SALT LAKE CITY — In her new role as FINRA’s executive leading examinations, Bari Havlik says she has some unique perspective from her prior job as chief compliance officer at Charles Schwab. A few members of her former team came to Schwab from the SEC, she recalls.

“Once they started having to respond to regulatory inquiries, they said, ‘Oh my God, I had no idea it was so difficult to get so much of this information. We thought you just had it at the snap of your fingers,’” Havlik says. “We need to be thoughtful about it and to try to understand the other side.”

Havlik, FINRA’s executive vice president for member supervision, appeared at the FSI Forum on Sept. 24 after she

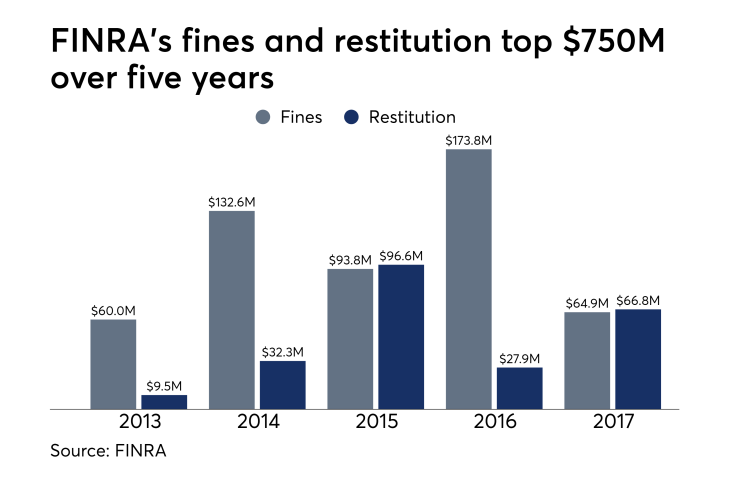

FINRA conducted more than 7,800 exams in 2017, collecting nearly $132 million in fines and restitution and barring almost 500 brokers,

The plan for 2019 includes looking further at how to get

“There will be an occasion when somebody interprets something in a way that is not as consistent as we would like. I would say that, in those cases, I would ask that firms escalate any concerns,” Havlik says. “I do need feedback on those situations. I can’t keep making improvements, and we can’t learn from situations unless we hear about them.”

She recommends advisors or their BDs seek out their FINRA district or regional director to discuss the situation or share it with a professional organization like FSI. Havlik has already met with Dale Brown, the CEO of FSI, and others from the IBD advocacy group at least two times in her first five months.

“We frequently act as that impartial anonymous buffer or broker, if you will, to say, ‘Hey this is what we’re hearing from a firm’ or mostly from a group of firms,” said Brown, who led the session with Havlik.

“If the question’s popping up enough,” he continued, “we’re able to have a good conversation with you and your team, and often that ends up looping our members into that conversation, reaching a better understanding.”

-

Regulators including FINRA are looking at ways to help spur innovation.

September 12 -

The regulator accused the four firms and the Advisor Group network of supervisory failures in sales of L-share VAs in separate but near-identical cases.

July 30 -

How to report a transaction that should have been disclosed to regulators long ago, but wasn’t.

September 11

One FSI member asked Havlik why FINRA didn’t just bar all of the brokers on its list of recidivist brokers, but she replied that the regulator has no “quote unquote list” of the so-called high-risk advisors.

“Not all disclosures are created equal,” she said. For example, she noted, brokers with five customer complaints about an unsuccessful product that their firm sold are different from a brokers with complaints about unauthorized trading or churning.

Before her presentation before an audience with Brown, Havlik met with FSI’s board for roughly an hour — which includes executives from some of the largest firms in the IBD space. She described the view that FINRA is “out to get them” as the biggest misconception among FINRA’s stakeholders.

“The vast, vast majority of the people in this industry are doing the right thing by investors and the markets. It’s a very, very small percentage that are not, that give the industry a bad name,” Havlik said. “The misconception is that FINRA thinks everybody’s in that space and everybody’s got something going on that’s wrong and that’s not at all the case.”