Financial advisors say that growing majorities of clients are feeling at least somewhat prepared for their financial future — a welcome result, they say, of the hard look clients have had to take at their financial situation over the long grind of economic dislocation springing from the coronavirus pandemic over the past seven months.

But while clients were generally feeling better about their financial situation in October than they did in April, that doesn’t mean they’ve returned to the pre-pandemic levels of confidence, according to Financial Planning's latest Financial Wellness Report.

"These are unprecedented times," one advisor says. "Each client has different needs and needs to be addressed individually. Almost all seem to be taking this time period seriously and doing a decent job of planning for themselves and their family."

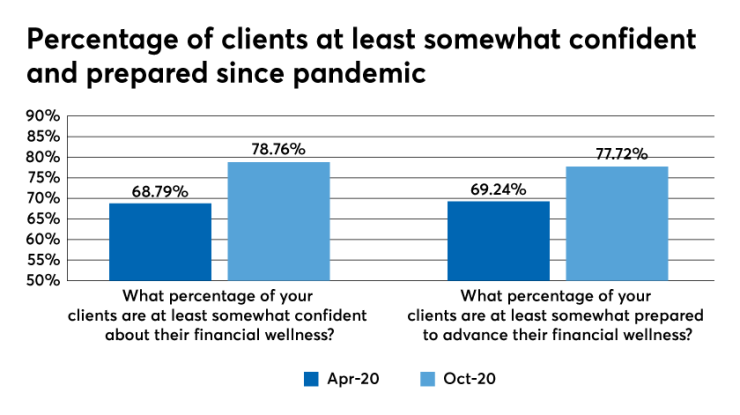

Some attitude shifts were stark. In October, the number of advisors who said their clients were "extremely" confident or well prepared to advance their goals had dipped significantly from six months earlier. Twenty-one percent of their clients enjoyed extreme confidence about their financial wellness in April as opposed to 15% in October. Over the same period, the proportion of clients who felt extremely prepared to advance their wellness goals slid from 21% to 17%.

But the latest quarterly Financial Wellness Report also found that the proportions of clients who feel at least somewhat confident and prepared to advance their goals have actually increased since April, with both metrics nearing 80%.

‘They finally get it’

Some of that rising sense of confidence and preparedness can be traced to the increasing interactions clients are having with their advisors since the onset of the pandemic.

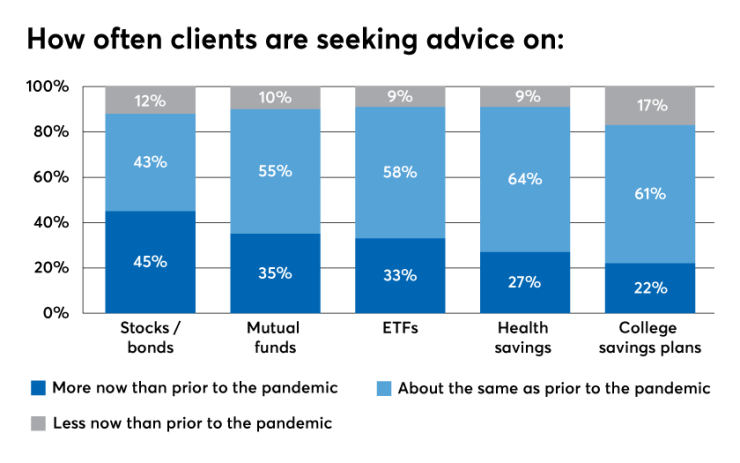

Many advisors say that clients are coming to them for advice about a range of products and investment strategies more often, suggesting that the market volatility and fragility of the economy has led many investors to turn to a professional for financial guidance.

"I make comprehensive recommendations, monitor and track them consistently with clients. I am constantly trying to educate them and making sure they understand," says one advisor. "Sometimes clients don't really want to know and just do what I recommend," the advisor adds. "The clients who are fully engaged and implement my recommendations are very well prepared."

After 27 years of speaking to clients about contingency planning they finally get it.

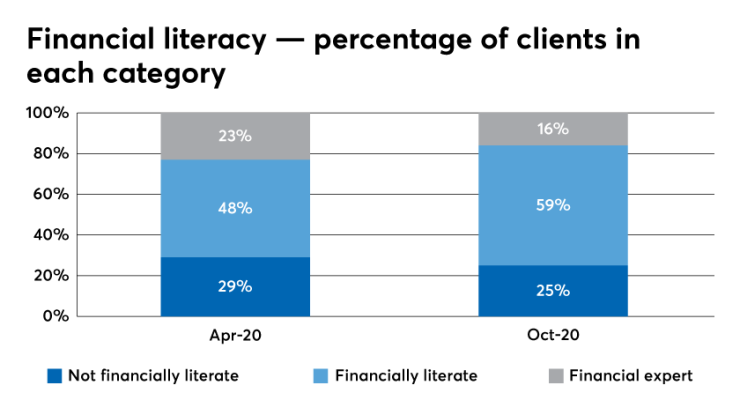

For many advisors, discussions around investments in the context of the pandemic have been an opportunity for broader conversations around financial literacy, an area key to clients' financial wellness and a metric that has been showing some uptick since April.

