Focus Financial snapped up Eton Advisors and its $1.5 billion in assets under management, marking the 12th major acquisition for the aggregator this year alone.

Eton, based in Chapel Hill, North Carolina, listed only 200 clients on its latest Form ADV filed in March – mostly high net worth individuals, as well as institutions. The listed customers also included pensions, pooled investments, charitable organizations and other corporations.

Founders Robert Mallernee, Jack Parham and Teresa Eriksson had previously worked together at UBS and US Trust before breaking off to form the firm in July 2009, according to Focus.

Focus has been one of the most aggressive aggregators in the industry after landing an influx of

DEAL FRENZY

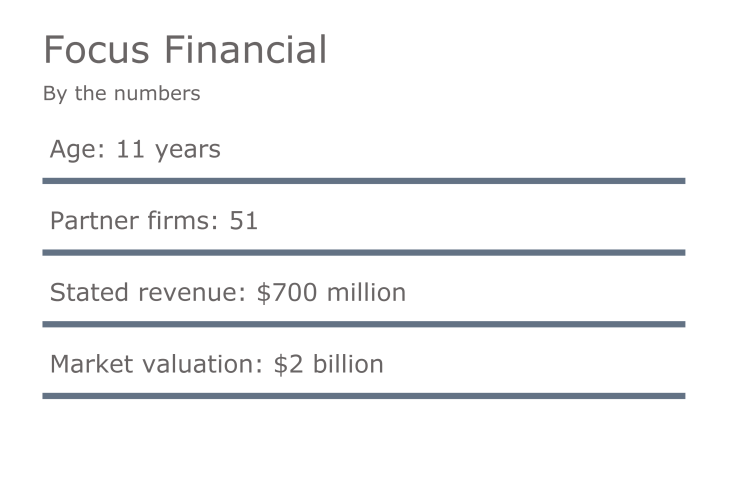

Focus has acquired at least a dozen firms in 2017 – many of them managing a billion-dollars-plus in client assets – and upwards of 50 firms since it launched 11 years ago.

Touted as the biggest deal to date for the RIA aggregator, Focus completed a blockbuster $16.5 billion

The deal also underscored a

MOVING UP, HEADING SOUTH

Eton focuses mostly on ultra-high net-worth clients, and becomes Focus’ first RIA in the Tar Heel State.

Focus founder and CEO Rudy Adolf says the new addition offers a beachhead in the highly competitive UHNW space.

“This deal not only extends Focus’ footprint to North Carolina, but it also boosts the partnership’s foothold in the UHNW space,” Adolf said in a statement.

Focus’ most recent deals, beginning in May, have focused primarily on the east and west coasts including the Boston-based SCS Capital and a Menlo Park, California-based firm, Bordeaux Wealth Advisors.

‘ENTREPRENEURIAL AUTONOMY’

Eton President Teresa Eriksson said Focus was best aligned to promote his firms' future growth.

“Since we first met Focus in 2011, we have dedicated a lot of time and effort to evaluating the needs [of our clients],” Eriksson said in a statement, adding an emphasis on “entrepreneurial autonomy” was particularly attractive for her firm.

“When paired with access to capital and best practices from other high caliber firms, Focus quickly emerged as our ideal partner,” Eriksson said.