At first, nobody at Cresset Capital Management was particularly eager to play a game using "fuzzy balls" from a local crafts store to prospect for high-net-worth clients.

But, at the insistence of the firm's leaders, the Cresset client services team hit the phones for three solid hours.

One fuzzy ball went into a jar for every call completed, three for each conversation held and five for every meeting scheduled.

"Not to make a pun, but it was a ball and we had pizza and beer afterwards," one of the partners, Doug Regan, told attendees of Financial Planning's webinar, "Growing Your High-Net-Worth Business."

In the final tally, the game netted two new clients, said Regan, who added a moral to the story: "Make time to prospect is the bottom line here."

Turning Calls Into Client Meetings

There's no single formula deployed by the best planning firms to attract wealthy clients, leaders of three top firms explained, but they’ve all found their own ways. Experts in the webinar included Regan, co-chairman of Chicago-based Cresset, Larry Miles, a principal at AdvicePeriod in Los Angeles and Jack Petersen, managing partner of New York City-based Summit Trail Advisors, a Dynasty Financial Partners firm.

When talking to prospects, advisors at Los Angeles-based AdvicePeriod have turned their focus away from asset management, Miles says. He finds clients still overvalue the service, despite industrywide commoditization that has reduced the value advisors can add in the area.

"The best advisors should stop trying to sell that they are better than everyone else," says AdvicePeriod's Larry Miles.

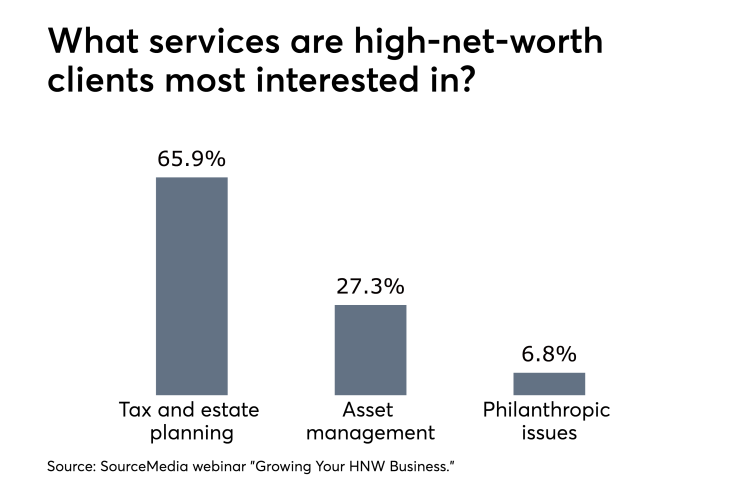

As a result, Miles expressed surprise to find most webinar respondents chose "tax and estate planning" as the service of greatest interest to their clients — over asset management and philanthropic planning – during live polling.

Of the three options, that was a good choice, he indicated.

Focus on Tax and Estate Planning

"Our belief is that the best advisors should stop trying to sell that they are smarter with everyone else," he said.

Most firms are already using similar, if not the same, investment managers, he added.

"That's not really moving the needle for clients," he added.

"Our focus at AdvicePeriod is on philanthropy and estate planning," Miles said. "When we are talking to our clients about financial and estate planning, we are talking about things that are incredibly valuable to them. It's about their families, their children, about how they want to be remembered."

Most estate planning attorneys, he maintained, are, at best, reactive and not proactive.

After setting up a grantor retained annuity trust, for example, many attorneys won't be likely to pay attention to how the assets inside of it have performed and deliver follow-up advice for clients, he said.

All Summit Trail advisors have equity, which cultivates loyalty, says managing partner Jack Petersen.

"We've grown precisely because of the missed opportunities" like these, he said, which allow AdvicePeriod to demonstrate a level of service that not only attracts but retains clients.

Summit Trail brings in new clients in part thanks to the firm's partnership culture that makes it an attractive place for new like-minded advisors to join and bringing in new business with them, Petersen says.

To that end, the advisors in the firm all have equity, he said, which cultivates loyalty. And there are few of the industry's more obvious barriers to leaving.

"We don't have a non-solicitation [or] non-compete" agreements, Petersen says. "We don't believe in them. If you cannot help an advisor build their business … you're not going to likely retain them. We have a pretty open border here."

At Cresset, advisors don't just rely on games to attract clients.

The firm's very structure also helps, Regan says, given that it was founded by private equity entrepreneurs Eric Becker and Avy Stein.

Cresset's founders introduced the firm to a pool of private equity investor prospects.

"Most clients, when they get upset, fire the firm and they go somewhere else," he said. "Private equity clients fire the firm and start their own."

Frustrated by opacity, lack of transparency, conflicts of interest and difficulty contacting their previous advisors, Becker and Stein launched Cresset, which started managing money in August of 2017, according to Regan.

"Now we have about $3 billion" in AUM, he says.

Thanks to their backgrounds, the firm founders were able to introduce the firm to a whole pool of private equity investor prospects.

"We rely heavily on our own internal network," Regan says.

Expanding Networks Through Personal Interests

To that end, Cresset has been leveraging its clients' interests in unusual ways.

For example, one client who is passionate about cars opened up his garages to Cresset's existing clients and to prospects for a gathering.

The firm is now talking to another client who has a presidential autograph collection about doing something similar.

"It creates an opportunity for us to have dialogues outside of commercial transactions," Regan says, demonstrating that planning is about "more than money."