After a temporary pause in its recruiting of financial advisor trainees due to the coronavirus, one of the largest wealth managers is restarting its hiring with a different approach.

The ranks of Edward Jones advisors — the largest brokerage force in the industry — slipped during the pullback, according to the May 7 first-quarter earnings

Note: Key metrics refer when possible to the company’s U.S. business, rather than its combined results, including those in Canada, where it has 890 advisors. The company breaks out most, but not all of its returns between the two countries.

- Earnings: In the first quarter, Edward Jones earned income of $381 million before allocations to partners on revenue of $2.78 billion. Profit jumped 25% year-over-year, while revenue expanded 15%. Operating expenses before variable compensation surged 8% to $1.94 billion due to the impact of higher advisor compensation.

- Client assets: The total amount under administration rose 40% year-over-year to $1.58 trillion on the higher equity values at the end of the first quarter. Net new assets increased 7% to $19.3 billion.

- Class action settlements: A federal judge granted preliminary approval on May 4 for the company’s

$34-million settlement of a lawsuit filed by three former Edward Jones advisors alleging the firm discriminated against its Black representatives. The order from the Chicago federal court enables the administration of the settlement to begin, according to the company’s filing. A separate settlement involving reimbursement of advisor and trainee business expenses in California is “substantially complete” after a judge issued the final approval in November, the filing states.

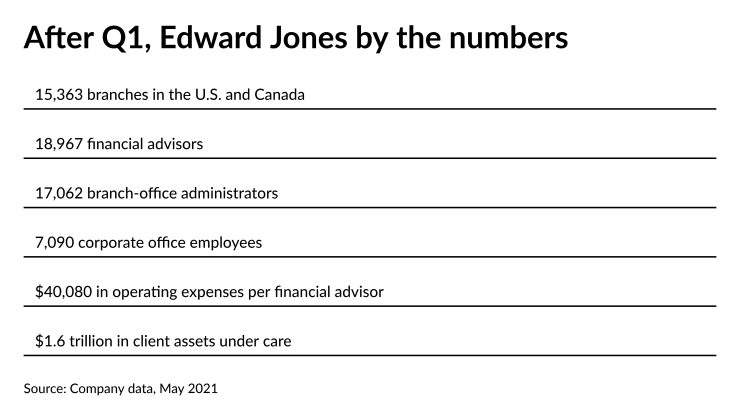

- Recruiting: Amid its pause in adding non-licensed advisor trainees, the firm’s headcount dropped by a net 47 registered representatives from the year-ago period to 18,077. Across the U.S. and Canada, the number of branches ticked up by 134 to 15,363, the number of branch-office administrators contracted by 158 to 17,062 and the number of corporate-office associates dropped by 62 to 7,090. In restarting its new entrant programs, Edward Jones is “offering a plan and resources for both current financial advisors and new hires,” according to its earnings statement. “This approach may result in fewer financial advisors hired than historically experienced.”

- Remark: In a statement, Edward Jones Managing Partner Penny Pennington described the firm’s new “intentional approach” to hiring advisors. “This will ensure we can serve our clients based on their unique needs and in a way that is personal and complete to them,” Pennington said. “Our purpose calls us to deeper partnership with our clients and colleagues as we seek to make a positive impact in their lives and benefit our communities and society."