Advisors commonly determine their clients’ risk tolerance before making any portfolio recommendations. Once known, advisors work to create portfolios designed to achieve investors’ goals and whatever required return and associated risk they necessitate.

This approach is flawed.

The best path forward is not to try designing an optimal portfolio; we all know such a thing doesn’t really exist. Rather, it’s about helping clients adjust their goals, such that they don’t need more risk than they can tolerate in the first place. Stated even more plainly, in a world where portfolios are invested to achieve specific goals, the first step is not to align the portfolio to the client’s risk tolerance, but to align the client’s goals to their capacity for tolerating risk.

Assessing a client’s ability to withstand risk associated with their investment portfolio is standard industry protocol. This assessment takes into consideration both the client’s willingness to stay invested through the inevitable market decline (i.e., their risk attitude) and their wherewithal to stay on track in the face of market volatility (i.e., their risk capacity).

It’s crucial to know how much of a drawdown an investor can tolerate before they panic. If an investor can’t stay invested when faced with market volatility — if they panic at the bottom and do something hasty or inappropriate — they may outright

And if the investor must rely directly on those investment assets — e.g., for ongoing distributions in retirement — an

Hence, designing portfolios around two different risk tolerance constraints: the investor’s attitude or willingness to take risk without panicking, and the investor’s capacity to take the risk without succumbing to sequence risk.

The caveat is that sometimes the proper portfolio based on a client’s aggregate risk tolerance — a

Example: Betty Burton, a 63-year-old widow, received a $500,000 life insurance policy payment following her husband’s death. She must support herself for the rest of her life via a combination of those insurance proceeds, a modest checking account balance and a $2,000 monthly Social Security survival benefit. Betty’s current standard of living requires about $4,000 per month to sustain, meaning she needs to draw another $2,000 per month — or $24,000 per year — from her portfolio, representing an initial withdrawal rate of nearly 5%.

The problem is that where a conservative bond portfolio may only yield about 3% in today’s environment, it’s virtually impossible for Betty to sustain a 5% withdrawal rate. At minimum her spending goal would necessitate a moderate growth portfolio to even have a chance of sustaining that 5% figure.

Yet Betty is extremely risk-averse. In fact, the reason why she has virtually no other assets for retirement is that her late husband lost the remainder of their retirement savings after a risky real estate investment made in the mid-2000s was wiped out in the subsequent financial crisis.

The end result is that Betty needs the returns of a moderate growth portfolio to maximize the odds of achieving her retirement goals, but does not have the risk tolerance for such a portfolio. Yet investing in a portfolio that is consistent with Betty’s risk tolerance will, in turn, have virtually no possibility of achieving the returns needed.

What is an advisor to do?

AUTHORITATIVE VS. ACCOMMODATIVE

When it comes to dealing with clients who have a fundamental mismatch between their tolerance for risk and the risk they need to take on to realize their goals, most advisors fall into one of two camps.

The first positions the advisor as the authority best positioned to determine what is in the best long-term interests of the client. The authoritative advisor’s response to Betty’s situation would look something like this:

“Betty will be invested in the moderate growth portfolio she needs to have the best chance of achieving her long-term goals. And my job is to help ensure she’s not only invested, but stays invested. That’s why Betty is hiring me in the first place: to help her implement the best path to reach her goals, and to provide the behavioral coaching and support for her to stay the course.”

Note that the point of this approach is to be authoritative, not authoritarian. It’s about recognizing that the advisor is being hired because they are the expert, and as such their recommendation should be implemented. The advisor then

By contrast, advisors at the other extreme take a more accommodative approach, recognizing that while the advisor can advise, in the end they must accommodate what the client is actually willing to do. Thus, the accommodative advisor’s response would look something to the effect of:

“Betty will be invested into a conservative portfolio that is consistent with her risk tolerance and risk capacity. But my job as an advisor is to educate her of the risk and danger of holding a conservative portfolio that may not be sufficient to achieve her aggressive goals, and hopefully to get her more comfortable over time with taking additional risk. Though in the end I acknowledge that it’s Betty’s money and Betty’s decision, and my role is simply to support her as best I can with whatever path she chooses.”

