Bank wealth management executives have a big challenge on their hands: convincing their bosses to lower revenue and profit expectations for the businesses they run.

Banks expect revenue from investment services to grow in the range of 4% to 6% despite the blow that the fiduciary rule is likely to deal brokerage and related businesses in 2017, according to intelligence gathered at a meeting organized by Kehrer Bielan Research & Consulting.

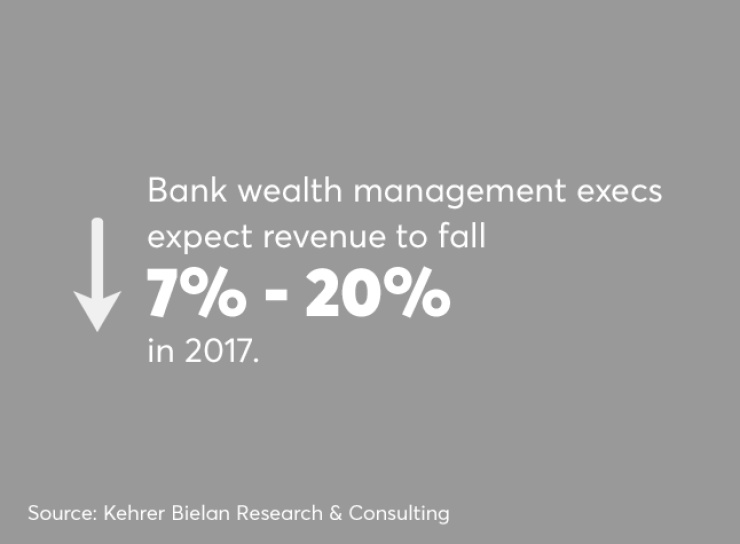

Many investment services leaders are understandably worried. They see revenue sinking 7% to 20% next year as a result of fewer commissions from transactions and shrinking advisory fees. Profits would get hit even harder, they say, due to the cost of reengineering systems to comply with the rule and the need to provide incentives to retain advisers in the new environment.

"The rule will put downward pressure on revenue, while also forcing firms to spend more money on compliance, squeezing profit margins badly," said Tim Kehrer, a senior research at Kehrer Bielan.

How can nervous execs curry a little sympathy from their bosses? They can start by providing management with independent projections showing the revenue hit the industry is likely to take as a result of the new regulation. Consulting firm A.T. Kearney, for example, projected that broker-dealer revenue will decline 11%.

The key is to set proper expectations for 2017, according to Kehrer. If they agree to an unrealistic growth goal set by the bank, investment executives will "get burned when they miss the goal next year," he said.

Wealth execs might also point out that the fiduciary rule is likely to be as disruptive to business as was the Dodd-Frank regulation that went into effect following the 2008 financial crisis.

"They aren't giving us a free pass, but they have been more understanding," said one of the participants at the meeting.

Investment services executives might even broach the idea of having banks and credit unions take a restructuring charge, said Jonathan Gabriel, managing director at Kehrer Bielan and a former bank executive. This would allow the broker-dealer and related businesses to reposition themselves to thrive in 2018 and beyond.

In addition to getting management to face reality, investment services leaders will need to make decisions based on incomplete or non-existent information. For example, they will need to develop budgets without knowing what the commission rates and fees will be on their product offerings and the overall impact the pricing has on product mix, said Peter Bielan, a principal of Kehrer Bielan and director of the firm's DoL Readiness consulting practice.

They will also have to decide whether to design compensation plans that enable their top-performing advisers to make as much as they usually do, even if they produce much less revenue, to help them through the difficult transition ahead, said Bielan. If they do, it will likely compress profit margins further.