Amid the stark data about advisors’ racial demographics and lawsuits that have alleged outright discrimination, large firms are taking actions that could drive change across the industry in how Black advisors are recruited, trained, retained and promoted to leadership.

In a virtual panel at the Association of African American Financial Advisors (Quad-A) Vision Conference, executives from Morgan Stanley, Charles Schwab, Raymond James and Truist discussed how their firms are fueling long-term shifts internally and in the industry. The wealth managers are using a combination of public data disclosure, leadership opportunities and other tactics to bring more diversity to their ranks.

In recent years,

“It's no secret that racism has been baked into the American wealth management system,” said Lazetta Rainey Braxton, the chair of Quad-A’s board and co-founder of 2050 Wealth Partners. “We have to continue the conversation about how we're changing and working towards changing this dynamic. And so we struggle with this perception that many wealth management firms operate a revolving door when it comes to retaining black talent.”

Fewer than 3% of financial advisors are Black or African American,

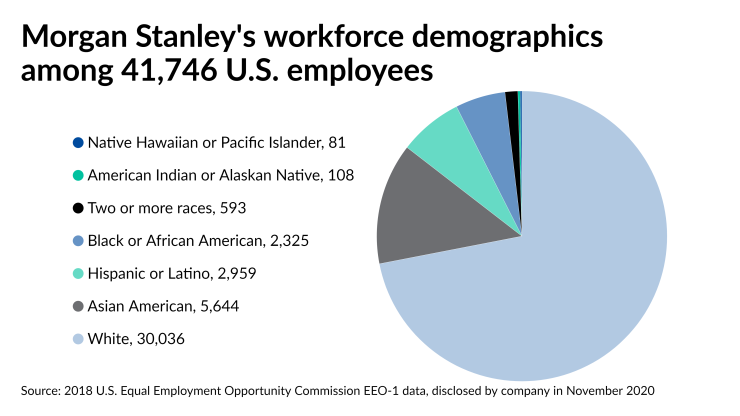

In that vein, Morgan Stanley followed

“We know our industry is not historically transparent,” Shabiolegbe said. “Transparency is one of the ways that we choose to create change where it matters and to show leadership and encourage some of our colleagues in the business and in the industry to start to show that level of transparency as well and really hold their own feet to the fire.”

At Raymond James, the firm has built partnerships focused on diversity in recruiting with the Ford Foundation, the Robert Toigo Foundation and Seizing Every Opportunity, according to Renée Baker, head of the firm’s Private Client Group Inclusion Networks. Among other programs, the senior executives of 21 different business units at the company each made a series of commitments relating to diversity and inclusion, Baker said.

“Those individuals really help us to have very specific action plans on how we address the needs of the business,” Baker said. “There's something to be said about the tone of it from the top, but even more to be said around how we have embedded D&I within our organization with a true focus on recruitment and retention and building cultural awareness.”

RIAs using Charles Schwab as their custodian have awarded scholarships for students from minority groups and expanded their local college recruiting efforts directly towards campus organizations, said Leslie Tabor, the firm’s director of advisor services, business consulting and education. Schwab is assisting the practices with identifying students pursuing RIA careers and examining their own company’s culture, she said.

“Firms are reaching out to us for support on how they think about creating a diversity strategy for their firms,” Tabor said. “They're creating sustainable practices. And they're not looking at this as an ad hoc project for recruiting diverse talent. They see diversity as a business competency that supports their books.”

Truist, the bank that stemmed from the 2019 merger of BB&T and SunTrust, launched a program called Grad, which stands for “grow, recruit, and accelerate development,” according to Travis O'Quinn, a senior vice president for unit investment trusts and structured products. The firm built Grad to select and provide support for promising diverse leaders in an effort “to propel them to senior management,” O’Quinn said. Truist will pay for their graduate school if they haven’t completed it, and the firm devotes 25% of the emerging leaders’ time to working on special projects for executives.

“As organizations, we have to ask ourselves, ‘Does our audio match our video?’” O’Quinn said. “Is it projecting in how we run our organizations in every business line? And so that's why I think this topic is really exciting, and it holds companies accountable.”