Abstraction is a key tool in how humans perceive and navigate the world. We create mental models and maps of the world that help us navigate and try to make sense of our surroundings.

Abstractions are also really important for communication. At different times, different levels of abstraction are useful for effectively communicating. For instance, consider the following image:

We can abstract what this image represents at any of the following levels:

- Living organism

- Animal

- Reptile

- Snake

- Rattlesnake

- Crotalus atrox

Depending on what message one is trying to convey, any of these abstractions may be best suited for communication.

If, for instance, I just watched one of these creatures crawl into your tent, a casual warning that there’s either a ‘living organism’ (what would be a ‘low-resolution’ abstraction) or a ‘Crotalus atrox’ (a ‘high-resolution’ abstraction) in your tent would probably not be appreciated. ‘Living organism’ is far too generic to convey the potential risk of the situation and ‘Crotalus atrox’, although technically more precise than ‘rattlesnake’, is simply too technical to conjure a useful mental image for most non-herpetologists. Instead, ‘rattlesnake’ would likely be the preferred level of abstraction to warn you about what just crawled into your tent.

Even a relatively similar abstraction here — like ‘snake’ — is still considerably less insightful, since while it still does convey the particular type of reptile in the tent, we don’t know whether it is a harmless garter snake or a venomous snake that could threaten a human’s life.

There’s no single level of abstraction that is going to be ideal for all situations. Obtaining the “maximal functional utility” is going to depend on circumstances, goals, etc. Perception is a trickier issue than we often appreciate, but it is still highly important because we must first perceive the world before we can try to figure out how to act in the world.

And all of this talk of abstraction is particularly important for advisors, since one of the most valuable things advisors do for clients is explain financial matters in a manner that helps clients make good financial decisions. Which means discussing matters at the appropriate level of abstraction.

After all, in attempting to fulfill this service for clients, an advisor’s messaging could end up being abstracted at a level that is either too high or low of a resolution, resulting in lost meaning at crucial moments (e.g., “there’s a Crotalus atrox in your tent!”). Which is even more challenging when recognizing that because the right level of abstraction depends on the context (as one herpetologist explains “this specimen is a Crotalus atrox” to another), there is no ‘perfect’ level of abstraction, per se, but only an ideal level of abstraction given a particular task or decision at hand.

Accordingly, the advisor may adjust the ‘resolution’ of the messaging depending on the client’s financial knowledge and acuity. For example, clients who are deeply interested in learning the nuances of financial concepts the advisor is teaching may need more detail and information, and would thus benefit from a high-resolution abstraction (e.g., an engineering-type client that actually wants to review all plan inputs in depth). On the other hand, a client who simply wants to know just enough

Missing the boat: Monte Carlo simulation results

This largely describes the current state of how financial planning software reports Monte Carlo results. The dial and ‘probability of success’ are so prominently displayed that it provides a strong incentive for advisors to present results framed around the probability of success.

But probability of success alone does not convey enough information to have a solid understanding of Monte Carlo simulation results, as this unidimensional presentation that considers probability of success alone

As such, only telling a client their probability of success provides a very low-resolution abstraction of their overall financial plan. Worse yet, ‘probability of success’ also does not convey to clients

The ideal level of abstraction, then, is the level that provides for this sort of conceptual scaffolding and promotes a clearer understanding of a client’s situation. Current solutions (e.g., examining probability of success and/or probability of adjustment) arguably fail both advisors and clients, since even if advisors understand the shortcomings of Monte Carlo results and try to put them in context for their clients (e.g., by explaining that ‘failure’ is really more akin to ‘adjustment’, and that many plans can potentially be saved via the willingness to make modest spending cuts), they still aren’t armed with the information needed to actually explain a client’s magnitude of failure (or the magnitude of adjustments necessary to get back on track).

Hitting the sweet spot: Morningstar style boxes

The

Thinking about low- versus high-resolution abstractions within an investment portfolio context, a high-resolution abstraction might be akin to a very detailed portfolio report with many pages and tens or hundreds of different data points reported throughout. It has all of the details, ratios and other metrics you might want to know about a portfolio. This high level of detail, however, is cognitively demanding to assess.

