SAN DIEGO — Annalee Kruger understands the importance of caregiving on a personal level. “Life has its own agenda,” the long-term care consultant and founder of Care Right told attendees at the FPA's annual retreat. Kruger's parents acted as her caregivers for eight months after she was hit by a school bus in 2012.

Financial advisors are uniquely positioned to relay that importance to clients, she said. But it's important to have the conversation in a timely fashion. The cost of caregiving — in dollars and in its impact on clients' health, work, family and finances — is significant, and will increase with each delay.

Advisors looking for the right opportunity to discuss long-term care planning should watch for how their clients talk about their parent or spouse, said Kruger. References to being overwhelmed or dealing with a family member’s memory loss can serve as catalysts.

“You’re a resource for your families,” she said.

There are a number of reasons advisors should be talking with clients — and clients’ children — about long term care.

IT'S GOOD FOR BUSINESS

The rise of robos pressures advisors to show their value, Kruger said. Helping clients prepare for the costly and difficult care of a parent or spouse is one way advisors can differentiate their practices, she said.

Establishing a relationship with a client's children can help insure their future business. When advisors fail to meet with their clients' children, they're more likely to lose that business in the future, Kruger said.

“If they don’t have a relationship with you, they’ll move that account,” she said.

IT'S GOOD FOR CLIENTS

Children and spouses thrust into caregiving without a plan risk burnout, said Kruger. Nearly half of caregivers said their health and well-being has suffered and — and they worked fewer hours as a result, according to 2018 data from Genworth. Nine percent have lost their job.

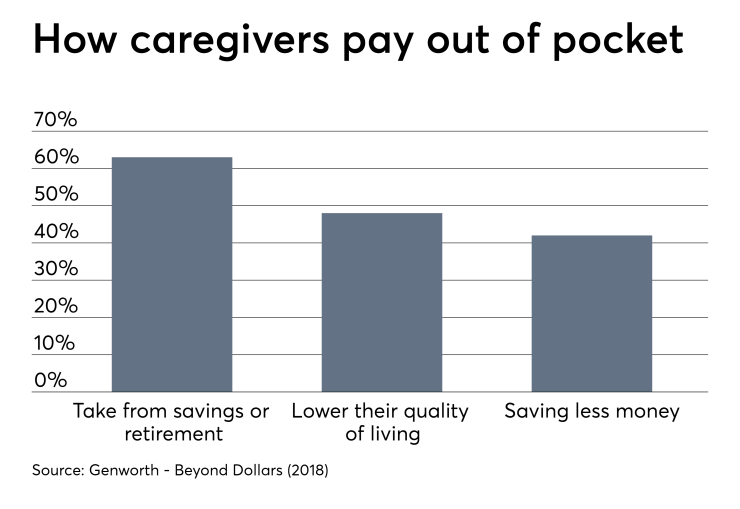

Caregiving can also take a toll on retirement: 63% of caregivers said they paid for care out of their own savings or retirement funds, the data show.

The toll disproportionately affects women, who comprise two of every three caregivers. The typical caregiver is a daughter or daughter-in-law, said Kruger, and 47% of adults ages 40 to 59 acting as caregivers are also raising children, according to a 2017 Merrill Lynch study.

Encouraging clients to plan ahead for long-term care can also save them money, said Kruger. If Medicare is not in place for a parent who suddenly needs it, caregivers may need to pay out-of-pocket, draining resources that were set aside for other expenses.

WAITING LEADS TO BAD CONSEQUENCES

Failing to prepare for long-term care creates a raft of problems. If an individual who needs care has not joined a waiting list for a facility, it may be too late to get a spot when it's needed, said Kruger.

Most nursing centers don’t even keep waiting lists for Medicaid now, she said, “because they’re miles-long”.

Children living in different parts of the country can complicate the picture because they aren’t nearby to help. Local children may come to resent their siblings as a result, she says. Kruger has witnessed the fallout of families who don’t have a plan for aging firsthand, she said.

Do not wait for a crisis to make a plan, she said to advisors. “Don’t wait for these things to happen with your families.”