The key to long-term steady returns can be summed up in one word: Patience. That’s the upshot of a two-decade performance review of key market indexes.

Specifically, clients with a long investing timeline should build a broadly diversified portfolio and stick with it. Then rebalance yearly to make sure to sell high and buy low. Clients may complain that this is boring — and tough to do during dizzying market gyrations — but that’s what it takes to generate solid gains over the long haul.

When building a diversified portfolio, encourage the client to plant an oak tree at the same time. I think they’ll understand the point of that suggestion.

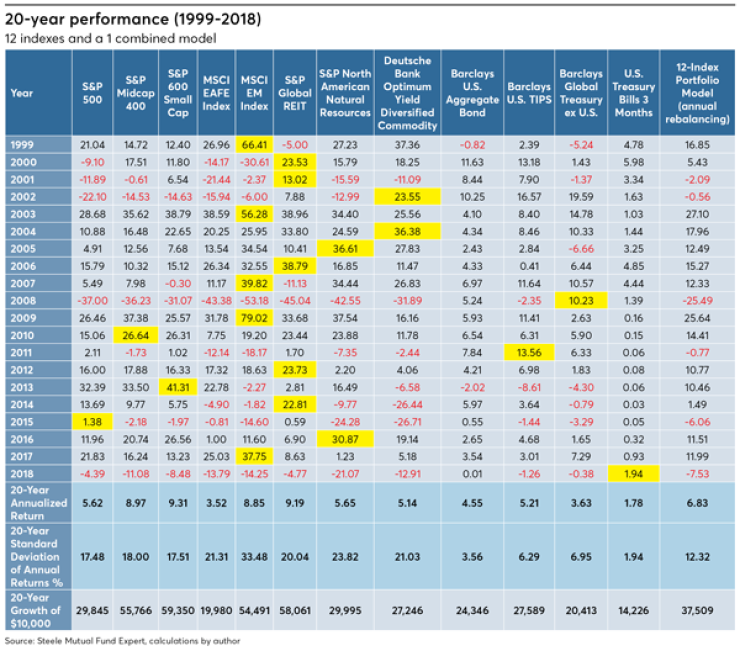

The accompanying “20-Year Performance” chart shows annual returns of 12 key indexes and a 12-index equally weighted portfolio model over the past 20 years (as of Dec. 31, 2018). Also shown are the 20-year annualized return, 20-year standard deviation of annual returns and the 20-year growth of a $10,000 lump sum investment. Negative annual returns are shown in red. The index with the highest return each year is highlighted in yellow.

It’s interesting to note that the S&P 500 was the highest performer only once during the past 20 years (in 2015) — despite the fact that it’s the most observed and mimicked index in the world. Real estate and emerging markets have been the best annual performer five times each. Commodities twice (2002 and 2004), and cash, the Rodney Dangerfield of asset classes, was the best performer once — in 2018!

When asset classes get beat up (and they all do), it’s tempting to forget the long-term picture and the achievements of the past and react only to the current pain. That approach generally ends badly for investors and in most every walk of life as well.

Successful investing isn’t necessarily about good timing (though that’s nice when it happens). It’s more about consistently good behavior. Success is likely when building a broadly diversified strategy and staying with it. Moreover, it’s important to rebalance the portfolio because when you do you are actually selling high and buying low. An example of a diversified strategy is illustrated in the far- right column of the table: a 12-Index portfolio. It is a portfolio strategy that combines all 12 indexes — equally weighted at 8.33% each and is annually rebalanced.

Several attributes of the 12-index portfolio model quickly stand out. First, it never once had the highest annual return. Guess what? It never will. It’s impossible. A diversified portfolio that contains multiple distinct asset classes will never out-perform the best performing single asset class within the portfolio. And, conversely, it will never perform as badly as the worst performing ingredient in it. Those are the basic ground rules of a diversified portfolio: It delivers middle-of-the-road, steady returns. Will that be good enough? Some may feel that such an approach is simply too boring. For those clients, let the numbers do the talking.

Over the past 20 years, a 12-index portfolio that was annually rebalanced delivered an annualized return of 6.83%. This exceeded the 20-year performance of eight of the individual indexes, including: the S&P 500, MSCI EAFE, S&P American Natural Resource, Deutsche Bank Commodity Index, Barclays Aggregate Bond Index, Barclays TIPS Index, Barclays Global Treasury Ex-U.S. Index, and U.S. 90-day Treasury Bills. Is that good enough?

