Financial advisors who continue to prefer independence in "excess" numbers will put trillions of dollars in client assets in motion over the next decade, according to a new study.

At least 71% of advisors prefer independent channels in which they're contractors to national brokerages or with registered investment advisors — even though only 44% of them have actually moved into that part of the wealth management industry, research and consulting firm Cerulli Associates found in a report

With 37% of brokers across all firms managing $9 trillion in collective assets expecting to retire on a complete or partial basis over the next 10 years, independent brokerages and RIAs are gaining a "slow but steady migration" of advisors that's "a pain point" for wirehouses, said Michael Rose, an associate director with Cerulli's wealth management division who co-authored the report. Fears that clients won't follow their advisors from giant, well-known firms to smaller brands in independence are often proving unfounded, he said in an interview.

"The client relationship is very much tied to the advisor, more than it's tied to the firm, on average — which makes sense given the nature of what advisors are doing for their clients," Rose said. "When they're making such a strategic shift, it is a good opportunity for the advisor to bring the clients who best align with how they want to run the business moving forward."

The findings came as no surprise to recruiters assisting advisors dropping the brokerages where they were employees in some cases for decades before seeking out the greater flexibility and pay of independent firms. Despite the usual "analysis paralysis" around

"There are several firms now that offer supported independence," she said. "There are a lot of really good options now where you can offload a lot of those duties and responsibilities but still be independent."

Retiring advisors with succession plans can reap higher valuations and revenue multiples for their businesses after becoming the owners of their practices through independent firms, according to Michael Terrana, the CEO of Terrana Group. Amid the pandemic of the past two years, the average size of wirehouse breakaway teams has been growing as "the light went on" for a lot of advisors working from home, he said.

"It forced everyone to work remotely and work independently," Terrana said. "It gave advisors a taste of what it would be like."

Despite the continuing

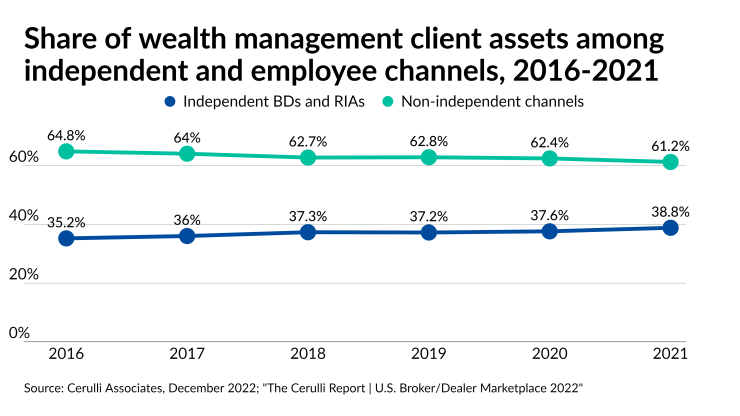

The share managed by independent brokerages and RIAs rose by 360 basis points over the past five years to 38.8%. Across the entire industry, advisor-managed assets soared at a compound annual growth rate of 9.6% during the largely bull stock markets of the past decade.

Among other interesting findings in the survey, Cerulli reported that:

- The average assets under management per advisor across the industry is $106.3 million. Wirehouses ($244 million) have the largest average AUM. Insurer-owned brokerages ($23 million) and independent brokerages ($68 million) have the lowest.

- Employee advisors cited more autonomy (62%), higher pay (57%) and building value in a business they own (54%) as the most attractive factors favoring independence.

- When advisors change their brokerage or RIA, an average of 75% of their client assets follow them to the new firm. An estimated 61% of such moves by advisors in 2022 kept them in the same industry channel when they switched firms.

- Hybrid RIAs that work with brokerages and other independent advisory firms boosted their assets more quickly than any other channels in the industry in the past year, the last five years and for the decade.

- At 42%, independent brokerages have the largest share of advisors expected to retire during the next decade. Wirehouses (37%) and other employee brokerages (38%) have the next highest rates of expected retirements.

- A quarter of advisors planning to retire during the next 10 years said they're unsure of their succession plans, and another 15% said they'll rely on their firms to reassign their clients.

- With 15,000 advisors in their first three years in the industry, a projected 11,482 of them will "fail out of the industry" across all brokerages this year, according to Cerulli. That's more than three-quarters of all trainees.

The rookie advisors most frequently identify training on financial planning techniques as the most important factor in their success, according to Rose. Industry training programs traditionally "have really been sales-oriented," meaning that aspiring planners must often "go out into a marketplace that is increasingly skeptical of financial professionals, in general, for a lot of reasons," he said. Firms will have

"This is a big challenge," Rose said. "This has been the case for quite a while, but it's become a bigger issue as the advisor age increases and the need to bring in that next-generation talent becomes increasingly important for firms."

Those incoming advisors, as well as the breakaway brokers from wirehouses, can pick from a rising number of independent firms that are investing in new technology and offering greater flexibility than the traditional incumbents, he said. Independent brokerages, for example, are starting to have hundreds of advisors who don't take any commissions as part of their business, which was rare only a decade ago. Cerulli's findings suggest that the independent movement will continue to develop and expand over time.

"It requires [brokerages] to rethink how they can provide the best value to their advisors," Rose said. "It's causing firms to be a little bit more creative, and I think all of that is good for the industry. Most firms recognize that it's going to challenge them to make sure they're on the ball."