. You should be including some of these emerging markets, this next wave of wealth. Women and NextGen should be part of a well-balanced portfolio of clients in order to ensure a lower risk and a higher return.”

Why aren’t advisors paying attention to younger clients? Cole said she hears several reasons: Young clients don’t have complex financial planning needs, aren’t wealthy or prefer technology over human interaction. None of these are realistic concerns, she said.

THE OPPORTUNITY

Millennials are already earning more than other young adult households did at their age, according to

Millennials could benefit from a financial advisor now, according to Cole, who says that too many young workers are holding their savings in cash. In addition, they have upcoming life events they need to plan for, including having children or becoming homeowners.

And even tech-savvy millennials will always value the human relationship, Cole said.

“The values are the same across all the generations. It’s really the tools and the messaging that need to be adapted,” she said.

-

"This multigenerational shift in wealth will reshape the wealth management landscape over the next quarter century," an expert says.

November 21 -

Workers looking to retire comfortably are more in need of professional guidance than they realize — and there are a lot of them.

November 5 -

You’ll probably find administrators blocking the backdoor Roth IRA strategy more than anyone else, says Kimberly Foss, planner, author and Financial Planning contributor. That’s when you’ll have to adopt the role of educator, she says.

October 18

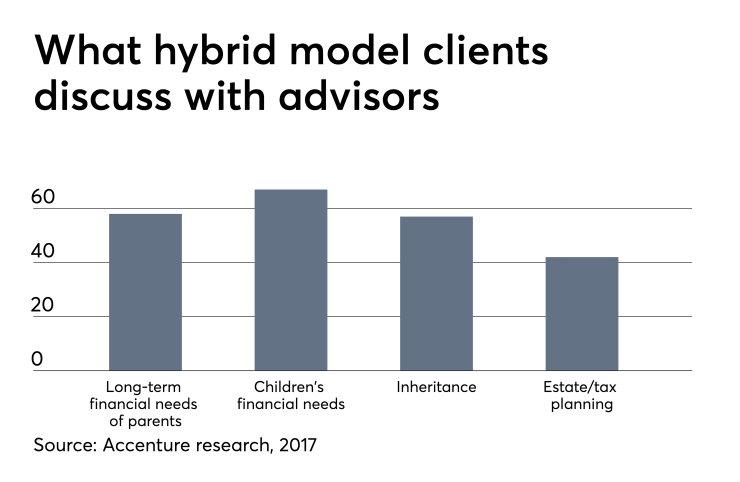

Millennials do, however, expect to use technology when it comes to investing. Approximately 68% of emerging wealthy Americans preferred hybrid investment advice over a traditional financial advisor or conventional robo advisor, according to

“Most millennials want a hybrid — they don’t want just technology and they don’t want just human advisors … they want a combination,” Cole said. “The trick is to be highly intentional about when you employ technology.”

Younger clients expect a seamless digital experience, she said, because it is what they are used to. “It’s not a nice-to-have. It’s a must have. It’s table stakes,” Cole said. “We can track our pizzas from oven to doorstep, so it shouldn’t be a surprise that we want to be able to see our financials in real time anywhere on any device.”

FINDING MILLENNIAL CLIENTS

Forty-eight percent of emerging affluent millennials say they will definitely or probably leave their current provider in the next 12 months, versus only 8% of other investors, according to a 2017

How should advisors go about attracting the next generation of clients? It starts with finding these clients where they already are — online.

While it’s not necessary for advisors to be on all social platforms, Cole says, they need to at least have a LinkedIn profile with a profile picture. In addition, advisors should pay attention to how they market themselves on social media.

Millennials use Instagram for their close friends and for inspiration, Facebook for larger circles and events and LinkedIn for professional services and networking. “Be intentional about where you show up [on social media] and how you show up there,” Cole said.

Content can get millennials’ attention, Cole said. She suggested writing a blog, sharing articles on LinkedIn and hosting monthly office hours as videos, so older clients can forward them to their kids, who may be potential clients.

Cole suggested advisors make guides for how to navigate important life milestones that they can hand out at events, or to a client’s children. “Use education as a way to get your foot in the door,” she said.

Once an advisor has gotten a client’s attention, transparency will be key to establishing trust, as millennials are used to readily available pricing models and being able to clearly understand what they are paying for.

“Transparency is the way to a millennial’s heart,” Cole said.

She suggested advisors consider publishing prices and fees on their websites, clearly illustrating what a client would pay and what services they would get in return. Advisors may want to consider alternative pricing models for their millennial clients as well, such as flat fees, setup fees or subscription fees, Cole said.

Advisors shouldn’t use retirement planning as a selling point, as it isn’t an immediate priority for them yet. Instead, advisors should help younger clients plan for near-term milestones, such as a wedding, or traveling.

It might benefit advisors to be up front about the firm’s personal values, she said. It can also help to highlight people at the firm who are the same age as the younger clients they are targeting.

“Leverage your younger team members,” Cole said.