HighTower Advisors’ search for a new CEO appears to be nearing the end, but the challenges facing Elliot Weissbluth’s successor will be daunting, industry observers say.

Multiple industry sources confirm that HighTower is in high-level discussions with outgoing HDVest Financial Services CEO Bob Oros to succeed Weissbluth as chief executive, a development first reported by AdvisorHub. The developments are a surprise given that, just two weeks ago, Oros was described as

A HighTower spokeswoman did not confirm or deny that Oros, an industry veteran who has worked for Fidelity, Charles Schwab and LPL Financial, was joining the company. The spokeswoman repeated previous statements that a search for a CEO was underway.

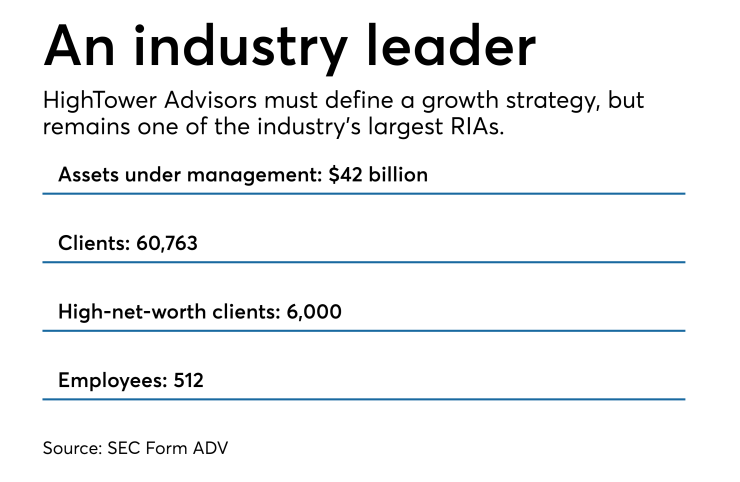

Installing a new chief executive represents a new chapter for HighTower, which was co-founded by Weissbluth in 2008 and is now controlled by private equity firm Thomas H. Lee Partners.

Lee Partners bought a majority ownership in HighTower last year and is looking to put its own stamp on the RIA — as well as maximize a return on its $450 million investment.

“HighTower’s new CEO will be under super high pressure,” says industry attorney and consultant Corey Kupfer. “Private equity is not known to be patient. They’re going to exit at some point and they want a return on their capital investment, so a new CEO will be under pressure to build enterprise value.”

Going public is one obvious exit strategy for Lee Partners in the wake of Focus Financial’s successful IPO this summer.

The problem for HighTower’s owners, Kupfer says, is that public markets “want a clear growth strategy” if a company is positioning itself for an IPO. But HighTower’s “business models keep changing,” he adds.

-

The firm's advisers and competitors are wondering about its next steps, and who will cash in. The answers will go a long way toward shaping the future of the independent channel.

March 28 -

An unexpected revelation inspired Elliot Weissbluth to launch HighTower Advisors.

August 27 -

Advisory firms need private equity capital, but problematic strings may be attached.

October 26

Industry consultant Tim Welsh agrees.

“The biggest challenge for a new CEO will be to define what the ‘new’ Hightower will be,” Welsh says. “Over the past several years, HighTower has been on a brand drift. What are they? A platform for rent? An acquirer? Breakaway broker home? Something else?”

Indeed, HighTower’s original model was dubbed “wirehouse light” in the industry as it aggressively recruited breakaway brokers.

For years, the Broker Protocol, which permits advisors to take basic client contact information with them when they switch firms, provided "legal air-cover to execute our business plan,"

It has been unclear what part of the business Lee Partners wants HighTower to invest in.

But the decision of

What’s more, a number of high-profile advisors who partnered with HighTower have subsequently defected. The most recent was the $1 billion-plus Bapis Group, headed by Michael Bapis,

HighTower began shifting its resources to acquiring RIAs and becoming a platform service provider. It has been unclear what part of the business Lee Partners wants HighTower to invest in.

As MarketCounsel president Brian Hamburger puts it: “A new CEO will be joining a firm that is the middle of rediscovering who they are and where they fit it in the financial services ecosystem. That’s a challenge.”

The problem for HighTower’s owners, Kupfer says, is that public markets “want a clear growth strategy” if a company is positioning itself for an IPO. But HighTower’s “business models keep changing,” he adds.

But a new leader will also be going to an RIA now backed by a company “with significant capital and well-funded to do deals that can lock in their bigger partners,” Kupfer notes.

In addition, Hamburger says, “HighTower still has one of the strongest brands in the independent space.”

To succeed, HighTower’s new CEO needs to be “a thought leader as much an operationally adept manager,” according to Hamburger.

Thomas H. Lee’s HighTower efforts are being headed by Gurinder Ahluwalia, an executive advisor to the private equity firm and the former CEO of AssetMark, who replaced David Pottruck as HighTower’s chairman in April.

Once a new CEO is named,