Want unlimited access to top ideas and insights?

Q: A client of mine took a pretty big hit on an investment I had suggested to him. He’s been making noises about complaining to my supervisor, and I was thinking of just cutting him a check for the loss to be done with it and avoid any hassles, but I thought I remembered something about that being prohibited. If it is, how do broker-dealers settle complaints and lawsuits?

A: You remember correctly — and your memory has likely saved you from a suspension and possibly a fine as well!

FINRA rule 2150(c) prohibits registered representatives from sharing in the profits or losses in a customer’s account unless all three of the following requirements are met: (i) the registered representative receives prior written permission from his or her member firm employer; (ii) the registered representative obtains prior written permission from the customer; and (iii) the registered representative shares in the profits and/or losses in direct proportion to the financial contributions the registered representative made to the account.

Since I doubt you contributed any money to this account, and I assume you haven’t received permission from your employer, if you reimbursed the client for his losses, you would be in violation of the rule and would likely find yourself facing an enforcement action.

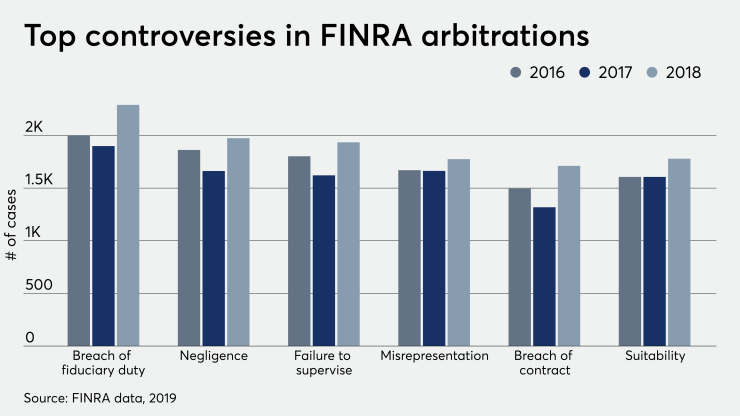

You do, however, raise an interesting point in that, given such a rule, how are broker-dealers allowed to settle complaints, arbitrations and lawsuits?

The supplementary material to the Rule provides the answer: “Nothing in this rule shall preclude a member, but not an associated person of the member (emphasis added), from determining on an after-the-fact basis, to reimburse a customer for transaction losses; provided, however, that the member shall comply with all reporting requirements that may be applicable to such payment. If, for example, the payment can reasonably be construed as a settlement, the member shall report the payment as a settlement.”

What’s interesting about this is FINRA’s prohibition against registered reps (or as they’re referred to here, associated persons) from making these reimbursements on their own. FINRA wants brokerage firms to keep track of these payments so they can determine if there was some wrongdoing underlying the payment. If reps were allowed to reimburse clients on their own, a lot of violations could fly under the radar.

Of course, you should discuss this issue with your supervisor, and all written customer complaints must be kept and preserved in accordance with