Client asset levels at Ameriprise fell, mirroring declines at rival firms and reflecting the impact that fourth-quarter market volatility had on the wealth management business.

Ameriprise said client assets for its wealth management unit dropped 4% year-over-year, landing at approximately $538 billion. Assets in wrap accounts inched up 1% to reach $249 billion.

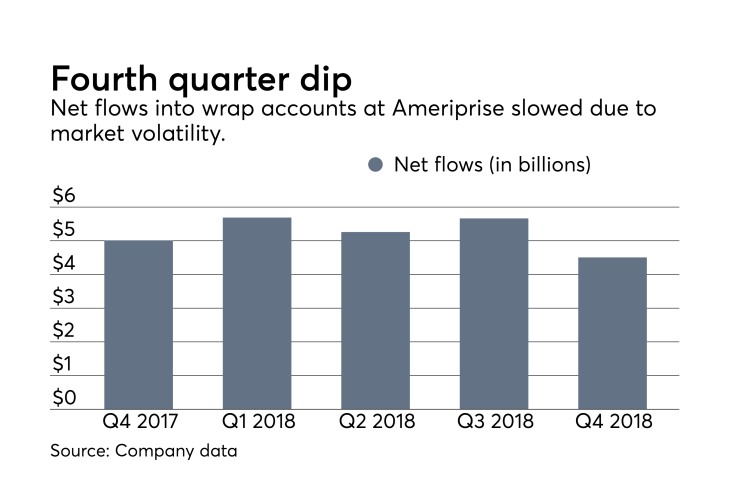

The firm reported net flows of $4.5 billion for the quarter compared to $5 billion for the year-ago period.

These elite advisors were responsible for more than $9 billion in client assets.

“While [equities] come back a bit, we are managing the business in light of this uncertain backdrop,”

Ameriprise’s competitors reported similar declines.

Cracchiolo acknowledged as much, but also said that market volatility provides an opportunity for the firm’s advisors to demonstrate to clients “

The long-serving CEO also pointed to investments Ameriprise has made in technology, which could position it for new growth.

Despite the volatile quarter, Ameriprise reported pretax profits of $368 million for its wealth management unit, up 13% year-over-year thanks in part to expense discipline.

Advisor headcount, at 9,931, was flat from the prior quarter and up 35 from the year-ago period. Ameriprise’s independent broker-dealer is larger than its employee BD, with 7,755 advisors to 2,176.

The Minneapolis-based firm reported average revenue per advisor was $159,000 for the quarter, up 7% year-over-year.