Nearly half the country is now on board with changing how advisors can respond to signs of elder fraud.

New Hampshire is the latest state to adopt model legislation championed by an association state securities regulator. The bill, which takes effect Sept. 8, permits broker-dealers and investment advisors to delay disbursements from accounts when they have reason to believe the request may result in financial exploitation.

State governments and regulators have been prompted to make changes to the regulatory regime in response to the high costs of elder abuse and advisors’ unique position to spot early warning signs.

“Financial advisors and financial services firms are often the first to detect possible financial abuse,” says Robin Traxler, FSI's senior vice president of policy and deputy general counsel. “So it’s critical that they have the ability to report it without fear of violating privacy laws.”

Seniors lose between $352 million to $1.5 billion annually to financial exploitation, according to a New York State study from 2016. The study also found that 35% of victims lived with their perpetrator. Elder abuse could become more widespread as aging baby boomers boost the ranks of senior citizens. An average of 10,000 people turn 65 each day in America, according to the Census Bureau, which projects that trend to continue until 2030.

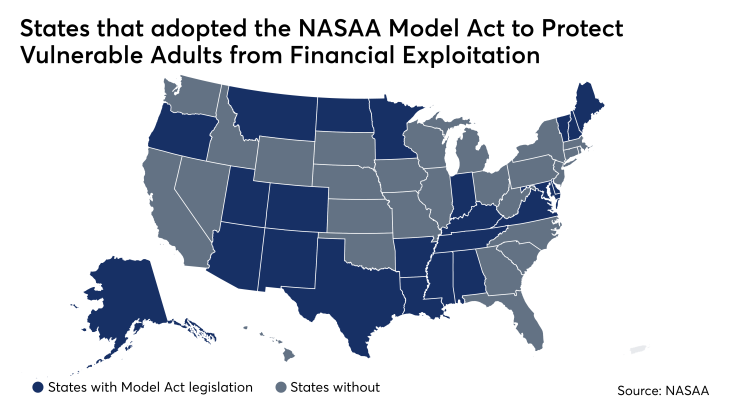

So far 23 states have adopted some version of a model act, dubbed the North American Securities Administrators Association's Model Act to Protect Vulnerable Adults from Financial Exploitation. Three other states — Arizona, Maine, and Virginia — turned the model act into law earlier this year.

“One thing to keep in mind is that the NASAA model act is just that — it’s a model,” says lawyer Joshua Jones from Bressler, Amery & Ross Securities Litigation department. Advisors need to remember that each state has its own interpretation, he adds.

New Hampshire's legislation “permits broker-dealers and investment advisors to delay disbursements from accounts of eligible individuals when such broker dealers and investment advisors, or other qualified individuals, reasonably believe that the requested disbursement may result in financial exploitation,” according to a summary.

The passage of such bills has found support among industry trade groups and advisor associations, but some find it outdated and prefer the language of FINRA Rule 2165.

The FPA, for example, works with legislators and recommends language that “permits” reporting to the authorities rather than “requiring” it. This would reduce any over-reporting to agencies such as Adult Protective Services.

FPA’s New England advocacy chapter worked with legislators in New Hampshire to put adopt the NASAA’s model act. “We plan to support draft bills in states for 2020 that permit our members to report suspected financial exploitation when they encounter it,” says Karen Nystrom, the association’s director of advocacy.

Industry trade group SIFMA is working with FINRA to add “report and hold” policies at the national level.

“We are currently advocating for the new FINRA rules – which have been effective for about 18 months – to be updated to reflect some of the emerging best practices in the newer state laws,” says Marin Gibson, associate general counsel of state government affairs at SIFMA. "One example would be ensuring that seniors and vulnerable adults are protected from harmful transactions in addition to harmful disbursements."

Financial advisors and financial services firms are often the first to detect possible financial abuse.

Meanwhile, there's more to be done at the state level.

California and Florida, which have the largest populations of residents age 65 or older, have yet to adopt the act.

There are 3.9 million senior citizens in Florida, according to the Census Bureau. Legislation modeled on NASAA’s act has been proposed in Florida, but has not been passed, having failed to reach the state’s senate floor in time for a vote.

“It would provide a safe harbor that if you act in good faith, and with a reasonable belief of exploitation, you can avoid regulatory or civil liability,” Alex Sabo, a Miami-based attorney at Bressler, Amery & Ross, says of the bill.

Sabo, a past president of the Florida Securities Dealers Association, says the association has lobbied to get the legislation passed. FINRA members in Florida are already allowed to place a hold on disbursements if they believe fraud is occuring. The proposed legislation would provide additional protection for advisors in the state.

The bill championed by Sabo and others passed through Florida’s House of Representatives twice but not the state senate — legislative sessions were busier than usual and other bills took precedence, he explains.

“There are a lot of moving parts as you go through the legislative process,” says Sabo. If the legislative session closes before state representatives and senators pass the law, then the process restarts from square one. “We fought a tough fight,” says Sabo, adding that they will renew their efforts next year.