Research around the spending habits of retirees is debunking old myths. Rather than assuming a stable standard of living throughout retirement, this growing volume of research looks more directly at not just the composition of a retiree’s spending goals, but also at how expenses change as the retiree moves through different age bands.

Projecting retirement expenses using an age-banding approach may allow for a more nuanced and accurate representation of how spending will change over time. The ramifications cannot be overstated: Indeed, retirees may not actually need to save as much or accumulate as large of a nest egg to retire in the first place.

WHY AGE BANDING?

The traditional view of retirement spending is that the person who no longer works will aim to generate enough income to replace their former earnings, and maintain their existing standard of living. Of course, some aspects of that standard of living itself will no longer be necessary — from taxes paid on employment wages to the savings that were being made to generate that retirement nest egg, and perhaps a handful of expenses that aren’t relevant anymore.

Thus, it may only be necessary to replace 70% to 80% of pre-retirement income in retirement itself: the so-called

Early approaches to securing retirement income were all various forms of pensions and lifetime annuities, which provided a fixed ongoing payment for life, made annually or perhaps monthly. With the inflation of the 1970s, though, combined with ever-increasing life expectancy, it became clear that the purchasing power of a fixed pension in retirement could be severely undermined over time, especially for retirees who might live decades after they leave the workforce.

Thus, by the ‘90s, the prevailing view — as exemplified by

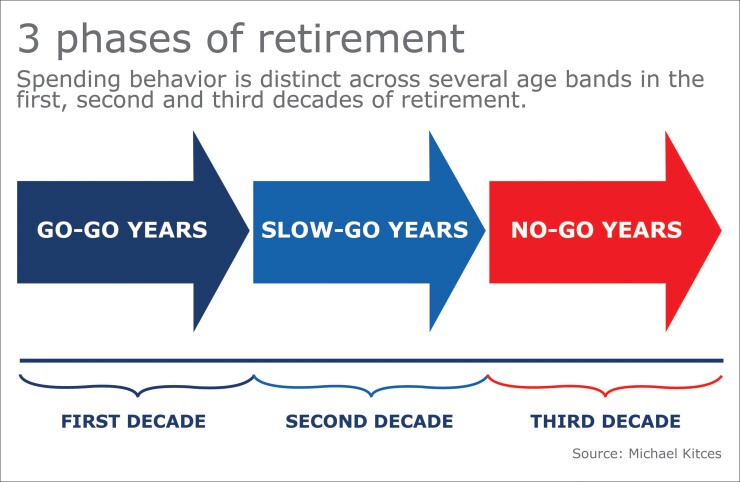

At the same time, a growing base of data on retirees in their later years began to reveal that the assumption of stable spending may not actually offer an accurate reflection of reality. Instead, retirees appear to shift their spending behavior over time, in a manner that Michael Stein of “The Prosperous Retirement” first dubbed the three phases of retirement: the Go-Go years, or the active first decade of retirement, largely a continuation of the pre-retirement lifestyle; the Slow-Go years, referring to the less active second decade of retirement, as health and energy begin to decline and some discretionary spending slows; and the No-Go years, comprising the final decade of retirement, as most discretionary lifestyle spending stops altogether, supplanted by health care expenses.

In essence, the idea is that spending behavior in retirement is not pegged to a consistent, level amount in nominal or real terms, but instead is distinct across several age bands in the first, second and third decades of retirement.

During each of those bands, retirees shift not just the level of their retirement spending, but also the composition thereof. For instance,

And as it turns out, subsequent research into the actual spending patterns of retirees across each age band is beginning to support the age-banding hypothesis.

HOW RETIREMENT SPENDING DECLINES

For over 30 years, the U.S. Bureau of Labor Statistics has gathered information annually on household spending behavior through its

For instance, a study in

Notably, though, the Bernicke study looked at a cross-section of people in the same year to see the differences in spending by age, rather than actually tracking a cohort of people to see how their spending changed over time. When a subsequent study by the

The challenge of cohort analysis is that it still only looks at groups of people who were born in a similar grouping of years, and checks to see how the group as a whole changes its spending behavior over time. It doesn’t actually track the spending behavior of specific individuals and how it changes over time.

A follow-up study by David Blanchett of Morningstar, though, used the

Notably, the chart above graphs the real — i.e., inflation-adjusted — change in spending, showing that real spending declines by an average of about 1% per year in the first decade of retirement, 2% per year in the second decade and about 1% per year again in the final decade. Given that inflation itself averages more than 2% per year through most of the years in the data set, though, this still means that retirees were maintaining or slightly increasing their nominal spending each year — just by less than the annual amount of inflation.

