In many large, publicly traded companies, employees are commonly rewarded with employer stock, often granted directly through a profit-sharing or employee stock ownership plan, or at least by allowing employees to purchase shares themselves inside of their 401(k) plan. Such strategies help encourage an ownership mentality among employees, who literally become small shareholders of the business. The disadvantage, however, is that when employer stock is purchased or owned inside of a retirement account, it is taxed as ordinary income when withdrawn.

But the Internal Revenue Code allows employees a special election to distribute appreciated employer stock out of an employer retirement plan, and have the net unrealized appreciation, i.e., the embedded capital gain, taxed at favorable gains rates outside of the account. This too has its caveats, but as a means of shielding clients from an undue tax bite, it can be an effective — and often overlooked — tool. Knowledge of these complex details is where advisors can play a role in helping clients.

RULES FOR NUA

The NUA rules provided a means for employers to still obtain their favorable tax treatment, and for employees to obtain theirs as well.

The NUA rules originated decades ago, at a time where employees of typically large corporations sometimes had both a pension plan and a profit-sharing plan or ESOP that gave employees bonuses in the form of company stock.

The upside of this approach was that the corporation could make a deductible contribution to the employer retirement plan, and by contributing shares the employer could obtain that tax deduction without any cash outlay. The bad news from the employee perspective was that stock — which would have been taxed favorably at long-term capital gains rates had it just been purchased and grown in the hands of the employee directly — would instead be taxed as ordinary income when coming out of the plan.

Thus, as a relief provision and tax-preference for employees to further encourage the strategy for employers, the NUA rules provided a means for employers to still obtain their favorable tax treatment, and for employees to obtain theirs as well.

Example 1. Over the years, Jenny has received annual bonuses of employer stock inside her

company profit sharing plan. The total contributions have been $105,000, and thanks to the good performance of the company stock itself, the cumulative value is now $235,000. If Jenny had simply owned the stock directly, the $130,000 of cumulative gains would have been taxed at long-term capital gains rates. However, as a standard distribution from an employer retirement plan, the entire $235,000 account balance is taxable as ordinary income — regardless of the fact it happens to be a highly appreciated stock.

Under the NUA rules though, Jenny can still be taxed on the $130,000 gain at long-term capital gains rates, even though the stock was originally purchased on her behalf inside the employer retirement plan.

REQUIREMENTS TO QUALIFY

Specifically, the NUA rules under IRC Section 402(e)(4) stipulate that if employer stock in an employer retirement plan is distributed in kind as a lump-sum distribution after a triggering event, then the cost basis of the shares will be taxable immediately as ordinary income. Further under

Notably, to meet the requirements for the NUA rules, three very specific requirements must be met:

1.) The employer stock must be distributed in kind. This means it must actually be true employer stock that is able to be transferred in kind. Selling the stock shares, transferring cash and repurchasing the shares outside the account don’t count, and

2.) The employer retirement plan must make a lump-sum distribution. In this context, a lump-sum distribution means the entire account balance of the employer retirement plan must be distributed in a single tax year. It’s important to recognize that this doesn’t just mean all the stock must be taken out of the plan; it means the entire account must be distributed. Although ultimately, it’s up to the plan participant to choose where the dollars end up. It is permissible to do an NUA distribution for just some of the account, and roll over the rest directly to an IRA, or even convert to a Roth. However, none of the money can stay in the plan past the end of that year.

3) The lump-sum distribution must be made after a triggering event. In order to be eligible for NUA treatment of an in-kind distribution of employer stock, the lump-sum distribution must be made after a triggering event, which are (a.) death, (b.) disability, (c.) separation from service or (d.) reaching age 59 ½. Notably, this means that an in-service distribution generally does not qualify for NUA treatment unless it is a distribution that also happens to occur after a triggering event, such as reaching age 59 ½.

