In today’s increasingly crowded advisory landscape, firms are eager to tout any competitive edge. Whether it’s experience and credentials, specialization or depth of services, or simply sheer size as based on assets under management (AUM), firms will press the advantage. But they also may be pushing against the boundaries of regulatory law — specifically those that outline what can and can’t be counted as AUM.

Enter assets under advisement, or AUA. This figure can be used to account for the increasingly comprehensive planning services common of today’s advisory firms, where advisers provide holistic planning advice on all of a client’s net worth. That’s not to say substantial AUA can be rolled into AUM to create a big, fat, enticing calling card for the firm’s services. And knowing what’s permissible is critical for firms hoping to stay on the right side of the SEC — and of their clients.

AUM AND CREDIBILITY

It is a standard of the media, especially trade publications, to cite an advisory firm’s assets under management when interviewing the adviser. In some cases, the size of the firm simply helps to provide context to the adviser’s comments — e.g., was he/she speaking on behalf of a large firm or a small one. In other scenarios, the adviser’s AUM is used as an implied marker of credibility; the larger the advisory firm, the more successful it must be, and the more valid the comments must be of the adviser being interviewed.

The amount of an advisory firm’s assets under management also appears to have an implied credibility factor with consumers. In this regard, the concern for regulators is more substantive.

To the extent that consumers might assume that an advisory firm with higher AUM has been more successful, is a safer choice, might offer more services or have more resources because of its size, or simply be likely to cite size as evidence that the firm must be good, a misrepresentation of the firm’s AUM can amount to fraudulent advertising. This is especially true given

And notably, a proper determination of AUM is also important for regulatory purposes. Under

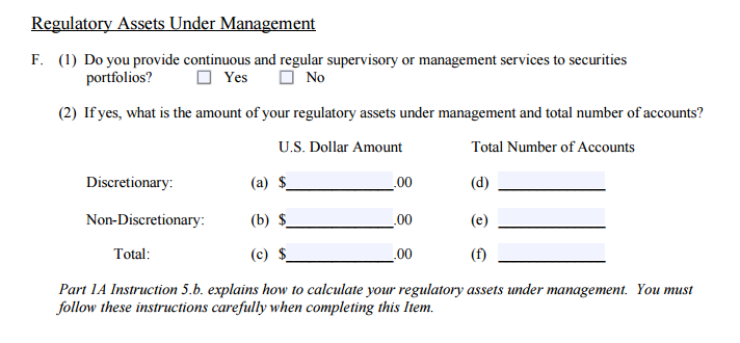

Accordingly, the SEC strictly defines what constitutes regulatory assets under management (RAUM) for an advisory firm when it markets itself to the public, and requires that these amounts be reported directly into Item 5.F on Part 1 of the Form ADV filing.

DEFINING RAUM

The SEC defines regulatory assets under management for the purposes of

The adviser’s AUM is used as an implied marker of credibility.

An account is defined as a securities portfolio if at least 50% of the total value of the account consists of securities, where a security includes any stock, bond, Treasury note, swap or futures contract, or any other investment registered as such. For the purposes of this test, cash and cash equivalents including bank deposits, CDs, etc., are also treated as securities, as are all the assets in a private fund including uncalled capital commitments for the private fund.

For most planners and wealth managers operating as investment advisers, virtually all client accounts will likely be treated as securities portfolios. The more complex requirement though is determining whether the adviser provides “continuous and regular supervisory or management services” to that account.

The general criteria to determine this are if either A) the adviser has discretionary authority over the account and provides ongoing supervisory or management services with respect to the account, or B), the adviser does not have discretion, but does have an ongoing responsibility to make recommendations of specific securities based on the needs of the client — and if the client accepts the recommendation, the adviser assumes responsibility for arranging or effecting the purchase or sale.

In other words, determining whether the adviser is providing continuous and regular supervisory or management services essentially boils down to two questions: Does the adviser provide ongoing management or advice, and is the adviser responsible for implementing the transaction — either with discretion, or once the client accepts the recommendation? As Tom Giachetti of Stark & Stark states even more simply: “If you can’t trade it, you can’t count it [as RAUM].”

Notably though, while the ability to effect trades — either with discretion or the client’s permission to implement a recommendation — is a fairly straightforward litmus test to determine if the adviser would not be able to count the assets as regulatory AUM, the ultimate determination still relies on whether the adviser provides continuous and regular supervisory or management services. In practice, this is often far less clear-cut.

To make the determination, the SEC prescribes three primary factors to consider: the terms of the advisory contract; the form of the adviser’s compensation; and the adviser’s actual portfolio management practices.

Terms of the Advisory Contract: Does the adviser’s agreement with the client actually stipulate that the adviser is responsible for ongoing management services as opposed to a more limited scope or one-time engagement?

