The traditional growth path for any business is fairly straightforward: Craft a product or service that you can deliver profitably, and then deliver it to more people. When an advisor is starting out and has a lot of time but not a lot of clients, adding more clients can quickly ramp up the advisor’s income.

But, only to a point.

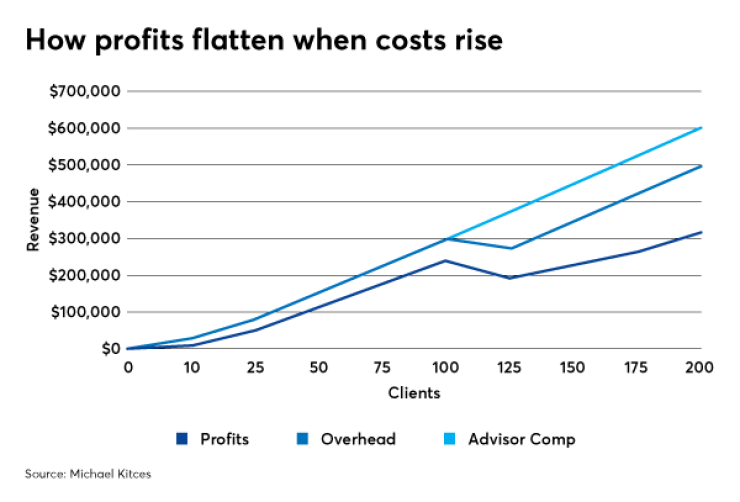

The individual capacity of an advisor is typically no more than 100 clients in an ongoing relationship. Once that capacity is reached, the advisor must add staff, including another advisor to work with them, which makes the next 100 clients not nearly as profitable to the advisor as the first 100.

This illustrates a difficult but essential truth. A business grows either by adding more clients, or simply via earning more revenue from each existing client. There is not necessarily a right or wrong path, but advisors with their eyes on growth should approach the idea with eyes wide open.

When starting out, it’s natural to have excess capacity. That’s another way of saying we’re ready, willing and able to serve clients we haven’t even won yet. For the end advisor, this usually means having negative income for a period, given there are at least some overhead costs to run the business, from compliance to website development to licensing core platform technologies.

Of course, as clients do begin to show up, the revenue of the firm rises, cash flow breaks even and then turns positive. That’s because most overhead expenses at startup are fixed and already sunk, so every marginal new dollar of revenue at the top line drops directly to the bottom.

Thus, the most direct path for the typical advisor to generate more income is straightforward: Get more clients. And the approach works quite well; it’s not uncommon for solo advisory firms to take home

In real dollar terms, an advisor with 70 clients generating $200,000 per year of revenue might take home nearly $140,000 of it, while an advisor who grows to 100 clients and $300,000 per year of revenue would typically keep anywhere from $210,000 to $250,000 in profits. Notably though, from the perspective of take-home income, the bigger driver of net income to the advisor is not actually the firm’s profit margin, but the total number of clients and the revenue they generate for the firm.

This formula only works up until a point, though. When an advisor reaches their maximum capacity to service their client relationships, expansion-based growth effectively is no longer sustainable.

After all, if the advisor is going to meet with clients at least twice a year, plus field another four hours’ worth of emails and phone calls per client that lead to ad-hoc research projects and analysis to answer planning questions, plus four hours of miscellaneous service time for trading, rebalancing and other investment management duties, it adds up to 14 hours per client. And at 100 clients, such tasks would consume 1,400 of the available 2,000 working hours in a year.

At that point it takes most of the other

Research also suggests that

In other words, even if the advisor had more time to service more clients, it’s not clear they’d be able to keep track of who’s who — even with the support of good advisor CRM — undermining their ability to maintain effective relationships.

The key point is that at some moment, every growth-minded advisor hits their personal capacity, and that point appears to be right around 100 clients in ongoing planning relationships.

THE SECOND 100

The virtue of the solo advisor model is the fact that overhead costs are so low, and generally fixed. But even the high-margin solo advisory firm isn’t truly running those aforementioned 85% profit margins, because a large portion of the advisor’s compensation is actually for the work in the business, not just the profits of the business.

Historically, this is embodied by the

Solo advisory firms may find it feasible to run with as little as 15% to 25% overhead, leaving the formula more akin to 40/15/45 or perhaps 40/25/35, and a combined take-home pay as high as 75% to 85% between the first 40% for the advisor’s work in the business doing planning and investments, plus the remaining 35% – 45% of bottom-line profits.

This means after the first 100 clients, the only way to add the next 100 is to hire another associate or even lead advisor to service those clients. And that’s when the economics of growth begin to change for the owner-advisor.

