Lincoln Financial Advisors poached a U.S. Bank executive for one of four new divisional head positions in what LFA’s chief describes as a shift from a “generalist” to a “specialist” structure.

Regulatory changes, particularly the fiduciary rule, prompted LFA head John DiMonda to add a new management layer above its 12 regional heads, he said last week. For the new position atop Lincoln’s Midwest market, DiMonda tapped John Ekman, who was a Midwest divisional manager at U.S. Bank.

The Department of Labor rule has

“We realigned our resources to capitalize on the strengths of the people we have working for us and our footprint in the marketplace,” DiMonda says. “They’re kind of the quarterbacks of the resources within the division.”

ON THE ROLLOUT

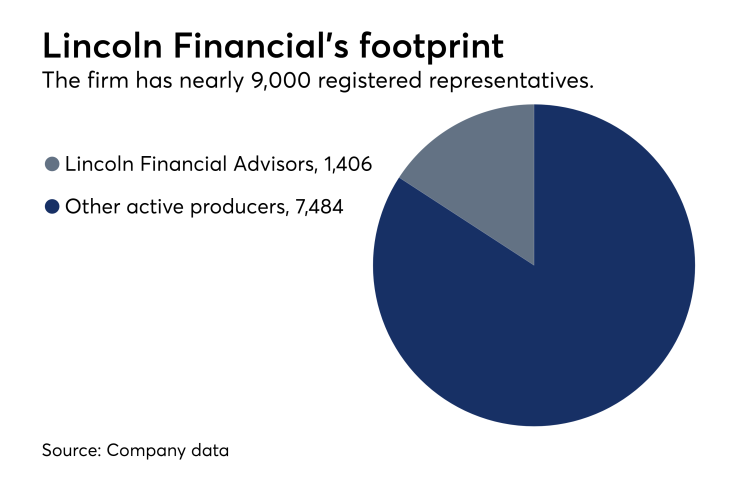

There are roughly 1,400 advisors at 80 branches within the Philadelphia-area Lincoln Financial Network’s force of about 9,000 registered representatives, according to DiMonda. LFA stands about two years into the three-year management change for those advisors. The Network

Ekman, a 30-year industry veteran, had been with U.S. Bank Investments nearly seven years before he joined LFA in May, according to FINRA BrokerCheck. As manager of the firm’s Metro Midwest region, he led recruiting and sales growth efforts, as well as business model changes.

A spokesman for U.S. Bank confirmed Ekman’s move.

“We don’t have anything more to add and we wish him well with the next phase of his career,” the spokesman said in an email.

Ekman also focuses on recruiting at LFA from among the firm’s main targets at wirehouses, insurance brokerages and other IBDs, according to DiMonda. Ekman reports to LFA’s head, assisting regions in the Midwest with headcount growth, succession planning and other services geared around advisors.

“His role is to oversee these larger relationships within the organization,” says DiMonda, noting the DoL rule and

LFA’s parent last week