A pitfall of this dichotomy is that advisors on each side of the divide are likely to disagree with the other. But that’s also the point. They are fundamentally different and opposite approaches, where the accommodative advisor would view the authoritative approach as taking too much control away from the client, while the authoritative advisor would likely consider it irresponsible to leave the client on a path to plan failure.

THE MIDDLE WAY

The central dilemma of the authoritative-accommodative debate is how to plug the right portfolio into situations where the client’s need for risk — and need for portfolio growth — doesn’t match their tolerance or capacity to take the risk in the first place.

This mismatch means that something has to give. Either the portfolio ends out riskier than the client’s tolerance and the authoritative advisor bears the added burden of helping the client stay the course, or the portfolio ends out not risky enough and the accommodative advisor runs the risk of plan failure if the client can’t eventually be nudged toward avenues for greater growth.

The reality is that there’s a middle way: altering the client’s risk need to align with what’s feasible within the portfolio.

The real challenge for Betty’s advisor is not deciding whether to be authoritative or accommodative, but navigating the fundamental mismatch between Betty’s risk need and risk tolerance. Those factors are in turn functions of Betty’s goals.

So instead of trying to determine whether to push Betty toward a more aggressive portfolio or to accommodate her conservatism, our hypothetical advisor helped Betty make a downward adjustment to her lifestyle spending by 20%, such that she now only needs $3,200 per month instead of $4,000. Stacked atop her Social Security benefits, this cuts Betty’s withdrawal rate from almost 5% to barely 2.5% per year — amounting to a $1,200 monthly portfolio withdrawal on a $500,000 portfolio — which in turn reduces her risk need to the point that even a very conservative portfolio will work just fine.

In other words, a conservative bond portfolio is perfectly O.K. when Betty only needs to spend 2.5% per year from the portfolio. And in turn, the reduced withdrawal rate also eliminates Betty’s exposure to sequence of return risk, as with a withdrawal rate that low, Betty will have more than enough invested to recover from any market drops.

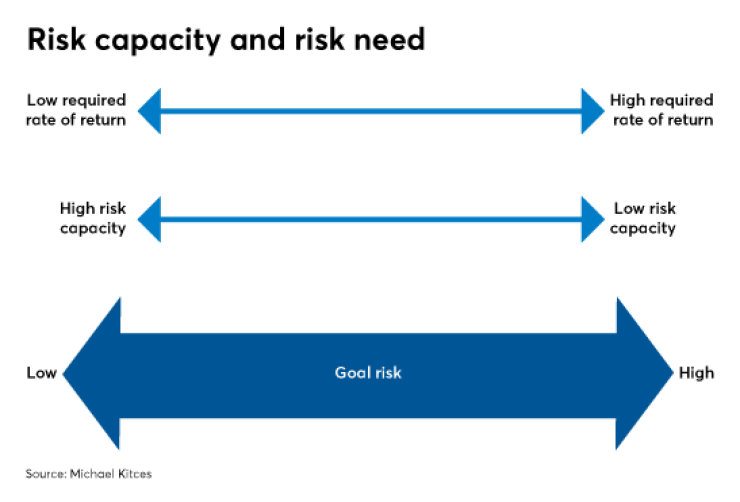

Changing Betty’s goals not only reduces her risk need, but also effectively increases her risk capacity. Indeed, the two are really opposite sides of the same coin. Risky goals mandate high returns to achieve them, while more conservative goals bundle a higher capacity for risk precisely because the portfolio doesn’t need to earn much to achieve them.

In fact, I’d argue that the entire challenge of clients whose risk tolerance doesn’t align to their risk need isn’t a portfolio problem, but a goals problem. The

Consequently, the advisor’s best course of action is to help the client understand that the mismatch between risk tolerance and risk need should prompt a revisitation of their goals.

Stated even more simply, the best approach to portfolio design isn’t about finding the optimal mix of investments to fit the client’s risk tolerance, but to help the client identify the optimal goal consistent with that risk tolerance. At this point, implementation is simply a matter of finding the portfolio that naturally fits that goal — a portfolio that will by definition also suit the client’s risk tolerance.