In an eleventh-hour attempt to save the fiduciary rule, AARP has filed a motion with the 5th U.S. Circuit Court of Appeals asking it to review the decision that vacated the Department of Labor’s regulation.

The Attorney General’s offices in New York, California and Oregon filed similar petitions.

The actions come amid doubt about the rule’s future. President Trump has ordered the DoL to review the regulation and consider revising or rescinding it. In March, a three-member panel vacated the rule — which requires advisors to put their clients’ interests first — in a two-to-one decision. The DoL has until the end of April to petition the panel’s decision.

AARP, one of the nation’s largest retiree advocacy groups, is asking the 5th Circuit to become a defendant in the original ruling that struck down the rule, allowing the group to push forward with a potential rehearing — even if the Labor Department decides to do nothing.

“We have not heard anything from the DoL that they were going to file for a petition for a rehearing,” said AARP Attorney Mary Ellen Signorelle, who was part of the team that filed the documents on Thursday.

AARP's motion is asking for a full 17-judge review of the decision, known as an en banc review.

The panel’s decision in March ran counter to previous federal court decisions by the District Court for the Northern District of Texas and the 10th U.S. Circuit Court of Appeals.

“Given the split in the decision, it made sense,” Signorelle said at a press conference held by AARP on Thursday, adding that only two judges from the 5th Circuit consented. “Every other court upheld the rule, so we thought that that was a good reason to move forward.”

Since the DoL has not appealed the ruling, AARP can argue that its 38 million members will be harmed without a more stringent standard of financial advice. In the 16-page filing, the group wrote that “the panel’s decision also presents an exceptionally important issue because it robs workers, retirees, and their families of crucial protections for their retirement investments.”

While not unprecedented, the move is rare, Signorelle said. “I don’t know if it’s common, but it certainly happens,” she said.

The advocacy group is a staunch supporter of the fiduciary standard. “Many financial advisors already give advice with the public’s best interests in mind," said Nancy LeaMond, AARP’s chief advocacy and engagement officer, in a statement. “But the recent court decision allows some financial advisors to provide guidance based on what’s best for their pocketbooks, not the consumers.”

In addition to the three states’ Attorney Generals’ petitions, the New York AG’s office concurrently filed a petition for a rehearing with the 5th Circuit, according to the agency, which also asks for an en banc review.

“It’s common sense: Financial advisors should act in their client’s best interest, not their own,” said New York Attorney General Eric Schneiderman in a written statement. The N.Y. petition alleges the decision “deprives millions of Americans of basic safeguards as they seek financial advice about their retirement investments.”

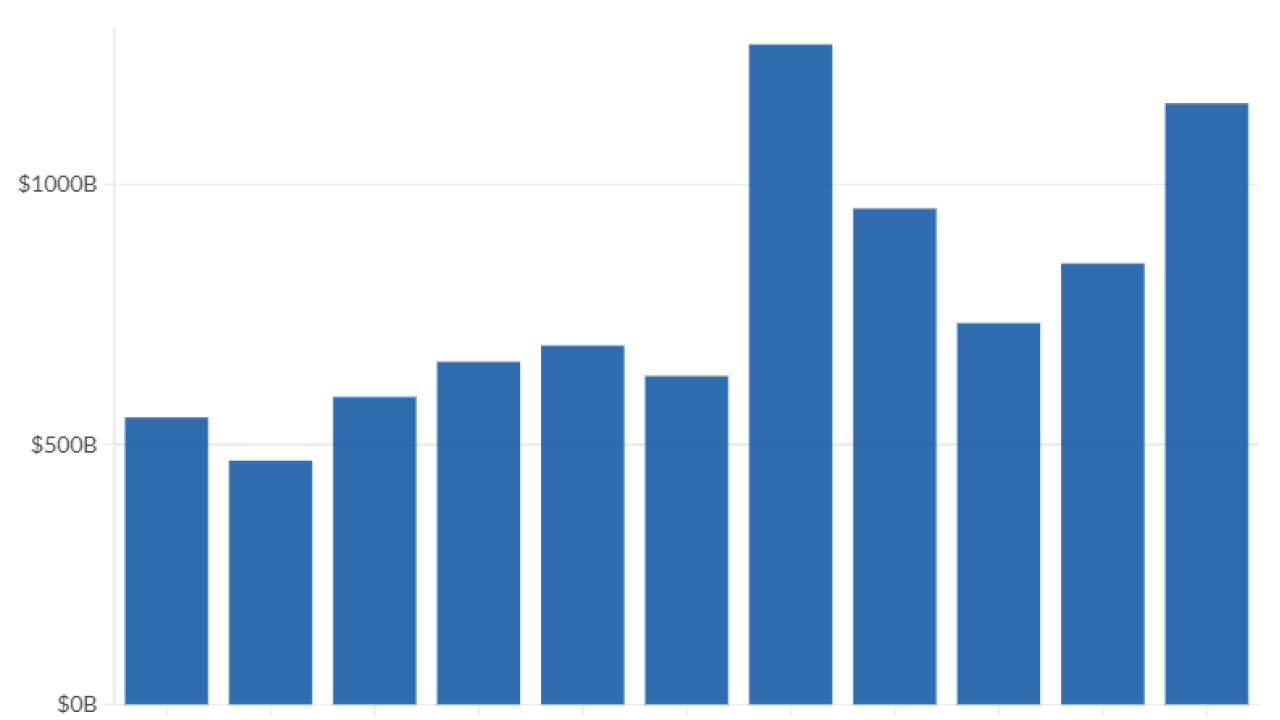

Individual investors lose an estimated $17 billion dollars annually because of hidden fees and conflicts of interest, according to the AARP citing government estimates.

“California, New York and Oregon are important states with a lot of people,” said AARP Legislative Policy Director David Certner at the AARP press conference. However, those rulings would only have jurisdiction over retirees in those states, he adds. Appealing the 5th Circuit decision directly could reinstate the DoL rule on a national level.

“We’re hoping that between AARP’s petition and then the states’ petition that there will be a good chance of granting en banc review,” Certner said. “There is a clear split out there and we think this court decision needs to be reviewed by the full circuit.”

However, there is good reason this type of legal wrangling is rare, says Bradford Campbell, a partner at the law firm Drinker Biddle & Reath.

“It’s essentially a political stunt,” says Bradford Campbell, who is also the former Assistant Secretary of Labor for Employee Benefits and former head of the Employee Benefits Security Administration. “I don’t think there’s much likelihood they would actually be granted the ability to intervene to take over this litigation.”

Allowing AARP to intervene in federal litigation could open the floodgates for other advocacy groups to steer future regulation, Campbell says.

“It doesn’t make sense to allow private parties to stand in the shoes of government agencies,” Campbell says. “Having regulation highjacked by interest groups in the courts is not a workable way forward.”

The

“The SEC and the DoL have different jurisdictions,” Certner says, adding that the SEC doesn’t regulate all retirement products like insurance products, for example. “The DoL rule really applies to all [retirement savers] and goes beyond the scope of the SEC.

“Regardless of what the SEC is going to do, the DoL rule is a strong rule, and necessary in its own right,” Certner says, adding the AARP will be active in shaping the SEC rule, as well.