NUA TAX TREATMENT

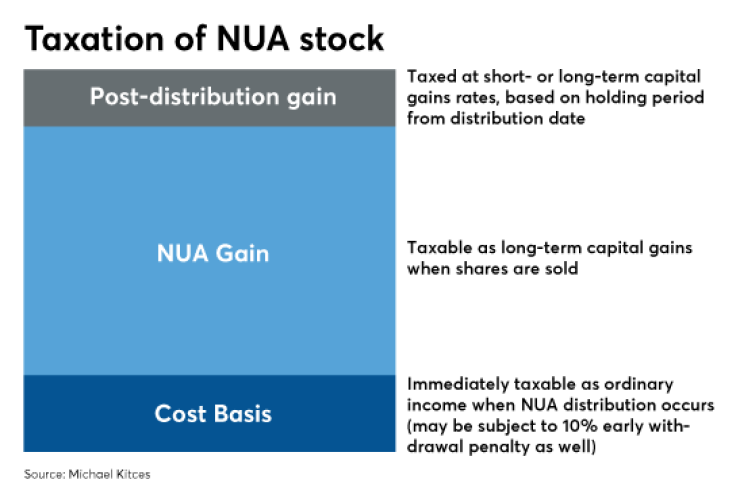

As noted earlier, when the NUA distribution occurs, the cost basis of the shares from inside the plan are immediately taxable as ordinary income, and if not otherwise eligible for an exception, the 10% early withdrawal penalty may apply as well. The actual NUA of the shares are taxable as long-term capital gains, but the capital gains tax event doesn’t occur until the shares are actually sold — although in many cases, due to a desire to diversify, the shares are sold as soon as they are distributed anyway.

If the shares are held past the distribution, any subsequent gains will be taxed at short-term or long-term capital gains rates, based on the holding period from the distribution date until the subsequent sale. If shares are held past the distribution date and losses occur, it will simply reduce the amount of net unrealized appreciation gain reported on the sale — although if losses cause the price to fall all the way down below the original cost basis, a capital loss can be claimed.

Because there’s no particular requirement that the NUA stock be sold immediately — though it often is for diversification purposes, but could be held for months, years or even decades thereafter — the NUA gains may be deferred for an extended period of time. Only the original cost basis of the shares inside the plan is taxable at the time of distribution. Although notably, the NUA gain will eventually be taxed, as it is not eligible for a step-up in basis at death (under

It’s entirely permissible to take just the NUA stock as an in-kind distribution, and roll over the rest to an IRA.

A key point of the NUA rules is that while the lump-sum distribution requirement necessitates that the entire account be emptied, there is no requirement that it all be distributed in a taxable event. It’s entirely permissible to take just the NUA stock as an in-kind distribution, and roll over the rest to an IRA.

Example 2. Continuing the prior example, Jenny decides to take advantage of the NUA rules, which includes both the $235,000 of employer stock with a cost basis of $105,000, and also some mutual funds worth $80,000. In order to comply with the NUA rules, Jenny must distribute the entire $315,000 from the plan in a single tax year after a triggering event has occurred — which in Jenny’s case is the year she retires, and therefore separates from service. Since Jenny only wants to do an NUA distribution of employer stock — and doesn’t want to liquidate her entire employer retirement plan in a taxable event — she can choose to take the $235,000 of employer stock in kind and roll over the other $80,000 to an IRA.

In doing so, the $105,000 cost basis will be taxable immediately as ordinary income, the $130,000 of gain on the stock will be taxable at long-term capital gains rates when sold, and the $80,000 IRA rollover will simply be taxed whenever distributions are made from that IRA under the standard rules for IRA distributions.

Furthermore, it’s also permissible to cherry-pick which shares of stock to distribute in kind, and roll over the rest — as long as the individual stock shares were earmarked for a particular employee’s account in the first place, under

Example 3. Continuing the prior example, it turns out that among Jenny’s $235,000 of employer stock shares, the first $100,000 purchased in the early years have a cost basis of only $10,000, representing a gain of $90,000, while the other $135,000 of shares purchased more recently had a cost basis of $95,000, representing a gain of only $40,000, because the company recently hadn’t performed as well. As a result, Jenny decides to do an NUA distribution for just the first $100,000 of shares with a cost basis of $10,000, and roll over to her IRA both the other $135,000 of employer stock and the other $80,000 of IRA assets. That’s because everything must leave the employer retirement plan to meet the lump-sum distribution requirement.

The end result is that Jenny reports only $10,000 in ordinary income — that is, the cost basis of the NUA shares distributed in kind — will have a $90,000 long-term capital gain when the NUA shares are sold, and finishes with $80,000 + $135,000 = $215,000 in a rollover IRA.

