More retirees would claim their Social Security benefits online if they knew they could do so and get answers to basic questions about the process, a new study says.

Only about 35% of retirees claim their Social Security benefits completely online without any phone calls or visits to the agency’s local office,

The data comes after President Biden signed an executive

“We also discovered that there are some situations that are going to require in-person,” Aubry said in an interview. “You want people to claim in the way that they can, in the way that they want to, in the way that's most accessible to them.”

Aubry’s report calls for the agency to set up online methods of resolving routine inquiries such as checking benefit eligibility and following up on a submitted application. Increasing retirees’ awareness of the agency’s website being able to handle the requests and fixing some data errors are the other main ideas. Making the changes could boost the share of retirees claiming their benefits completely online by 15 to 20 percentage points. A younger group of incoming retirees could raise the share by another 3 points. When asked their reason for applying in-person or through the phone, the participants of the poll listed the fact that they didn’t know there was an online option as the most common reason at 13%, according to the survey.

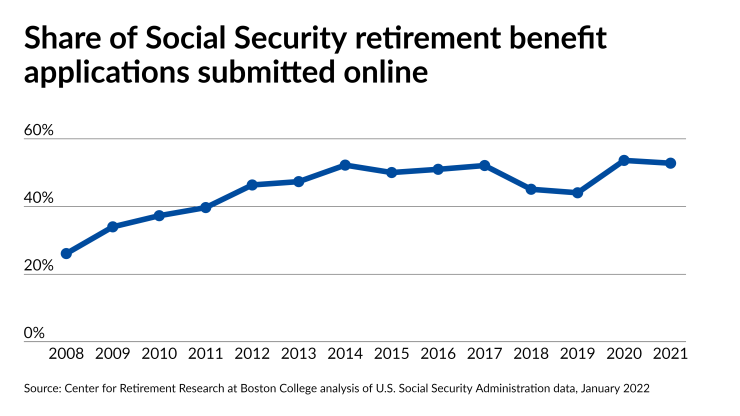

“Retiring baby boomers are increasing the demand for SSA’s services at a time when budget constraints and retiring staff are limiting the agency’s capacity to deliver these services,” according to the report. “In theory, investing in web-based tools that people can use to serve themselves could help SSA meet the projected increases in demand, even with fewer staff. But, despite SSA’s investments, the share of retirees who apply for benefits online has hovered around 50% since 2013.”

If the federal government made claiming Social Security more digital-friendly, it could partner with private companies to provide services, tech executives say.

The agency has “a great opportunity for public and private partnership” with online tools, according to Rhian Horgan, the CEO of retirement planning education and savings app

The challenge is that the SSA has traditionally placed the burden on consumers to mail in identity and income verification documents rather than using available online tools or obtaining data directly from the IRS, Horgan said in an interview. Personalized information specific to certain demographic groups and creating interfaces designed for older people could also increase online adoption, she said.

“The American consumer is spending a lot of time online trying to understand [Social Security benefits]. They're also buying 300-page books about it, and that alone should tell you there's a problem,” Horgan said of retirees’ Social Security election decisions. “They feel like there's probably loopholes and a lot of complexity, and they do a lot of research.”

The Dec. 13 executive order from the White House contained specific instructions for the agency’s commissioner designed to make it easier to get Social Security benefits. The administration made several requests in the order: a report analyzing how to modernize services “that currently require original or physical documentation or in-person appearance;” the creation of a mobile-friendly, online portal enabling more beneficiaries to avoid office visits; the revision of any guidelines requiring “that members of the public provide physical signatures;” and a system to help beneficiaries find out if they’re eligible for any other state or federal benefits. Executive departments and agencies across the federal government impose a “time tax” through more than 9 billion hours worth of mandatory paperwork annually, the order states.

“For millions of people who retire each year, you should be able to apply for Social Security benefits without needing to go to a Social Security office and have Medicare proactively reach out to you with the tools you need to manage your health and save money,” President Biden said in remarks after signing the order. “The bottom line is we’re going to make the government work more effectively for the American citizens so it’s not as confusing and it’s straightforward.”

The administration’s order is part of “a constantly evolving effort” to improve service experiences across the government over recent decades, Aubry said. In terms of the government’s plans to raise awareness of the online tools, advisors may play a role as well in their work with millions of retirees nationwide, he said.

“Financial advisors are one part of that communication,” Aubry said. “If financial advisors inform their clients of these opportunities, that also helps nudge that percentage upwards.”