Baird is acquiring rival firm Hilliard Lyons, swelling its wealth management ranks by about 44% or 380 advisors, and expanding its presence in the Southeast, according to the firm.

-

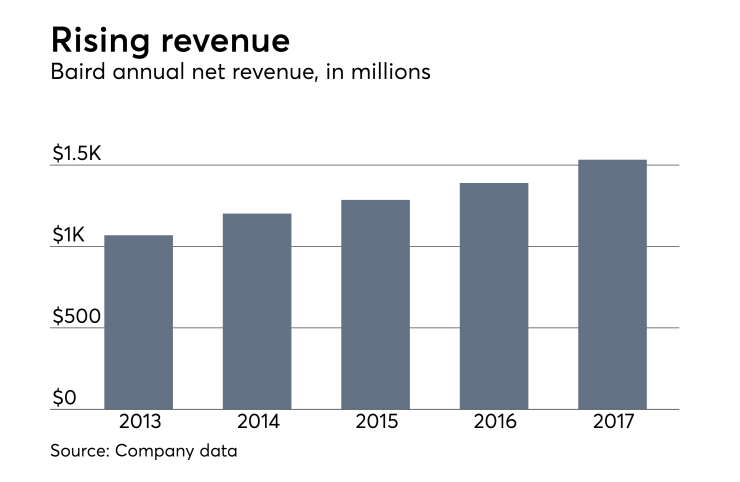

The regional broker-dealer has stepped up its expansion this year.

July 23 -

The acquisition will expand the Milwaukee-based firm's presence in the Northeast.

June 5 -

The move comes more than three months after Morgan Stanley and UBS quit the agreement.

March 20

"Joining forces will accelerate the success of both firms and the success of our clients," Baird Chairman Paul Purcell said in a statement.

The deal includes both Hilliard Lyons brokerage and Hilliard Lyons Trust Co. The company has more than $50 billion in client assets and had more than $280 million in revenue as of Sept. 30, 2018, according to Baird. Terms of the deal were not disclosed.

Acquisitions have been consolidating the industry for years as firms seek greater scale to cope with higher regulatory and technology costs.

Stifel, for example,

And in 2015, three global banks exited the U.S. wealth management market. Barclays sold its unit to Stifel Financial. Deutsche Bank sold its U.S. private client business to Raymond James. And Credit Suisse entered into an

Milwaukee-based Baird, which has been steadily adding advisors through its recruiting efforts, has also bought smaller rivals.

In 2014, the firm acquired

However, its acquisition of Hilliard Lyons dwarfs those deals.

Baird fielded 858 advisors at the end of 2017, according to its annual report.

Louisville, Kentucky-based Hilliard Lyons has 70 branches in 12 states and has been attempting to expand through revamped recruiting efforts. The firm joined the Broker Protocol earlier this year. It has also hired about two dozen brokers and

Last year,

The deal with Baird also caps a long history for Hilliard Lyons, which traces its origins to 1854.

Hilliard Lyons leadership — including CEO James Allen, President Tom Kessinger III and Director of Private Wealth Alan Newman — will continue in their current roles, according to Baird. The firms are expected to complete the transition in the second half of 2019.