More than a month has passed since the Department of Labor unveiled the final version of its fiduciary rule, and despite years of heated debate, most advisors now say there's little to be afraid of in the new regulation.

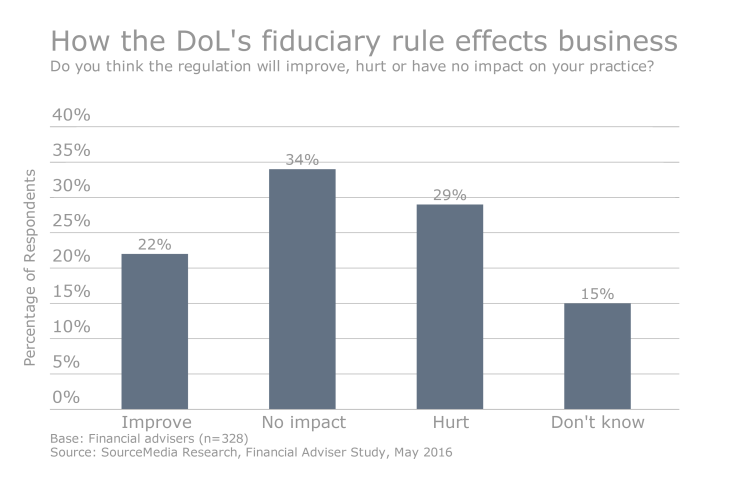

About a third of advisors say the rule will have no impact on how they conduct business while nearly a quarter expect a boost, according to a new SourceMedia study.

Just under a third of advisors say it will negatively affect their practices, according to the survey, which polled 330 advisors in the employee, bank and independent channels. About 15% of advisors say they are unsure as to what impact the regulation may have.

Opponents of the rule say that firms may be forced to abandon middle-income clients rather than submit to its contractual provisions, which are perceived to be too onerous.

SIFMA CEO Kenneth Bentsen, speaking at a conference in New York earlier this month, said opponents are not opposed to a best interest standard, but rather to the nuances in the way the rule would be implemented.

"Perhaps most troubling is the lack of clarity with respect to the new prescriptions and mandates, particularly under the new best interest contract exemption, which combined with a new private right of action established outside the normal legislative process creates the potential for unlimited liability risk hanging over firms and advisors like the sword of Damocles as they seek to serve their clients," Bentsen said.

Advisors concerned about getting tripped in compliance matters may have help coming their way.

Timothy Hauser, a deputy assistant secretary at the Labor Department who also spoke at the conference, said that the department would closely monitor its implementation and welcomed feedback from the industry as the DoL has plans to publish further

“We want to get out guidance sooner rather than later, and we certainly don't want a firm to build something only to have it not comply,” Hauser said.

With additional reporting from Andrew Welsch.