By contrast, Morningstar Style Boxes are low-resolution abstractions. The composition of the portfolio is effectively distilled into two dimensions: size and value. Consistent with insights from the

Therefore, this style box abstraction has practical value for advisors. Furthermore, because it is a low-resolution abstraction, it is cognitively very simple to derive insights from this representation. Which in turn helps to explain why its use has been so enduring and persistent; high-quality abstractions that convey the right level of information when needed are very useful.

Of course, if our

It is probably also not a coincidence that the Morningstar Style Box captures two primary dimensions, since two-dimensional abstractions tend to be fairly easy for our minds to process and understand (other examples include

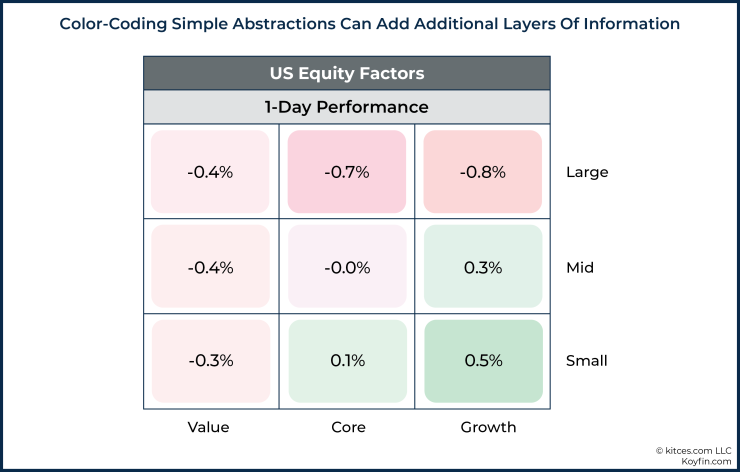

Another advantage of the style box presentation is that it can easily be modified to present additional information. For instance, Koyfin (among others) presents color-coded market returns within a style box format in a manner that quickly conveys how different segments of the market performed on a given day. The colors become the third dimension of the abstraction, adding further context but in a manner that does not overwhelm our ability to process the information.

Ultimately, the Morningstar Style Box quickly conveys information about a fund (or portfolio) across the two most important dimensions of equity investing: size and value. Extra details could be nice to know, but assuming a fund is reasonably diversified, they tell us very little.

Furthermore, abstracting at any higher of a level would leave us with too little information, as reporting just size or value alone would leave out an important piece of information. So, in the end, the ‘just right’ abstraction for practical application helps explain why Morningstar Style Boxes have been incredibly popular and broadly imitated throughout the industry.

Getting Monte Carlo abstraction just right

The

However, it is still quite unclear how these metrics should be expressed.

Likelihood of adjustment

Given the

First, note that the use of ‘likelihood’ is intentional here, if only to draw attention to the fact that perhaps something other than ‘probability’ could actually be more useful. ‘Probability’ still seems like a good candidate, but if we’re thinking outside of the box, then we probably shouldn’t commit ourselves too soon.

The key to searching for an ideal abstraction is to think about what clients ultimately want to know. Clients probably want to know something to the effect of “How likely is it that I will have to cut my spending in the future?”

From there, there are yet further considerations. Do clients want to know the likelihood that they will have to make a year-to-year cut? Do they want to know the likelihood that they will need to cut below some threshold (e.g., some predefined desirable spending level or ‘minimum acceptable’ standard of living)? Should cuts ‘count’ if they only occur after increases had pushed their spending up in the first place (such that they ‘cut’ but not below the point that they started originally)? How should we think about ‘cuts’ that were

These are by no means straightforward questions. Furthermore, any abstraction that is too hard to understand, or otherwise doesn’t quickly convey the relevant information, is unlikely to be effective to help guide client decisions. So, any abstraction that is itself too complex may be self-defeating.

Probability of adjustment

In the case where ‘probability of adjustment’ is merely just a substitute for probability of failure (or the equivalent of one — Probability of Success) that is dominant today, then by ‘adjustment’ what we are really referring to are scenarios that did run out of money and therefore should have adjusted at some point prior.