Moreover, that 6.83% annualized return of the 12-index model came with a 12.3% standard deviation. By comparison, the S&P 500 had a 17.5% standard deviation. Thus, the 12-index portfolio had higher returns by 121 basis points compared to the S&P 500 Index over the past 20 years — and with roughly 30% less volatility. Maybe boring is good.

The S&P 500 was the highest performer only once during the past 20 years — despite the fact that it’s the most observed and mimicked index in the world.

If you’re looking for the standout performers of these 12 indexes, it’s clearly been U.S. small caps, U.S midcaps, global real estate and emerging markets. They have each had a 20-year annualized return of roughly 9%. But, the level of volatility has been considerably higher than the 12-index model. In the case emerging markets, almost three times higher. Is the extra volatility worth it? That is the challenging question that every advisor undoubtedly contemplates frequently.

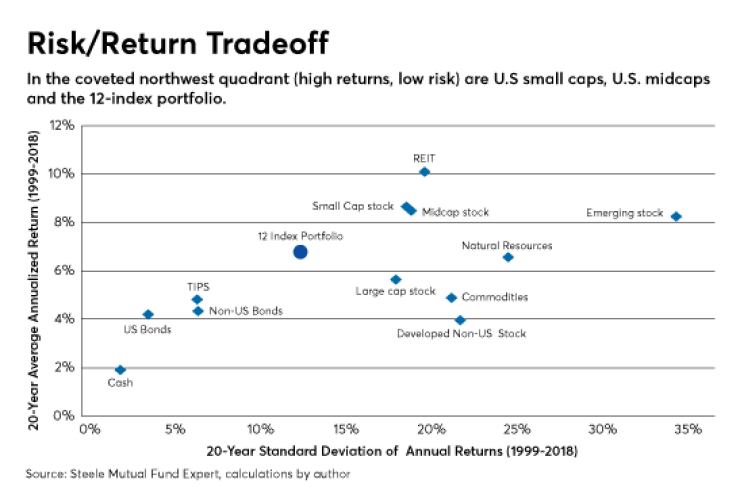

A helpful way to visualize the combination of risk and return is shown in the “Risk/Return Tradeoff” chart. The lower right quadrant of the graph represents low return and high volatility. Over the most recent 20 years, commodities, natural resources, and non-U.S. stock are positioned there (albeit not too deeply in the southeast quadrant). The lower left quadrant represents lower return with lower volatility — which is the normal location for fixed income indexes. Also located there — albeit barely — is the S&P 500.

The upper right quadrant of the graph represents high return and high volatility. The only index that is genuinely in that quadrant is emerging markets. Real estate is also in the upper right quadrant, though barely. Thus, it seems more appropriate to categorize real estate as “weakly” in the upper left (or northwest quadrant). Also located in the coveted northwest quadrant (representing higher return with lower risk) is small cap and midcap US stock…and the 12-index portfolio.

A few key observations to remember:

• Clients who check their portfolios every 15 minutes — or every 15 days — may not be good candidates for a diversified portfolio. Clients that micro-manage their investments will not likely have the patience to endure the moderate-growth performance behavior of a broadly diversified portfolio. Here’s a possible solution for the client who tends to be a diehard micro-manager: Partition their portfolio into two segments: one segment is a broadly diversified, annually rebalanced model where no micro-management is permitted. The other segment is composed of stocks and/or mutual funds and ETFs that the client is allowed (but not encouraged) to micro manage within reasonable guidelines.

• The 12-index model was never the winner in any given year. It never will be. The investor who diversifies needs to be content with hitting singles and doubles: Very seldom will they hit home runs. Diversified investing is a long- term philosophy, not a short-run tactic. When a diversified portfolio is built, encourage the client to plant an oak tree at the same time. I think they’ll understand the point of that suggestion.

• This 12-index model that does not favor any index, but rather employs equal weighting among the 12. As such, it is a purely strategic approach and is not attempting to market-time any particular asset class by overweighting it. However, viewed at the macro level, eight of the twelve indexes fall into the equity or diversifier asset class and four of the indexes are fixed income. Thus, it represents a 65% “engines” and 35% “brakes” allocation. This 65/35 allocation puts the 12-index model in the camp of “balanced funds” with their classic 60% stock/40% bond allocation.

• Building a diversified portfolio such as the one illustrated here need not be expensive. Using a variety of ETFs to represent these 12 indexes can result in an actionable portfolio with an annual expense ratio of less than 20 bps.

The verdict: Over the 20-year period from 1999-2018, a diversified 12-index model fared well … for the patient investor. And in the end, patient investors generally do better anyway.