The next advisor who joins — and who ostensibly is not an owner in the firm — will simply want to be paid what they’re worth off the top, as a direct cost of the business. This means that 30% to 40% of the next 100 clients’ worth of revenue doesn’t accrue to the owner, but rather is paid to the next advisor who services them.

Bringing on another advisor adds overhead in other ways too. Growing from 100 to 200 clients often requires more administrative infrastructure. There may now be a full-time client service manager, plus an administrative assistant to support the two advisors, and potentially someone to just handle the trading and to support the investment research or paraplanning analyses.

These developments in turn may require new office space, additional technology licenses and more compliance support. At that point it may no longer be feasible to run the firm with only 15% overhead. Now those costs rise to 25% to 30%, as the firm’s formal infrastructure — at industry-standard overhead expense ratios — starts to take shape.

The end result is that not only does the advisory firm owner just participate in the bottom-line profits of the next 100 clients, but those clients — saying nothing of the advisor and support staff required to service them — typically increase the overhead costs of the firm as well. That ultimately means the advisor participates in even less of the revenue for the next 100 clients.

For example, a solo advisor might have originally had $300,000 of revenue — e.g., $3,000 revenue/client x 100 clients — and enjoyed an 80% profit margin as well as $240,000 of take-home revenue. However, while the addition of the next 100 clients may bring the firm to $600,000 of revenue, the next advisor would need to be paid at least $100,000 to service that new group.

The firm’s overhead costs may rise to 30% x $600,000 = $180,000, as two more full-time staff members would be needed to support the breadth of 200 clients — such that the firm owner’s net profits rise just $80,000, from $240,000 to $320,000, for a 25% increase in take-home pay.

The end point of the above example is that the advisor has added far more in complexity to the advisor-owner’s life, as the firm may well shift from just the advisor and assistant or paraplanner to a team of five, including two advisors and three support staff. That in turn requires an increase in time allocated by the advisor to the management of the firm as well. And even after doubling the firm’s revenue — a 100% increase in clients and the fees they pay — the advisor gets only a 25% increase in their own compensation.

In other words, growing past an advisor’s individual capacity is the opposite of growing to gain economies of scale, at least in the near term. Instead, the transition from 100 to 200 clients tends to undermine economies of scale, and requires a substantial level of reinvestment into the business and infrastructure building, to the point that the advisor’s income may initially go backwards, and only as the second advisor approaches capacity will it finally turn positive again. By then the advisor is still only up 25% in profits, despite doubling revenue and more than doubling staff headcount and complexity.

Ultimately though, that’s the whole point of the shift from getting paid for the clients that the advisor takes on to getting profits by adding more clients to the business. The path to 100 clients compensates the advisor for both the clients themselves and the profits of the firm, while the next 100 clients only compensate the advisor with the profits of the business — at a cost of investing into infrastructure and complexity along the way.

GOING BIG

Even if economies of scale cannot be realized, there is still the possibility of growing profits on a larger revenue base from the same number of clients. I.e., getting more for less.

Indeed, for those who want to increase the financial rewards of doing advising, the trick may be not growing revenue by earning more clients, but by landing bigger clients that slowly but steadily replace the ones the firm already has.

The central driver for income growth for most advisory firms is not just growing total revenue and profits by adding more clients, but specifically by increasing revenue through an

After all, an advisor who moves upmarket and tries to focus on fewer but more affluent clients — and ends out with

And it may go even higher than that, given additional revenue drops right to the bottom line. What’s more, scaling down from 100 to 50 clients may even reduce the advisor’s overhead costs, further improving the firm’s profit margins.

This is likely why it’s already so often the case that advisory firms tend to move upmarket as they grow, seeking out and working with more affluent clients and

For advisors who are approaching capacity and must decide what to do next, a decision to move upmarket coincides with the advisor’s own growing level of credibility and community connections that make it feasible to generate more affluent business opportunities or referrals.

The key point is simply to know what you want to build, and why. Just adding more clients won’t necessarily generate much more income for the founding advisor, but will potentially generate a lot more work and complexity for the firm. That’s a fine challenge to work through for those who envision being an entrepreneur, growing and scaling far beyond themselves.

But it is also important to recognize and be prepared for the challenges of this path. Otherwise, the advisor risks becoming an

For most advisors who simply may want to grow a little and have some potential for additional income and upside — albeit without the complexity of hiring and adding staff — continuing to grow the total number of clients is perhaps counterintuitively not the best path forward.

Bottom line, the next 100 clients are simply never as profitable for an advisory firm owner and founder as the first 100. Instead, the most straightforward path to growth is not adding another 100 clients, but