Turn off the blinders to systemic racism, engage in more education and events in which you are the minority, and revamp screening processes to remove bias in hiring. Those are the tangible actions planner Lazetta Rainey Braxton told hundreds of wealth management executives and financial advisors they can take to help dismantle systemic racism and increase access for underrepresented groups in the industry.

Rainey Braxton, co-founder of 2050 Wealth Partners, the founder of the recently launched diversity, equity, inclusion and belonging consulting firm Lazetta & Associates, the chair of the Association of African American Financial Advisors and a

After moderator and FSI CEO Dale Brown invited the audience to join him and Rainey Braxton “out on the thin ice of the uncomfortable conversation,” he asked her about topics some consider divisive at a time when the nation is supposed to be coming together.

For Rainey Braxton, the controversial discussions revolve around the connection between what she describes as “racial literacy” and financial literacy.

“We say, ‘My God, I am an adult; I should know this,” Rainey Braxton said. “And then that's the shame and the fear and the guilt. As financial planners, we see that frustration, that shame with our clients because they didn't know what they didn't know, and they didn't get the training. We should be doing the same thing about racial literacy, because that also impacts economics and finances as well.”

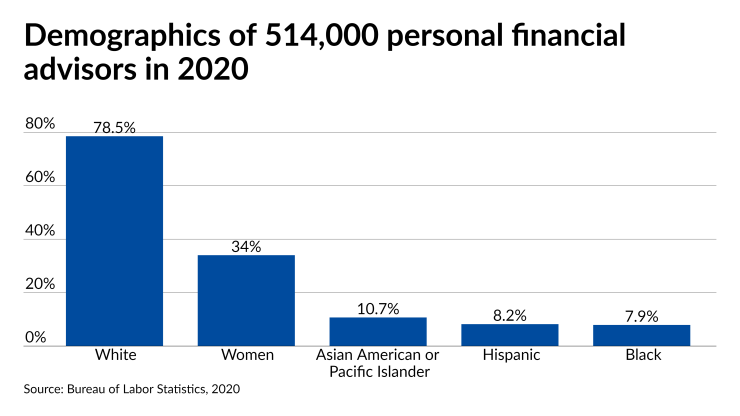

A mutual friend, longtime Pershing RIA executive Mark Tibergien, introduced Rainey Braxton to Brown. As part of FSI’s goal of expanding access to “affordable, objective, quality financial advice,” the group launched a task force last September aimed at boosting the number of advisors and executives who are women and minorities, Brown said. Despite some

FSI’s program began a year earlier, Brown explained in the panel.

“We actually started a journey in September of 2019, brought in an outside consultant to help us learn together, learn how to grow more comfortable having the uncomfortable conversations that we have to have in order to make progress on this important issue,” Brown said. “Today's session is an important part of that journey.”

Rainey Braxton emphasized a need for companies to commit to real actions to make a difference in the fight to reduce racial disparities. That means developing “cultural competency” through activities like pro bono services, engaging in minority-led conferences and improving hiring processes. But before any of that can be effective, she said companies must develop plans around why diversity, equity, inclusion and belonging is important to their businesses.

She also reminded the audience to take advantage of resources such as

“The goal is for you to get out of your comfort zone, to be self-aware, to put on the table any barriers you may cause to prevent a more inclusive, diverse environment and what you may be doing to make people feel like they don't belong as well,” Rainey Braxton said.

While advisors who are Black, Latino or other minorities have shouldered a disproportionate share of the burden of the country’s racial history, it’s time for others to “dig deep, show up and be a partner on this journey,” she added. “We’re all just trying to advance.”