In three years, a former UBS executive has built an RIA to nearly $1 billion in client assets under management on a sustainable investing strategy.

She has a lofty goal.

"I would like to help repair capitalism, frankly," says Erika Karp, the founder of Cornerstone Capital Group and the former head of Global Sector Research at UBS. "Capital should be used for the good. It shouldn't be exploitative, but regenerative."

Part of Cornerstone’s success comes from its ties to prominent figures like former President Bill Clinton, eBay founder Pierre Omidyar and feminist icon Gloria Steinem.

Before starting her own firm, which is based in New York City, Karp spent 25 years in high-level research positions in banks, including a decade at Credit Suisse prior to joining UBS.

About 10 years ago, she began to develop an expertise in impact investing, which she defines as "the systematic analysis of environmental, social and governance factors" in investment analysis.

While declining to name her own investments, Karp cited Nike, oil producer Apache and Danish pharmaceutical company Novo Nordisk as favorites of sustainable investors.

All three have improved their reputations for sustainability, she says, following highly publicized missteps, such as Apache's 2013 oil spill in northern Alberta, Canada, Nike's historical problems with the treatment of its workers abroad and Novo Nordisk's recent $58.7 million settlement in a U.S. Justice Department lawsuit that alleged the firm downplayed the cancer risks of a diabetes medication.

-

Some clients may demand more evidence of actual outcomes.

November 10 -

Advisors can differentiate their practices by helping clients help communities in need.

November 10 -

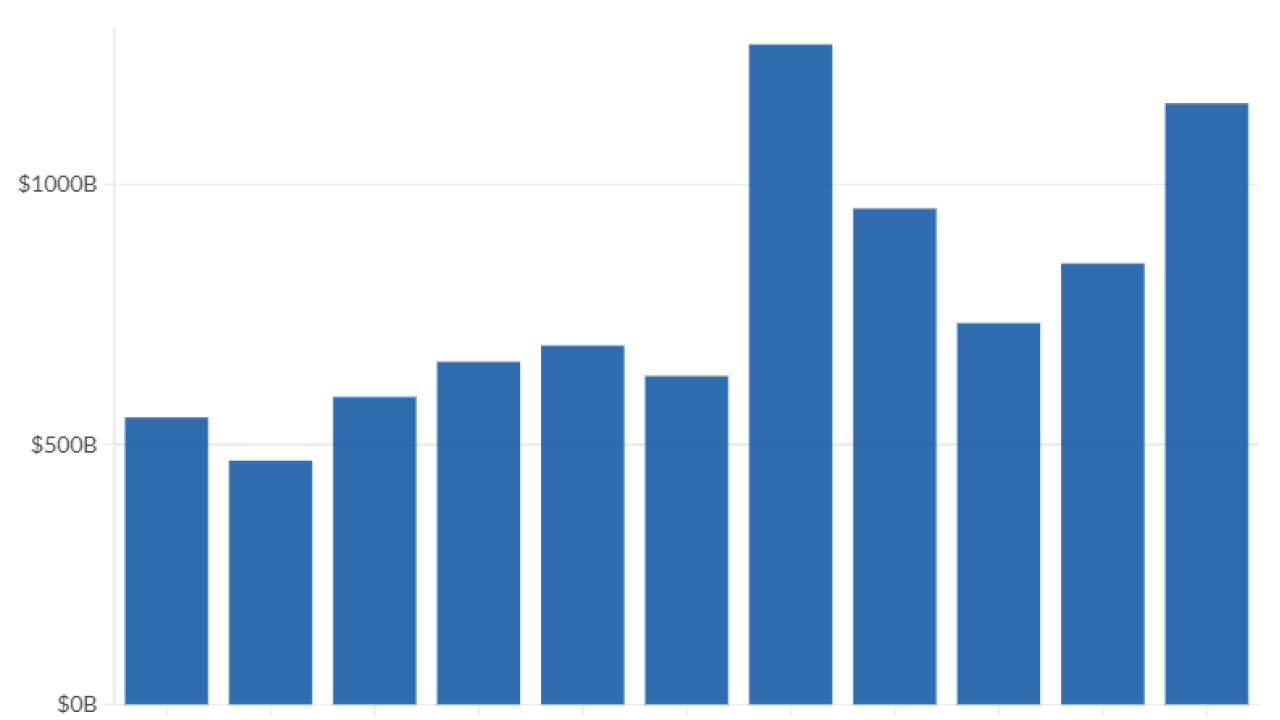

The majority of public and private funds using the strategy launched in the last three years.

November 16

Today she is a member of the World Economic Forum, an advisor to the Omidyar Network's Know The Chain initiative and an advisor to the Clinton Global Initiative, which is in the process of winding down. She also sits on an advisory council for Harvard Business School's executive education program on sustainable investing and is a founding board member of the Sustainability Accounting Standards Board.

Karp has spoken before the Organization for Economic Cooperation and Development, the U.N. Global Compact initiative, the White House and the Aspen Institute.

She says her new clients at Cornerstone include Steinem's Ms. Foundation for Women and the

Ben Walton is the grandson of Walmart founder Sam Walton, and his family office is also named after his wife Lucy Ana Walton.

Cornerstone's strategy is built around analyzing fund managers, Karp says.

"I think there are loads of managers out there — including hedge fund managers — who are actually practicing sustainable investing and they don't even know it," she says. "On the dark side, there are fund managers who are calling themselves impact investors, but they are not impact investors."

The extra work it takes to weigh environmental, sustainable and governance factors, with a lens that is both wide and deep, does a better job at predicting success, Karp says.

In time, she thinks this focus will not be considered niche but become mainstream.

"It's a better investment discipline. Why would you not want to know more about a company? When you look at these factors you can get a better handle on risks, rewards and returns," Karp says. "We think that this kind of enhanced analytics is pragmatic and, frankly, that's the future of finance."