SPENDING PATTERN DIFFERENCES

A key aspect of the Blanchett retirement

For instance, using the CES data, Blanchett looked at the composition of spending throughout an individual’s lifecycle from age 25 to 85, and found that in the retirement years, there are distinct shifts in the composition of retirement spending. As retirees age, some spending categories steadily decline — e.g., insurance premiums, as life insurance, disability insurance and, eventually, automobile insurance become less necessary; transportation, as the household consolidates to one or even no cars; housing, as spending on new furniture and other household goods slows down; and clothing. Other categories, meanwhile, rise — most notably, health care.

A similar study by

One notable aspect of these results is that while health care expenses do ramp up in the later years, health care expenditures overall are still only a relatively moderate percentage of the retiree’s total spending, falling roughly in the 15% to 20% range, and not even fully replacing the decreases in spending in the other categories, such that total spending in a retiree’s 80s is still more than 20% below where it was at the beginning of retirement.

In other words, health care expenses really do rise in the later years of retirement, but not enough to raise total spending in those later years.

This speaks to the relative effectiveness of Medicare in holding a household’s health care expenditures relatively stable in retirement; while it may cost upwards of $5,000 per year for an individual or $10,000 per year for a couple

And in fact, since the data on health care would include all such expenditures — both for medical needs, and also for long-term care expenses — the spending for medical-related health care expenses appears to be even more stable, as a material portion of the later years’ increase is likely attributable to a small subset of consumers with larger, uninsured long-term care expenses.

IMPLEMENTING AN AGE-BANDING APPROACH

So how might the research on age-banding retirement spending be incorporated into planning projections for clients? The first option would simply be to reflect the tendency for retirees to spend less as they age and move through the Go-Go, Slow-Go and No-Go years.

For instance, spending could be projected to decrease by 10% each decade in retirement — that is, cutting spending by 10% at age 70, another 10% at age 80 and yet another 10% at age 90. The middle decade could be cut by even more, such as by 15% or even 20%, to reflect Blanchett’s retirement spending smile. And that spending decreases even faster in the middle Slow-Go decade.

Notably, though, while the research suggests these spending decreases as people move across age bands, for any particular individual, the shift is more likely to be driven by a health-related event — e.g., Mom falls and breaks her hip, and from that point forward doesn’t want to travel or eat out much — rather than reaching an arbitrary age threshold.

Thus, in real life a spending cut might happen to occur promptly as someone moves across an age band, but it may well be off by several years as well. Consequently, an alternative approach might also just be to project retirement spending to increase by 1% less than the expected rate of inflation — e.g., 1% less than the inflation rate being used to inflate other fixed income streams — such that real spending decreases by 1% per year.

This will still cumulatively reflect the likelihood of anticipated spending changes, without making the plan unusually dependent on a big change in a particular future year that might not actually occur at that exact time.

Of course, the reality is that the decreases in retirement spending over time are less a function of absolute reductions in spending across the board, and more a result of significant spending decreases in some categories — mostly coming from leisure and discretionary spending — with less-than-full substitutes in other categories such as health care and medical expenses.

Thus, a better implementation of

This makes it feasible to not only adjust different categories of spending at different rates as the retiree ages, but also to reflect the different inflation rates that apply to each — especially given how health care expenses inflate higher than other expenses.

For instance, spending on essentials might be projected to decline at 10% per decade in real dollars, but leisure could fall by 20% per decade, and health care might be projected to rise by 10% per decade. In addition, health care could be projected with a higher inflation rate than the other categories.

In turn, both the starting levels of the retiree’s budget and the projected adjustment factors could then be specified to the individual situation. For instance, the J.P. Morgan study’s authors

Accordingly, globetrotters might have their own “travel” category that starts out much higher as a percentage of spending, but falls off the most in their 80s, when they presumably wouldn’t travel much anymore. Meanwhile, the homebodies might have a larger allocation to basic living expenses that inflate more slowly, but decline very little.

Though notably, retirees may not be very good at projecting their own lifestyle changes in the later years of retirement — a version of the so-called

Doing this kind of projected retirement spending may also be more difficult with

Nonetheless, while research studies vary as to what the exact magnitudes of spending declines are in various categories — and the age-banded thresholds when they apply — the data from both the

This all means that projecting any reasonable decrease in retirement spending in later years is arguably a better baseline for retirement planning than the current default of assuming no decreases at all.

So what do you think? Do you assume that retiree spending will decrease in the later retirement years? By how much? Please share your thoughts in the comments section.