Helping clients navigate critical health care decisions as they approach retirement is perhaps the ultimate holistic added value financial advisors can offer — particularly when it comes to Medicare options.

“Clients can be overwhelmed and very confused about what to do when it comes to making decisions about Medicare,” says Robert Tucker, a vice president and wealth manager at Plancorp. “They need help and Medicare has a lot of moving parts.”

Tucker should know. He had been an orthopedic surgeon in St. Louis for 25 years when, in 1983, he and his wife hired Jeff Buckner, a co-founder of Plancorp, as their advisor. Over time, Tucker became more involved in the administrative side of his medical practice, went back to school to earn an MBA and became medical director of his group practice.

As he approached the target date in his financial plan to consider their next steps, Tucker discussed second career options with advisors at Plancorp and expressed his interest in financial planning.

Buckner offered him a job and Tucker transitioned from being a physician to an advisor in 2006. He went on to earn his Series 65 license and is also an accredited investment fiduciary, an Fi360 certification.

“There are a lot of similarities between the two professions,” Tucker says. “As an advisor, I develop relationships with individuals, help them identify a problem and a solution to the problem, and then I monitor the solution to be sure that it taking care of the problem. That’s exactly what I did as a physician.”

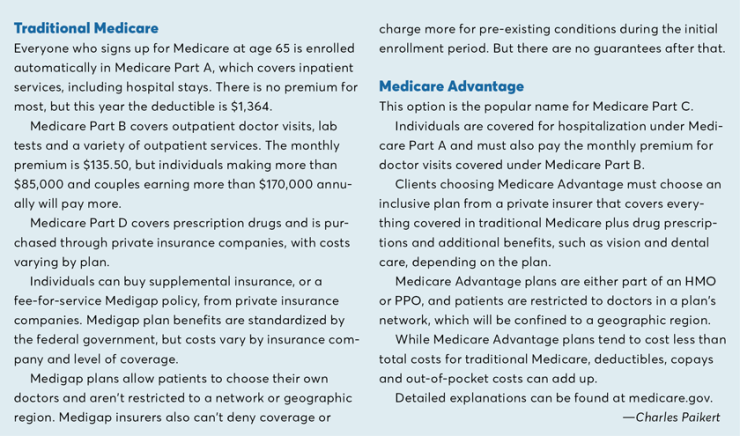

The initial task is to help clients pick which Medicare plan to choose: Traditional Medicare or Medicare Advantage. Advisors need to inform clients turning 65 who don’t have existing insurance coverage that they face an important Medicare deadline.

Individuals have three months before the month of their 65th birthday until three months afterward to enroll in Medicare Part B. If a client is age 65 or over and goes on a COBRA plan, he or she has eight months to sign up for Medicare Part B.

If individuals miss this deadline, they will be subject to a 10% penalty of their Part B premium for every 12 months missed. For example, if they miss two years, they will pay a 20% penalty. What’s more, the penalties will continue for life.

“Medicare has very strict rules,” says Sarah Caine, a CFP and financial strategist at Agili, a planning firm in Bethlehem, Pennsylvania.

“Deadlines are important, and if you don’t meet them, you can lose important rights, such as Medigap’s guaranteed issue right, which requires insurance companies to offer certain policies even if you have a pre-existing condition.”

(Clients who are 65 or older have a “guaranteed issue right” to buy a Medigap plan with no restrictions on pre-existing conditions within 63 days of losing private health coverage.)

But beware, being on a COBRA plan does not qualify as being insured by your employer, warns Shikha Mittra, president of Retire Smart Consulting in Princeton, New Jersey.

“If an employer is paying a COBRA premium, going into COBRA instead of signing up for Medicare can be a huge mistake people make,” she says.

Advisors helping high-net-worth clients navigate Medicare should also be up to speed on another potential minefield: surcharges on high earners.Medicare will examine an individual or married couple’s modified adjusted gross income on their tax return going back two years.

An individual with an annual income over $85,000 and less than $170,000, and couples with income less than $214,000 and over $170,000 must pay an additional $54.10 on top of a monthly premium of $135.50. There are four additional surcharge brackets (see chart), including one added this year for individuals making over $500,000 and couples with more than $750,000 in modified adjusted gross income.

“Many clients are unaware that there is income testing for Medicare,” says Stuart Millard, an insurance broker for Senior Insurance Solutions in suburban Boston who is also a CFP. “It can impact a lot of people and it’s important to plan ahead to try and anticipate or mitigate the cost.”

One of Millard’s high-net-worth clients on Medicare affected by the surcharge was married to a younger spouse who went back to work. The client went on his wife’s group plan and suspended his Medicare Part B coverage to avoid the cost.

“When she stops working, he can resume his Medicare Part B coverage,” Millard explains. “In the meantime, it’s more cost-effective for him to be covered by her plan. It comes down to doing the math.”

Advisors should also keep an eye on vested and restricted stocks that may increase a client’s income in the two-year look-back period, according to Millard.

Careful monitoring of cash flows from sources such as stock dividends and income from rental properties can help clients avoid unexpected income that could trigger surcharges, says Aaren Strand, an advisor with Paracle in Mercer Island, Washington. Tucker employed a strategy using an IRA to help a retired married couple who had no earned income and were not yet taking required minimum IRA or 401(k} distributions.

“The couple had very low adjusted income for the year and was taxed at a very low bracket,” Tucker says. “We converted a portion of the IRA to a Roth IRA at a lower bracket to avoid being in a higher bracket later when the required distributions begin so there won’t be an onerous effect on the Medicare premium.”

Steering clients through the Medicare gauntlet also requires familiarity with the programs’ Part D drug plan. Participants in traditional Medicare should review their Part D Prescription Drug Program every year, Tucker cautions.

“Pricing structures change from year-to-year,” he says. “We worked with a husband and wife who had vastly different medication lists. By reviewing the options, we were able to project prescription savings of literally several thousand dollars for the year.”

Massachusetts alone has over two dozen drug plans, Millard notes, “and no plan covers every medicine.”

Make sure clients list all their medications, he says. “If a client doesn’t include a prescription, and it’s not on the drug formulary, they will have to pay out-of-pocket until the next enrollment period. And it’s important to review every year, because medications may change.”

Financial advisors also stress the importance of working with insurance brokers. Most, like Millard, don’t charge either the client or an advisory firm a fee, but are paid a commission from an insurance company.

“Medicare is very hard to navigate alone,” Strand says. “You think you have the right form but you don’t and you end up spinning your wheels. You really want expert help.”