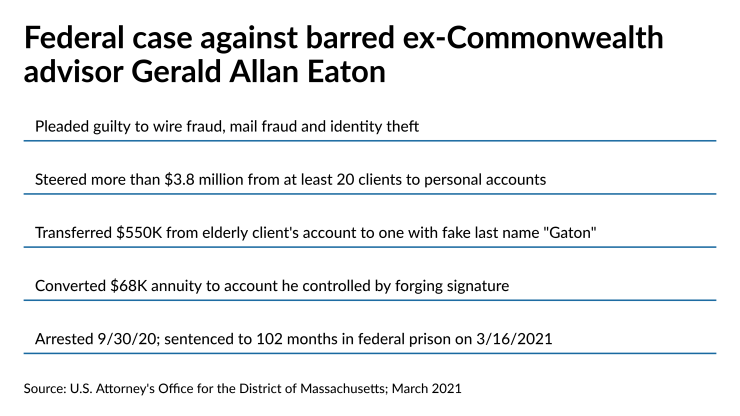

One barred ex-advisor from a prominent wealth manager pleaded guilty to fraud, and another who did so six months ago received an eight-year sentence in federal prison.

The cases involve Merrill Lynch and Commonwealth Financial Network — which have separately paid more than $7.25 million in restitution to the respective victims of former

Each of the firms fired the brokers upon learning of the fraud schemes, and the SEC and FINRA have barred them. Commonwealth paid victims of Eaton — whose Boston-area practice had been affiliated with the firm for 24 years — $4.16 million in restitution plus interest, according to prosecutors’ sentencing memo. Boggs must pay Merrill — his employer of 12 years in its Chicago office — $3.09 million after the firm paid restitution, his plea agreement shows.

Boggs misappropriated money from the accounts of at least eight clients “for his own personal benefit, including to pay for international travel, expensive meals at restaurants, rents at multiple apartments and the mortgage on his personal residence,” the document states.

An attorney representing Boggs, David Weinstein, declined to comment on the case. William Halldin, a spokesman for Merrill Lynch parent Bank of America, noted in an emailed statement that the company fired Boggs in 2018 “after an internal investigation found he stole client funds and made unauthorized transactions.”

“We promptly notified the appropriate authorities and cooperated with their investigations,” Halldin said. “The clients affected by Mr. Boggs’s actions have been compensated.”

The group included Shainne Sharp, one of five teenagers

Prosecutors are calling for a sentence of between 78 and 97 months, while Boggs’ attorneys requested a range of 51 to 63. District Judge Mary M. Rowland scheduled the sentencing hearing for June 11.

In the other case, U.S. Senior District Court Judge Douglas P. Woodlock

For over 20 years, Eaton “artfully executed a scheme to steal his clients’ life savings,” the sentencing memo states. “Gerald Eaton learned everything he could about his victims so that year after year, he could exploit those things to line his pockets and with callous disregard as to the impact his actions had on the lives of his clients.”

Attorneys representing Eaton in the case and representatives for Commonwealth didn’t respond to requests for comment on the case. At the time that he pleaded guilty, Commonwealth CEO Wayne Bloom

In their sentencing memo, Eaton’s lawyers asked for a five-year sentence while noting he “is truly remorseful and disgusted at himself” by his actions.

“Why he worked so hard to ensure his clients’ financial security — clients he truly did care for — while at the same time selfishly jeopardizing that security, Jerry may never know,” the filing states, adding that “his life is destroyed” after his wife divorced him and he lost his standing in the community. “Jerry knows these consequences pale in comparison to the loss and betrayal felt by his clients, but they are part of the punishment he endures as the result of his actions.”

The memo states that Eaton, with the help of his ex-wife, paid victims the $3.82 million he stole. However, Woodlock ordered him to pay restitution plus interest of $5.52 million after prosecutors stated in their memo that Commonwealth has compensated victims. The sentence also includes three years of supervised release. Eaton must report to begin his sentence by July 15.