In practice, adjustment was probably prudent for many scenarios that came close to depleting assets (or otherwise dipped very low at some point) even if they subsequently recovered, so if the hope is to convey a clear picture of the likelihood that a client will need to take prudent actions to reduce spending, then perhaps we want to think about identifying ‘adjustment’ scenarios differently than those that completely run out of money (or dip below the desired legacy value).

Metrics related to actual adjustments experienced within simulated iterations are an alternative method that may be useful in thinking about likelihood of adjustment. For instance, some baseline of desired spending could be defined, and then iterations that ever dipped below that baseline could be classified as downward adjustment scenarios. This would likely convey the downward type of adjustment that is most relevant to the client. In effect, the practical question this would answer is “What is the likelihood that a client’s spending has to be adjusted down below some target threshold at any particular point during retirement?”

While our focus thus far has primarily been downward adjustment, it is worth noting that conveying information about upward adjustment may be really useful for clients as well. After all, in most scenarios, those who follow

Similar to considerations for measuring downward adjustment, actual increases experienced in simulated iterations could be a measure of upward adjustment. Alternatively, some threshold could be defined to indicate what counts as upward adjustment if we don’t want to, for instance, count increases that followed decreases and are really just a return to the original baseline (e.g., where the client cuts their spending by 10% for three years in response to a decline in the market, and then gets a subsequent spending “increase” that in practice merely gets them back to where they were in the first place).

Perhaps the simplest solution is to define a ‘planned’ income (i.e., the spending planned for each year at the time the plan is run) and measure adjustments below or above that level. Again, there are all sorts of nuanced considerations (e.g., Is it time spent above/below plan? Frequency of adjustments above/below plan? Etc.), but the key point is just that reporting simulated experiences relative to a ‘planned’ spending path would help convey to clients how likely they are to be able to spend more or less than ‘planned’ under various scenarios.

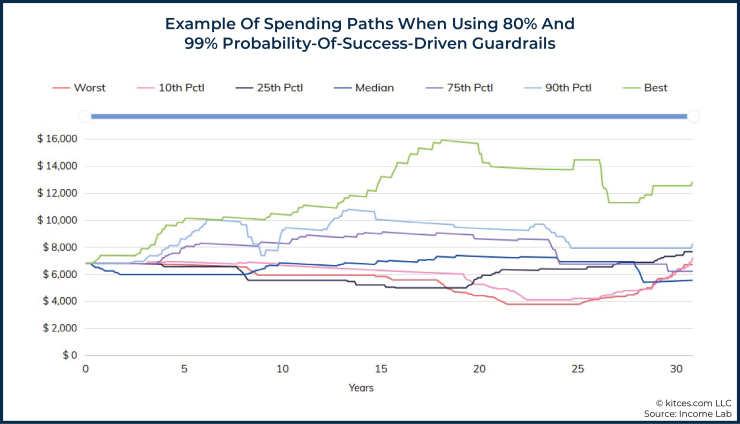

For instance, consider the graphics below, which include a ‘planned’ spending path (orange line) that is intended to decrease inflation-adjusted spending in a manner that roughly aligns with Blanchett’s retirement spending smile. We can also see a wide range of additional historical spending paths for someone who was using an 80% lower guardrail and 99% upper guardrail

As we can see in the graphics above, more scenarios were above ‘planned’ than below ‘planned’. Additionally, we can use some of the statistics from the graphic below to try to describe the outcome of the analysis (e.g., 76% of scenarios above plan versus 24% of scenarios below plan), but the key point here is not so much the metrics suggested below as it is simply acknowledging that there is a range of potential ways that we could try to describe plan results, and there’s yet to be any commonly accepted metric for reporting such results (unlike the example of the Morningstar Style Box).

One additional benefit of comparing against a ‘planned’ scenario is that the planned scenario can itself then accommodate general trends in spending (e.g.,

From an abstraction perspective, this approach also has the added benefit of being very straightforward to convey and understand (e.g., “Mr. and Mrs. Client, you indicated that you were happy with a particular spending path, and what our software is showing you now is the likelihood that you are able to spend more or less than that amount during retirement”).

