Want unlimited access to top ideas and insights?

Two mistakes financial advisors see far too frequently are clients making ineligible or unwanted IRA contributions. These mishaps occur in both traditional and Roth IRAs.

In the wake of tax law changes of 2017, recharacterizations of Roth conversions are no longer an option. But a remedy remains: Recharacterizations of IRA contributions are still possible and can prove a valuable strategy to correct such missteps.

A Roth IRA contribution can be recharacterized as a traditional IRA contribution, or vice-versa, as long as the recharacterized contribution is valid in its own right. A recharacterization can be done for any reason and can also be used when the wrong type of IRA mistakenly receives a rollover or transfer.

Which clients can benefit?

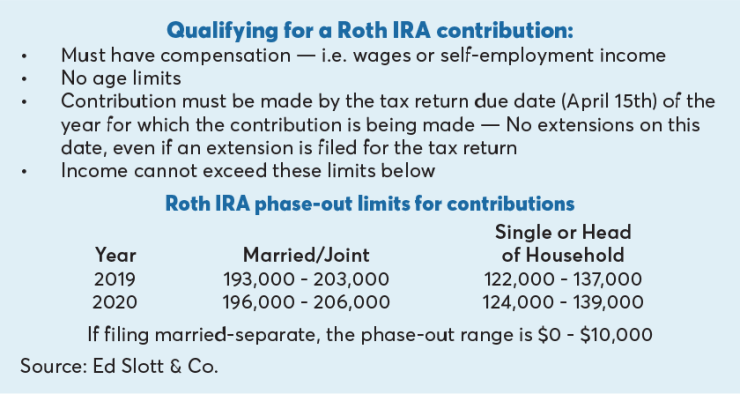

A client who contributes to a traditional IRA and later discovers the contribution was not deductible due to plan participation and income limits could recharacterize the contribution to a Roth IRA — as long as that client qualifies for a Roth IRA contribution with income under the limits.

Conversely, another client who contributes to a Roth IRA, not knowing that their income was above the eligibility limits, could recharacterize that contribution to a traditional IRA.

Keep in mind that recharacterizations can be done for reasons large or small, including clients who simply change their mind about their retirement savings strategy. The only limitation is that the client must be eligible to contribute to the type of IRA to which the funds are being recharacterized. A 75-year-old client, say, cannot recharacterize a Roth IRA contribution to a traditional IRA because they are ineligible to contribute to a traditional IRA due to his age. (Note: That could change under proposed legislation that would eliminate the age restriction on traditional IRA contributions.)

Additionally, a contribution cannot be recharacterized from one tax year to another.

How it works

To recharacterize an IRA contribution, the IRA custodian will transfer the funds along with the net income attributable — also known as an NIA — from the first IRA to the second IRA. Note that this must be a trustee-to-trustee transfer. Simply distributing an excess or unwanted contribution and recontributing it to another IRA will not work.

While this is a tax-free transaction, both IRAs report the transaction to the IRS.

The recharacterized contribution is treated as if it had always been made to the intended IRA. Recharacterization has no negative tax consequences and allows tax-advantaged savings in an IRA to continue.

What happens if the recharacterization deadline is missed?

The deadline for recharacterization is Oct. 15 of the year following the year for which the contribution was made.

The IRS user fee for a late Roth recharacterization private letter ruling is $10,000, plus professional fees of possibly thousands more to prepare the ruling request. The IRS can provide relief through a private letter ruling but this is an expensive way to go as the cost of the ruling can easily exceed the contribution amounts involved.

However, two recent private letter rulings, released this summer, highlight how IRS can provide relief if the recharacterization is not completed by the Oct. 15 deadline. In those similar rulings, the IRS allowed IRA owners an extension to recharacterize several years of ineligible Roth contributions as traditional IRA contributions, even though the statutory deadline for recharacterization had long passed. Rulings can be seen here:

The IRS found in both cases that the taxpayers had acted reasonably and in good faith. Because the taxpayers asked to recharacterize the Roth IRA contributions as traditional, nondeductible IRA contributions, the IRS allowed the late election, despite the fact that several of the years in question were closed by the three-year IRS statute of limitations.