Form of Compensation: Being compensated based on assets managed implicitly suggests that the firm is providing ongoing services with respect to those assets. Although being compensated by AUM fees is not a requirement, the SEC does note that simply charging hourly fees based on time spent with the client, which implies services aren’t ongoing outside the client meeting, or a retainer based on the overall net worth of the client or the assets covered by a financial plan, which implies the adviser isn’t being compensated primarily for asset management, suggests that the adviser’s focus is not on providing continuous and regular supervisory or management services.

Management Practices: To what extent does the adviser’s actual investment process demonstrate that continuous and regular management services are being provided? Clearly, ongoing trading activity would demonstrate ongoing services. Meanwhile, infrequent trading — e.g., a buy-and-hold strategy — does not automatically mean the adviser isn’t providing continuous and regular services, but it does create an additional burden on the adviser to substantiate what exactly is being done on an ongoing basis to prove that the assets are actually being supervised or managed.

In fact, the SEC explicitly notes that advisers who make an initial asset allocation recommendation, but don’t do continuous and regular monitoring and help implement reallocation trades, would not be providing continuous and regular services, and thus cannot count those client assets as regulatory AUM. Nor would just providing trading recommendations, such as what to buy or sell, without any ongoing management responsibilities or providing impersonal — e.g., not client-specific — investment advice, such as via a market newsletter.

Industry benchmarking data suggests more affluent clients really do tend to choose advisory firms with higher AUM.

Similarly, the SEC states that merely providing advice on an intermittent basis, such as on client request or on a standard periodic basis — e.g., during quarterly or annual meetings to review the account and make adjustments — does not constitute continuous and regular management services. In other words, even meeting with clients regularly on a quarterly basis is not considered continuous or regular asset management. Indeed, the adviser must also substantiate that due-diligence monitoring and other management services are occurring between the quarterly meetings as well.

On the other hand, continuous and regular services can be in a supervisory capacity, and not necessarily a hands-on management role. Thus, having discretionary authority to allocate client assets among various mutual funds — which in turn have their own managers — may still allow those assets to be treated as regulatory AUM.

Similarly, using third-party managers via a TAMP, SMA or other service, and operating as a manager of managers, is also permitted, but only if the adviser retains discretionary authority to hire and fire those managers and/or to reallocate assets among them. If the adviser doesn’t have discretion to hire and fire the third-party managers without the client’s permission or to reallocate among the third-party managers, then it is technically not RAUM.

CALCULATING RAUM

Once it is affirmed that the adviser is providing continuous and regular supervisory or management services, and the client accounts do constitute securities portfolios, it’s time to actually add up the amount of assets under management.

In this context, the adviser should still only include accounts or portions thereof for which the adviser actually provides continuous and regular supervisory or management services. Even if the adviser meets the rest of the requirements, the holdings of a securities portfolio that aren’t continuously and regularly monitored or supervised aren’t included in the AUM calculation. On the other hand, as long as they’re otherwise managed, advisers should include any family accounts, proprietary accounts or even accounts for which the adviser is not directly compensated, such as house accounts.

When reporting the calculated amount of regulatory AUM on Form ADV — or for

Fortunately, the SEC does provide substantial latitude to the adviser in determining what is a reasonable estimate of value — which is straightforward for market-traded securities, but can be more challenging for infrequently traded or illiquid assets. However, the SEC does expect that the adviser consistently uses the same values for AUM calculation purposes that are used to report values to clients — such as in quarterly or annual portfolio statements — and when calculating the adviser’s own fees.

Notably, when determining total AUM, the SEC directs investment advisers to calculate regulatory assets under management without reducing the value by any indebtedness associated with the account — e.g., margin loans or other securities-based loans. In other words, regulatory AUM is calculated based on the adviser’s gross assets under management, including securities purchased with borrowed amounts, and not the net value of the accounts.

From a regulatory perspective, the requirement to use gross assets — and to include such a wide range of assets — was intended to prevent advisers from excluding assets to try to stay

COMMON MISTAKES

With recent high-profile fraud cases like that involving

But in practice, it appears that the most common problems are not the straightforward scenarios of deliberate fraud, where an RIA knowingly overstates its regulatory AUM. Instead, it’s situations where the adviser unwittingly overstates AUM by failing to properly exclude assets/accounts that don’t actually meet the requirements for inclusion as regulatory AUM.

For instance, common mistakes and pitfalls when determining AUM includes:

- Counting all investments in all accounts, without segregating out non-managed accounts that might happen to be included in the adviser’s portfolio accounting software — but aren’t actually accounts receiving continuous and regular management services from the adviser, and therefore shouldn’t be counted.

