Automation is happening within financial services – so how should incumbent wealth management firms adapt in a way that doesn't erode their existing business model or the need for advisors?

It's a process that is at odds with itself, says Uday Singh, a partner in A.T. Kearney’s financial services practice.

Firms have to balance change with external pressure on revenues both from the pace of technology and regulation – the management consulting firm estimates about $10 billion of revenue erosion for wealth managers and retirement advisors resulting from the Department of Labor’s rule change alone, while increasing compliance costs 10-15%.

Speaking with Re: Invent|Wealth, Singh says he sees several challenges for wealth managers in the pivot to digital, and how data use will develop in the future.

Is it a remarkable coincidence that regulatory change has come at the same time when the market is shifting to passive and low-cost alternatives?

What has happened is that the cost for advice has become much more of a public conversation and the reason for that is because people are putting money against it becoming a public conversation. When you look at the advertising that Betterment or WealthFront does, it is essentially creating that public conversation: how much you pay for advice?

Of course the DoL ruling has been in the works for a couple of years now, but it's really the topic of our times as far as financial services are concerned. Though, if you spent a couple hundred million dollars on any topic you will have it in the public conversation.

How do the firms in this market facing this change pivot? Which are best prepared and what are the weakest models?

The one thing that we can point to, in terms of best pivoting, would be investing in digital capabilities. Everything is becoming more digital. Approach it not as an artistic process, but as an engineered process, which is there are certain outcomes that you are seeking.

The second aspect of it is there's a lot of value that the traditional firms have had with the traditional models. There is a magic that takes place when a financial advisor has been with a client for 20 years. That magic cannot be lost. So, while they look at these new models, they have to ensure the goodness of that model is not dissipated.

And the third is firms have to be comfortable with experimenting and disrupting themselves.

I am almost contradicting myself. The first message is you have to be open to change. The second message is be careful you retain your goodness. And that contradiction is where management judgement comes in because that contradiction has to be managed intelligently using data.

Could this industry have continued in the model that it had, and ignored technological change?

The big question that these companies face is: Should they be a disrupter or a defender?

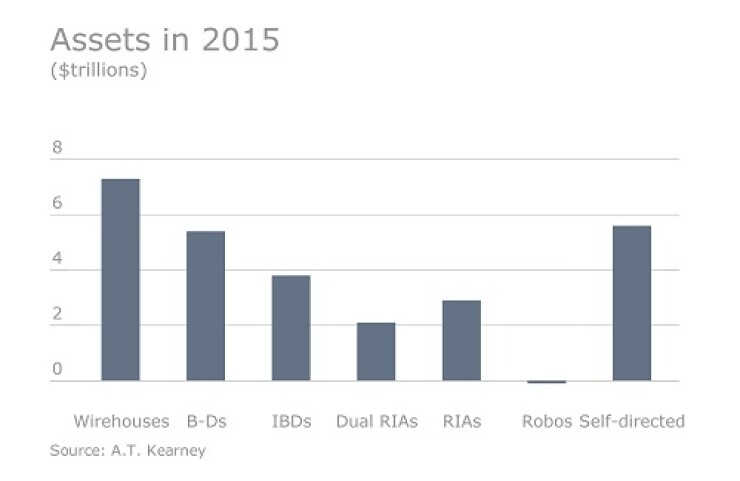

If you look at the businesses that the large players have, especially wirehouses and traditional brokers, those tend to be businesses where they mainly cater to the high-net-worth individual, or certainly one with over $1 million in assets, but more like $2.5 to $5 million. One would suggest that that customer is a lot less sensitive to price than one with investable assets below $1 million. Certainly a traditional business that is focused on high-net-worth individuals, that are very high-touch, would wish to keep that financial advisor at the center of the business model.

You may choose to defend and the digital solutions that you provide will keep the financial advisor front and center. So how do I make my advisor more efficient? That is quite different from a B-to-C business, which is let me go directly to the end customer and disrupt the financial advisor.

Will the wealth management industry experience the trend of technology creating efficiencies, and ultimately redundancies, as we have seen in other industries?

There are technology interventions that are reducing the cost of delivery of any financial services product already. A great example of that, and it's just taking off, is robotic process automation, or RPA.

Ultimately, in any financial services product, especially in wealth, there are going to be numbers of people who process transactions – but a lot of that work can now be disrupted by using technology and some of it being low-cost technology. When we talk with RPA, it basically mimics the human being, and you would set up a robot just like you would set up a human with a login and a password and they can access multiple systems and they can cut and paste and do basic calculations and put it in an Excel sheet and so on. All that can be programmed using very easy with visual language and that is creating a massive dislocation in the workforce.

In the U.S. there is something more common, but RPA actually takes away the reason to offshore to low-cost locations because you just automate it all the way. That's something that's really taking off in Europe in the moment and now spreading to the U.S.

Do you see digital advice platforms developing to a point where it becomes intuitive?

We will see in the near future, within the next four or five years, a holistic solution that helps you meet your financial goals and your financial goals – a place for all of that to come together because all of the data exists. Your spending data sits on your credit card statement, your home should be on your mortgage statement and your retirement data sits on your 401(k) provider's statement. All that can be put together, and the profile can be built, which has a level of knowledge that has accuracy that is not dependent on human interaction, and that accuracy can be reflected in your retirement planning.

The second thing this does is it has an important social component to it. So if you are a teacher in the suburbs of Cleveland, it will tell you how much do people on average – who are demographically close to you in age, close to you in income, close to you in geography and close to you in profession – spend on coffee on a daily basis?

And if social aggregation can tell you that most people are having two cups of coffee from Starbucks – one in the morning and one in the evening – then you know where you rank and that can allow you to be wiser about your decisions in terms of your consumption habits. You might want to spend more money on certain things and less on other things. But you have that information now and you can compare. All consumer behavior studies show that we are social animals.

Maybe that data analysis ability is the answer to regulator doubts about digital advice.

I am sure that there are arguments to be made. But there's a role for the human touch in terms of customer segment and there's a role for human touch in turbulent times.

There's a conversation that most advisors have regarding generational wealth transfers. So if you're a high-net-worth individual with a significant estate, there is a classic talk that they might want to give to the kids saying, 'Spend money responsibly,' or, 'You don’t have money to spend.' That conversation over a lunch or dinner has to take place with a human advisor because that second generation may not be as engaged with the wealth as the first generation that made it. Those types of interactions are really high-quality interactions, hugely trust-based, that an advisor has to be there for.