Magnitude of adjustment

While the likelihood of adjustment at least has some comparable metric (probability of success) within existing financial planning software, the magnitude of adjustment is a concept that is far harder to get at with existing retirement tools.

Shortfall Risk = Probability of Shortfall * Magnitude of Shortfall

In the equation above, Probability of Shortfall is expressed similar to Probability of Failure (i.e., 1 – Probability of Success) in most Monte Carlo analyses. Magnitude of Shortfall is the amount of money one wanted to spend but could not because they ran out of money (expressed as a percentage of the initial portfolio value).

From an abstraction perspective, computing a single value of Shortfall Risk doesn’t really do much for conveying the qualitative nature of one’s prospects in retirement.

For instance, consider the following two scenarios:

In terms of computed Shortfall Risk, both of these would measure the same (i.e., Scenario A = 50% × 10% = 0.05; Scenario B = 10% × 50% = 0.05), but clearly the two scenarios are qualitatively very different.

In Scenario A, the likelihood of adjustment is fairly substantial, but that adjustment is economically quite manageable for most (“just” a 10% spending cut). In Scenario B, on the other hand, the likelihood of adjustment is much smaller, but the magnitude of the adjustment is so large that it would entail a material alteration to the retiree’s lifestyle. Representing both as the same shortfall risk (.05 in this case) is not a very useful level of abstraction.

- Scenario A: 50% probability of shortfall; 10% magnitude of shortfall (e.g., spending only has to be cut half the time, and when it is, the cut is only from $100k to $90k)

- Scenario B: 10% probability of shortfall; 50% magnitude of shortfall (e.g., spending cuts are unlikely, but if they do occur, it’s from $100k to $50k)

In terms of computed Shortfall Risk, both of these would measure the same (i.e., Scenario A = 50% × 10% = 0.05; Scenario B = 10% × 50% = 0.05), but clearly the two scenarios are qualitatively very different.

In Scenario A, the likelihood of adjustment is fairly substantial, but that adjustment is economically quite manageable for most (“just” a 10% spending cut). In Scenario B, on the other hand, the likelihood of adjustment is much smaller, but the magnitude of the adjustment is so large that it would entail a material alteration to the retiree’s lifestyle. Representing both as the same shortfall risk (.05 in this case) is not a very useful level of abstraction.

Arguably, Fullmer’s model is most insightful when the Probability of Shortfall and Magnitude of Shortfall remain as two distinct concepts. That said, so long as the software can provide the conceptual scaffolding that allows for drilling down further to investigate both components of shortfall risk, then perhaps a measure such as Shortfall Risk could work reasonably well.

After all, while the single number abstraction of Shortfall Risk doesn’t tell the whole story, so long as the Shortfall Risk is relatively low, we can reason that either (a) Probability of Shortfall is low, (b) Magnitude of Shortfall is low, or (c) the combination of (a) and (b) is low.

-

Probabilistic forecasts provide a durable framework for a sound financial future, the author says, and offers some for the new year.

January 7 -

Monte Carlo simulations can only do so much.

March 12 -

More investors can now invest in private capital markets thanks to an SEC amendment that broadens criteria beyond wealth and income, writes Sophia Duffy.

April 16

A preliminary result that grabs an advisor’s attention and concern (e.g., a high Shortfall Risk measure), could prompt drilling down further right away into the two components that comprise total shortfall risk and understand whether it’s a high probability of a moderate cut, or a low probability of a potentially more stressful (or outright catastrophic) required adjustment.

However, similar to how there are a number of different ways one might think about the likelihood of adjustment, there are additional ways to think about the magnitude of adjustment as well.

Notably, Fullmer’s Shortfall Risk approach really doesn’t convey how much spending adjustment would be needed in any practical sense. If the intent is to help individuals better understand their financial prospects in retirement (or make choices that may qualitatively influence their retirement), then a metric that better conveys the magnitude of adjustments needed to stay on track would be useful.