Advisors polled in the survey say that while fewer clients today qualify as "financial experts" than in April (16% down from 23%), the ranks of those they consider "financially literate" have risen from nearly 48% to more than 59%.

"This is a great time to address this topic,” says one advisor. “After 27 years of speaking to clients about contingency planning they finally get it.”

He adds: “Clients have always been somewhat advice receptive, now they are more so. For those of us who wish to improve our clients' financial wellness, it's a great opportunity."

Just enough savings

The pandemic has also helped focus advisor-client conversations on savings rates, both for regular retirement planning and for emergencies such as unexpected health expenses or unanticipated loss of income — both hard realities for many Americans this year.

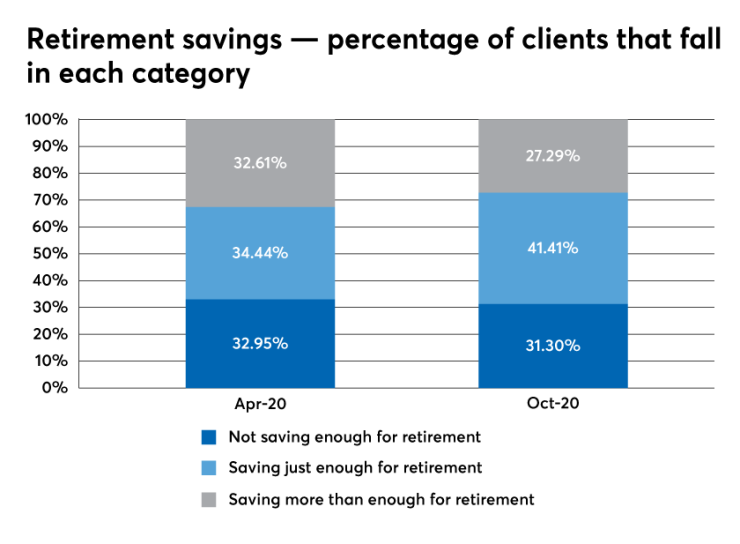

Survey data indicate modest improvements in client savings patterns since April. The biggest mover in retirement savings was in the category “clients who are saving just enough for retirement,” which jumped from 34% of clients in April to 44% in October. The number of clients not saving enough ticked down about a point-and-a-half.

However, the number of clients saving more than enough for retirement fell off a few percentage points over the same span, according to the survey.

The story was similar, if less dramatic, when advisors were asked about clients' emergency savings. The number of clients saving enough for an emergency ticked up a couple points, while the numbers of clients either saving more than enough or not enough inched down.

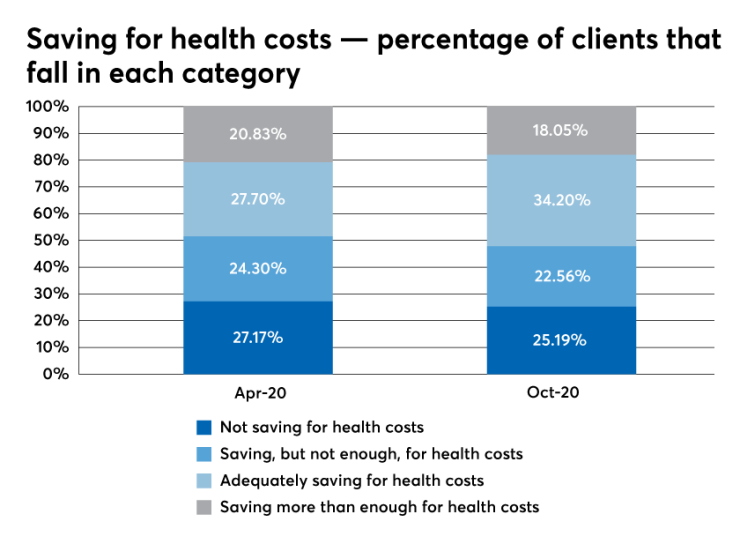

Regarding health care, advisors say that the number of clients who are adequately saving for health costs has risen from 27.7% in April to 34.2% in October, while the number of clients either not saving at all for health costs or not saving enough has ticked down slightly over the same period.

Those increases in savings rates, however modest, track with several advisors who report that their clients have been reassessing their financial picture amid the pandemic, with many cutting unnecessary expenses and recommitting to financial wellness.

"We are living in very unusual times," one advisor says. "If we have learned nothing from this year it's that financial preparation is the key to navigating unusual events."