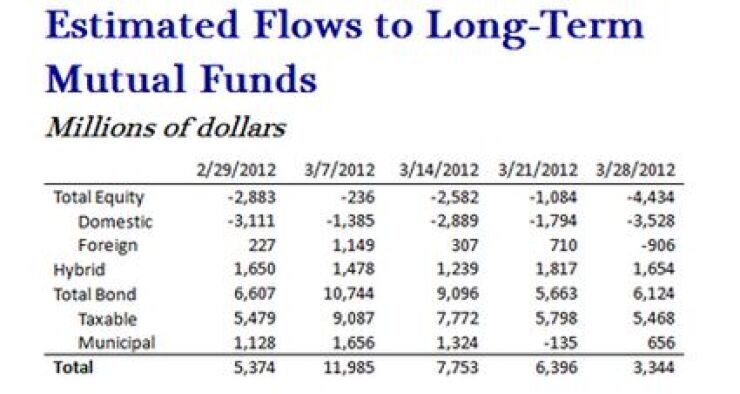

Investors continue to spurn mutual funds that invest long-term in U.S. stocks, according to the latest statistics from the Investment Company Institute. For the week ended March 28, investors pulled $3.53 billion from domestic stock funds, the largest weekly outflow so far this year.

Foreign mutual funds also posted an outflow, its first since early January, losing an estimated $906 million for the week. Between them, stock mutual funds posted estimated outflows of $4.43 billion.

Bond funds, in contrast, continued to attract investors, drawing an estimated $6.12 billion in fresh investments for the week, up from $5.66 billion a week earlier. Of the $6.12 billion, $5.47 billion went to taxable bond funds with the remaining $656 million going to municipal bond funds.

Hybrid funds — those that invest in both stocks and fixed income securities — posted estimated inflows of $1.65 billion, down slightly from the $1.82 billion inflow the week before.

All told, mutual funds saw estimated inflows of $3.34 billion, the weakest infusion yet this year.

The weekly fund flow estimates are derived from data covering more than 95% of industry assets, according to ICI. The statistics cover long-term mutual funds, those the ICI defines as investing in long-term instruments.

Margarida Correia writes for