One approach for dealing with this particular question is summarizing the outcomes of planned versus actual spending in the various plan iterations that were considered in the analysis. For instance, summaries of the underlying iterations modeled in a Monte Carlo analysis (e.g., How much did spending increase/decrease? How frequently did spending increase/decrease? etc.) could be provided. However, again, there are many considerations for how to summarize such information. For instance, should it be average increases/decreases? Should it be the largest increases/decreases? Something else?

And furthermore, we again must consider how the baseline for measuring magnitude is defined in the first place. For example, is it relative to planned spending? Relative to year-to-year fluctuations? How do we even define triggers for modeling increases/decreases in the first place?

Ultimately, the key point is to emphasize that there are no obvious and simple answers to the questions above. There are, however, significant challenges associated with trying to find a better solution for abstracting Monte Carlo results to be understood by clients (and advisors), but the current practices of emphasizing probability of success while entirely neglecting magnitude of failure are not sufficient for delivering practical insight about one’s prospects for financial success in retirement.

It does seem fairly clear that ‘probability of success’ does not work well as the focal point. That said, the concept of probability of success may survive as an important planning metric, but just one that needs to exist as a relevant metric and not the focal point (e.g., such as the case in a

If we are looking for direct replacements to probability of success, ‘probability of adjustment’ has a number of compelling advantages, even if the two are not mathematically perfect substitutes.

We can also note that two-dimensional abstractions are generally much better than one-dimensional abstractions. With this in mind, capturing both (a) probability of adjustment and (b) magnitude of adjustment are two highly relevant dimensions that will likely be useful for identifying better abstractions of plan results.

Unfortunately, capturing relevant metrics to help broaden the discussion with clients is very difficult to do using the dominant financial planning tools of today. Moreover, even if some statistics are available, there’s going to inevitably be a period of getting better at quantifying which metrics are the most relevant that will lead to some challenges until a dominant framework emerges.

However, in the meantime, advisors may want to at least think about ways they can provide greater qualitative context to plan results. Helping clients understand the potential magnitude of changes required, or even just how reliant they are on portfolio versus guaranteed income sources (since the latter will inevitably provide a greater ‘floor’ of minimum income), could be worthwhile considerations.

Furthermore, at a higher level, advisors may want to consider to what extent Monte Carlo results should even be the focal point in the first place. While such results are likely useful for helping clients understand their potential long-term income experience (and will therefore likely always have some role to play in the planning process), arguably the focus for managing shorter-term expectations on an ongoing basis could focus much more on

However, similar to how there are a number of different ways one might think about the likelihood of adjustment, there are additional ways to think about the magnitude of adjustment as well.

Notably, Fullmer’s Shortfall Risk approach really doesn’t convey how much spending adjustment would be needed in any practical sense. If the intent is to help individuals better understand their financial prospects in retirement (or make choices that may qualitatively influence their retirement), then a metric that better conveys the magnitude of adjustments needed to stay on track would be useful.

- How much they can spend now;

- The portfolio value they would need to achieve before getting an increase in their income (plus that increase amount); and

- The portfolio value they would need to achieve before getting a decrease in their income (plus that decrease amount).

The information above is arguably highly relevant to a retiree in terms of actually managing their spending and knowing when a change is coming. For instance, if a retiree’s portfolio value is currently $1 million and they know their ‘lower guardrail’ (i.e., the guardrail that would trigger a spending decrease) is $700,000, then that retiree may have a much better understanding of where they stand financially (e.g., they may not panic when their portfolio falls to $900,000), as well as the possible consequences that might result from experiencing that level of portfolio decline (e.g., perhaps they need to cut spending by $500/month). But, notably, all of that can be conveyed without talking about probability of success at all.

In the end, the key point is to simply acknowledge that how we abstract results that we report to clients matters. The ideal level of abstraction is not self-evident and could vary by context, but it is quite clear that probability of success leaves a lot to be desired. We’re still at an early stage of figuring out what those abstractions may be, and most dominant platforms currently have quite limited ability to report anything other than the focal point of ‘probability of success’, but we as advisors should be thinking about better ways to communicate with clients and, if the current tools don’t provide that ideal level of abstraction, letting software providers know that we want more than ‘just’ probability of success.

Derek Tharp is the lead researcher at