A financial advisor faces an eight-year prison sentence after his conviction in a complex fraud case investigators describe as an international advance fee scheme.

James Michael “Mike” Johnson, 69, and at least three other conspirators bilked entrepreneurs for $5.7 million by soliciting loans from the clients to an entity called Chimera Group Ltd. in exchange for promised interest payments, the principal and subsequent business capital,

After a jury convicted Johnson on charges of wire fraud and money laundering conspiracy on Oct. 30, he received a 97-month sentence on March 5. One alleged co-conspirator from London who claimed to be Chimera’s portfolio manager on behalf of a Hong Kong-based parent called Ion International Holdings remains a fugitive. In sentencing memos last month before the hearing, prosecutors argued Johnson “played a crucial and central role” in the scheme.

“Johnson abused the trust reposed in him by investors with whom he had long-standing relationships, and he inflicted significant economic harm on his victims,” the prosecutors’ memo says. “Many of the investors were individuals who could ill-afford to lose six-figure sums that represented years of personal savings or inherited wealth accumulated over a lifetime.”

The attorney representing Johnson in the case, S.W. Dawson, said in an email that his client had "never wavered in asserting his absolute innocence" for the length of the trial.

"My client himself was a victim of a scheme concocted by a London financier and a California-based attorney who used my client as a pawn to reap financial gain," Dawson said. "Mr. Johnson looks forward to vigorously appealing his conviction and working to clear his good name."

Johnson’s sentence fell below the prosecutors’ recommendation of 11.25 to 14 years. The defense produced nine letters from friends and family members who said the scheme sounded nothing like the church member who is a caregiver to both his 89-year-old mother and an adult son with serious medical issues.

“It is unquestionable that Mike Johnson was not the mastermind of the scheme outlined in the indictment,” the defense’s sentencing memo says. “Mike Johnson was not the lawyer controlling the levers. Mike Johnson never falsified any documents.”

Industry tenure and alleged conspirators

Johnson had already been suspended from the industry for much of the alleged four-year scheme, due to a different case accusing him of violating FINRA rules while with Commonwealth Financial Network in 2010. Johnson hasn’t been registered with FINRA since his two-year suspension in 2015 — which came after Commonwealth permitted him to resign in 2012 and First Allied Securities discharged him in 2013, FINRA BrokerCheck

Representatives for Cetera Financial Group, which has been the parent firm of First Allied since that year, didn’t respond to requests for comment. Representatives for Commonwealth and an RIA that Johnson affiliated with in his last registered tenure in the industry from 2013 to 2015, Harvest Financial Group, didn’t respond to requests for comment.

With respect to the convicted conspirators in the federal fraud case, a California-based lawyer, Stuart Jay Anderson, 54, pleaded guilty to the scheme and received a four-year prison sentence in December. Another man from Midlothian, Virginia named James L. Smith, 64, has a sentencing hearing scheduled in May. The fourth, Brian M. Bridge, 46, of London, England, is a fugitive, according to prosecutors

Between July 2014 and March 2019, Richmond-based Johnson reeled in at least a dozen clients to the purported loans to Chimera Group by offering them interest payments on top of their principal, followed by business capital for their companies, court documents say. The conspirators employed phony documents made to look like official Santander Bank materials and false claims about Chimera being a 10-year-old, $5-billion fund, investigators say.

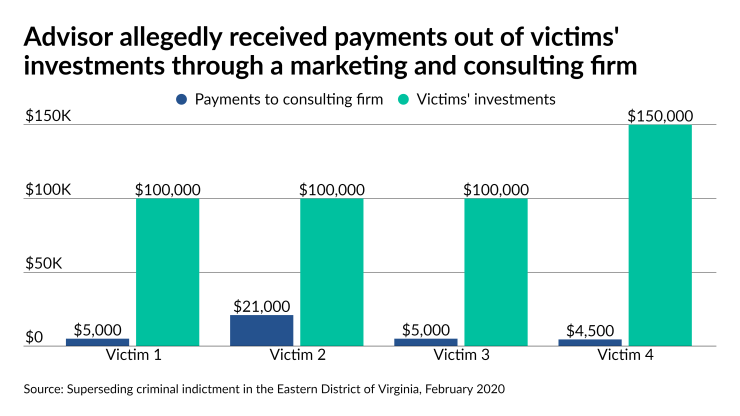

After they convinced the victims to deposit checks into Anderson’s escrow account, the lawyer distributed the funds to accounts all over the world, such as one for Johnson’s marketing and consulting firm, the indictment states. Other destinations for their money included purported interest payments to the victims, wires to Smith’s firm and accounts in various locations such as Latvia, the Dominican Republic and the United Kingdom, the document shows.

One startup firm had to lay off 17 employees as a result of losing $500,000, and Johnson also bilked a volunteer firefighting company for $100,000, according to court documents. Adding “intended losses” to the actual ones of nearly $6 million would add up to $13.8 million, prosecutors said in last month’s sentencing memo.

The Community Fire Company of Exmore, Virginia, filed a civil lawsuit in the state’s 2nd Judicial Circuit in 2017 against Johnson, Harvest Financial and the RIA’s owner, Kyle Mills,

The circumstances of Johnson’s departure from Mills’ firm weren’t immediately clear. Commonwealth had cited undisclosed outside business activities as the reason for its separation from him in 2012, while First Allied accused him the following year of placing trades in a client account without speaking to them, Johnson’s BrokerCheck shows.

Without admitting or denying FINRA’s November 2015 allegations of negligent misrepresentations and omissions while he was with Commonwealth five years earlier, Johnson accepted the suspension and paid a $50,000 fine, another disclosure states. Former clients of Johnson’s also won settlements for $600,000 in 2012 and $2,500 in 2010, BrokerCheck shows.

Ten years later, after hearing the different case’s allegations against Johnson in a three-day trial, the jury found him guilty of conspiracy to commit wire fraud, wire fraud, and conspiracy to commit money laundering. He must report to federal prison by April 22.