- Counting all investments in a hybrid adviser’s book of business without recognizing that the brokerage assets — for which the adviser doesn’t have an advisory agreement nor discretion — should not be counted as regulatory AUM. In other words, a hybrid adviser who has $20 million in C-share mutual funds in a brokerage account and receives a 1% trail, who also has $30 million in advisory accounts under a corporate RIA, should only be reporting $30 million in regulatory AUM, not $50 million. Generally, if there is no discretion with the client and no ongoing advisory agreement to substantiate continuous and regular services with the client — which typically isn’t the case for brokerage accounts — then the mutual funds, variable annuities, etc., probably should not be counted as regulatory AUM.

- Counting fixed annuities, along with fixed-indexed annuities, which are not counted as securities at all, and therefore should not be included when discussing the adviser’s regulatory AUM.

- Counting TAMP or SMA assets, where the adviser may have recommended the third-party manager and may be paid an AUM fee, and may have implemented a discretionary account because the third-party manager has discretion, but the adviser doesn’t have discretion to hire/fire/change third-party managers, which renders the accounts/assets ineligible to be counted as regulatory AUM.

- Counting the value of outside 401(k) plans on which the adviser provides investment recommendations but doesn’t actually provide ongoing and regular management services, because the adviser doesn’t actually have the authority or capability to effect trades — because the adviser doesn’t control or have access to the account. Notably, if the adviser has login credentials to the client’s account and can effect trades, the assets may be included in regulatory AUM. That said, having access to client login names and passwords for third-party accounts

could trigger custody under Rule 206(4)-2.

- Counting assets for which the adviser is a consultant — e.g., in the case of working with institutional clients as a plan consultant or adviser to the investment committee — but where the adviser doesn’t have discretion and/or cannot implement the trades. Just because the adviser gives advice regarding those assets doesn’t mean they can be claimed as assets under management!

- Counting otherwise discretionary assets that are bought and held, and only reviewed when clients come in for periodic review meetings. While the definition of regulatory AUM is not limited to just active managers, if a passive adviser wants to substantiate regulatory AUM, it’s necessary to share that there is an ongoing supervisory due diligence process to monitor client accounts and the underlying investments all year long, not just at review meetings.

- Counting assets for which advice is given on an ad-hoc basis as part of an hourly or financial planning retainer agreement. Notably, the mere fact that advice is being charged on an hourly or retainer basis does not automatically disqualify the assets from being considered as regulatory AUM. But if the adviser is only charging for client-facing time and no other time, it implicitly demonstrates that the adviser is not engaging in continuous and regular supervisory or management services. And in the case of a retainer-based adviser, it’s not enough to just show ongoing fees and regular client meetings. Again, as in the case of a passive adviser, it’s also necessary to show what monitoring, supervisory, and/or management services are being provided

on an ongoing basis as well.

RAUM VS. AUA

In recent years, the growth of financial planning has increasingly broadened the scope of assets on which advisers provide advice. As a result, it’s now increasingly common for advisers to provide advice about the client’s entire net worth and all his/her assets and liabilities, including both the accounts that the adviser manages and those the adviser merely “advises” — and financially plans — upon.

Nonetheless, assets on which the adviser merely advises and includes in the financial plan are not assets under management for regulatory purposes, which means they should not be claimed as assets under management at all.

As an alternative, a growing number of advisory firms are also claiming assets under advisement, or AUA, which includes the value of all assets that are touched by the adviser-client relationship. This would include most of the various assets discussed earlier that are part of the client’s household net worth but not eligible for being counted as regulatory AUM. In the broadest of situations, AUA might simply include the total net worth of all clients for which the adviser does financial planning or otherwise provides advice.

Even meeting with clients regularly on a quarterly basis is not considered continuous or regular asset management.

Fortunately, the SEC does permit advisers to describe, in Item 4 of the Part 2 Form ADV brochure, their assets under advisement. Interestingly, the SEC never directly uses the term assets under advisement, but it does permit advisers to compute client assets managed in a different manner than regulatory assets under management.

However, if the advisory firm does report AUA or some other alternative approach to calculating managed assets, it should be done separately from — that is, in addition to — regulatory AUM, and the RIA should keep documentation describing the methodology used to calculate AUA and substantiating the total amount reported. This in turn should be kept for five years as part of the general requirement for retention of books and records under

Of course, if more and more advisory firms begin reporting their AUA in addition to their AUM — which seems likely, given both the temptation to report what will typically be a larger asset AUA amount for marketing purposes, and the shift of advisers to more holistic financial planning where advice really is given on a wider range of assets — it seems only a matter of time before regulators intervene to more strictly define the calculation of AUA as well.

For the time being though, the SEC as well as state securities regulators are providing more latitude to RIAs to calculate and report their own AUA — as long as the methodology is disclosed and the amount can still be substantiated. But even with AUA being permitted, it’s still crucial for advisers to actually report it as such, and not overstate their regulatory AUM instead.

Special thanks to Chris Stanley of