Given the favorable treatment available for an NUA distribution — turning a gain that would have been taxed as ordinary income from an employer retirement plan or IRA into a long-term capital gain taxed at preferential rates — it might seem odd to ever cherry-pick some lower-cost-basis shares for an in-kind NUA distribution, but not the rest of the higher-cost-basis shares. However, the relative amount of cost basis to gain for employer stock shares inside an employer retirement plan is actually crucial to determining whether an NUA distribution is actually a winning strategy or not.

DISTRIBUTION PROBLEMS

The fundamental challenge to the NUA distribution is that it immediately triggers ordinary income taxation on the cost basis of the employer stock, which means the decision to distribute stock in kind immediately forfeits to Uncle Sam a portion of the account that otherwise could have remained tax-deferred.

In addition, the subsequent liquidation of the employer stock itself triggers a second tax event, on the NUA gain. While the benefit of the NUA rules is that the gain is at least taxed at preferable long-term capital gains rates, it is again a tax event that, if rolled over, might not have occurred until many years or even decades into the future. This means that the faster the stock is sold — i.e., the more quickly the owner wants to sell and diversify — the more long-term tax-deferral is forfeited. And of course, from that point forward, any future dividends, interest and capital gains generated by the reinvested proceeds will also be fully taxable.

By contrast, simply rolling over the entire employer retirement plan to an IRA and diversifying is not a taxable event. And in a world where retirees often take no more than 4% to 5% of the annual account balance in distributions — and even RMDs begin at only 3.6% of the account balance at age 70 ½ — the value of the stock might have remained growing tax-deferred for literally decades. Or, if left as a stretch IRA for the next generation, it might have kept growing even longer.

In other words, the NUA strategy is not merely an opportunity for free tax savings — i.e., by turning what would be an ordinary income distribution from a retirement account into capital gains treatment on the NUA gain. Instead, it’s more of a trade-off: a decision to pay taxes sooner, at a blend of ordinary income rates on the cost basis immediately and long-term capital gains on the NUA gain when liquidated, rather than pay all ordinary income at what might have been a much later point in time.

As a result, it’s especially important to look carefully at how much net unrealized appreciation there really is in the first place.

Example 4. Jeremy is 60 and has $250,000 of employer stock that was bought inside the plan for $140,000, which means it is cumulatively up about 78%, and the cost basis is effectively 56 cents on the dollar. The $110,000 gain being taxed at 15% instead of an assumed ordinary income rate of 25% in the future produces a prospective $11,000 tax savings. However, a rollover allows all $250,000 to remain invested, while an NUA distribution triggers 25% gains now on the $140,000 cost basis, plus the 15% tax liability on the $110,000 gain, for a total tax impact of $51,500. Thus, the trade-off is really $250,000 in a tax-deferred account subject to ordinary income in the future, or just $198,500 to reinvest in a taxable account, having lopped off just over 20% for immediate taxes.

Of course, if the $250,000 IRA were liquidated at ordinary income tax rates, it would be worth only $187,500, and the taxable account is still ahead by $11,000, thanks to the tax savings on the NUA distribution. However, until it’s actually liquidated, the $250,000 IRA can continue to grow tax-deferred, while the $198,500 has already been taxed, and going forward will continue to be annually taxable.

Accordingly, we can analyze the long-term impact and after-tax value of each strategy in the above example over time. Assuming a moderate 7% growth rate and that the IRA will be taxed at 25% in the future with RMDs beginning at age 70 ½, compared to a 5.95% after-tax growth rate in the brokerage account — assuming a 15% rate on qualified dividends and long-term capital gains — we find that it only takes about six years for the NUA strategy to fall slightly behind. And after several decades, the NUA strategy lags dramatically.

Notably, this example generously assumes that the lump-sum income from the NUA distribution stays in the 25% tax bracket, when in reality if all $140,000 of cost basis is taxable at once, some of it would at least bleed into the 28% bracket. Also, it’s assumed that the brokerage account has no short-term capital gains or bonds yielding ordinary interest at higher tax rates, which would make the blended rate a bit higher than 15% and cause the NUA strategy to lag even further.