In one of the cases (PLR 201930027), the taxpayer had been making Roth IRA contributions for a number of years. And in most of those tax years, the IRS statute of limitations was closed. During those years, she used a CPA to help prepare her returns. The tax advisor was aware of her modified adjusted gross income and that she was making Roth contributions, but the CPA did not inform her that her MAGI disqualified her from making Roth IRA contributions or that she could recharacterize those contributions.

The taxpayer remained in the dark until she met with an investment advisor — but that was after the recharacterization deadline. As a result, she went to the IRS for a private letter ruling requesting an extension of time to recharacterize her Roth IRA contributions as traditional, non-deductible IRA contributions.

In PLR 201932019, a married couple had each been making Roth contributions for a number of years — at least some of which were closed tax years. One spouse learned of MAGI limits for Roth contributions at a retirement seminar.

The couple subsequently discovered that each of them had made ineligible Roth contributions for at least some of the years. By that time, the deadline for recharacterizing the Roth contributions had passed. They went to the IRS for a private letter ruling and represented to the IRS that their request was being made before the IRS discovered the failure to recharacterize. Each requested an extension of time to recharacterize the Roth contributions as traditional, nondeductible IRA contributions.

Taxpayer win

In both rulings, the IRS granted the taxpayers 60 days to carry out the recharacterizations. The IRS said that, under Section 301.9100 of the tax regulations, it has discretion to grant an extension of time if the taxpayer establishes that (1) they acted reasonably and in good faith; and (2) the grant of relief doesn’t prejudice the interests of the federal government.

Acting “reasonably and in good faith” applies if the taxpayer reasonably relied on a tax professional and the professional failed to advise them to make the necessary election. In PLR 201930027, the IRS concluded that the taxpayer had met both conditions.

Another circumstance would be if the taxpayer requests relief before the IRS discovers the failure to make a timely election. The couple in private letter ruling No. 201932019 met that condition.

The IRS noted that the interests of the federal government would be prejudiced if granting relief would result in a reduction in the taxpayer’s tax liability compared to what it would have been had the taxpayer made a timely election. In both rulings, the IRS concluded that granting relief would not lead to such a result because the recharacterization was to a nondeductible traditional IRA, so income for the closed years would not be reduced by a tax deduction.

If the taxpayers had not received relief from the IRS, the ineligible Roth contributions would have been considered excess contributions, which are subject to a 6% penalty for each year until they are fixed. The only way to avoid the penalty is to correct the excess contributions, by recharacterizing or withdrawing them — plus NIA — by Oct. 15 of the year following the year for which the contribution was made.

Was the private letter ruling worth it?

Assuming both the husband and wife maxed out their ineligible Roth contributions for the three years, the combined 6% excess contribution penalty would have been less than $2,500. Maybe one of the financial planners who oversaw the ineligible contributions covered the cost of the PLR to regain some credibility or to avoid liability.

Advisors should not blindly accept IRA contributions without making sure that the client has met the eligibility requirements for the contribution.

IRAs are individual retirement accounts. There is no such thing as a joint IRA. When a couple is married, each spouse makes his or her own IRA contribution and, if the contribution is improper, that account owner is liable for fixing it. Despite this, the IRS did not require each taxpayer in PLR 201932019 to file an individual PLR request and issued a joint ruling.

Advisor action plan

In PLR 201930027, the tax advisor, a CPA, totally missed the Roth IRA eligibility rules. Advisors should not blindly accept IRA contributions without making sure that the client has met the eligibility requirements for the contribution.

Advisors must understand how the recharacterization process works in order to take full advantage of the rules. To confirm IRA contribution eligibility, an advisor should ask these questions:

- Does your client have taxable earnings? The tax code limits IRA contributions to the lesser of the annual dollar limit ($6,000 for 2019 and 2020, plus a $1,000 catch-up contribution for taxpayers age 50 and older) or the taxpayer’s earned income for the year.

- Is your client’s MAGI above the phase-out limits for a Roth? If so, the client cannot make a Roth IRA contribution for the applicable year.

- How old are your clients? Traditional IRA contributions are not allowed for any year in which the IRA owner is age 70 ½ or older. Roth IRAs do not have an age limit.

While the ability to recharacterize a Roth IRA conversion is no more, the ability to recharacterize an IRA contribution remains on the table, but it is often overlooked as a strategy to fix excess or unwanted IRA contributions.