Nonetheless, as the results show, while the NUA strategy is appealing in the near term, over the long run the lost growth opportunity on the taxes paid sooner rather than later — both on the cost basis of the NUA stock and the capital gains taxes on the actual NUA gain — is quite damaging. Even for a stock that was up 78%, the NUA distribution quickly falls behind, and dramatically so by the end. And of course, if there was actually money left over, that IRA could have been stretched even further to the next generation — allowing the compounding to continue even further — or alternatively could have been opportunistically

FINDING BALANCE

For very long-term employees, employer stock shares might not just be up 78%, as was the case in Example 4 above, but several hundred percent, or even 1,000%.

For instance, a long-term employee at IBM for the past 40 years would have split-adjusted shares with a cost basis of just 10 cents on the dollar — a split-adjusted share price of about $17/share in 1977, versus over $170/share today — for a gain of about 900%. An investor at Altria (formerly known as Phillip Morris, and now also the owner of Kraft and Nabisco Foods) since 1977 has a split-adjusted cost basis of about $0.30, which means with the stock now around $71/share, it is up more than 23,500% in 40 years. Viewed another way, the cost basis is less than half a penny per $1 of share price.

In the case of Altria, this means that even $1 million of stock at current value that is eligible for NUA would face ordinary income of only about $4,000 and a tax bill of just $1,000 at a 25% tax rate, with the entire $996,000 remainder taxed at long-term capital gains rates, which would likely be at a blended rate of 15% and 20%, given a gain of that size. And a softer tax hit on NUA liquidation means more dollars that can be reinvested, which in turn means it would take longer for a mere IRA rollover to be more appealing.

In other words, the size of the cost basis relative to the total value of the stock is a key determinant in the NUA trade-off, as a lower cost basis means a lower ordinary income tax hit, which in turn reduces the overall upfront tax impact and makes the NUA strategy more appealing.

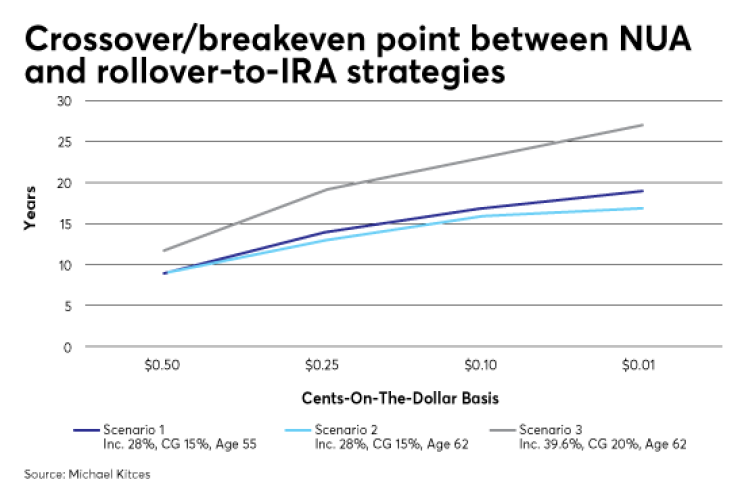

The chart below examines how long it takes for the IRA rollover and its tax-deferred compounding growth to overtake the NUA distribution, at various levels of appreciation and assuming different tax/age scenarios. Notably, among the scenarios considered, the crossover point between NUA and rollover-to-IRA strategies with a cost basis of 50 cents on the dollar ranged from nine to 12 years, depending on assumptions, while at just 25 cents on the dollar and down to only one cent on the dollar, the crossover point ranged from 13 to 19 years and 17 to 27 years, respectively.

As the results reveal, the NUA distribution really does work better as the cost basis of the NUA distribution decreases, with the breakeven point approaching or reaching past normal life expectancy in the lower cost basis scenarios. NUA strategies are also more appealing as a retiree’s age increases, which both reduces the deferral time available until RMDs need to be taken — as RMDs reduce the value of the rollover — and reduces the likelihood of living long enough for the IRA to overtake the NUA distribution. Given the time horizon is more limited, the more immediate tax savings of the NUA rules are favorable.

Of course, it’s still important to recognize that for especially large NUA positions, the gain may be so sizeable that the capital gains rate is higher than 15% — for instance, if some of the gain pops up into the 20% bracket. This in turn makes the NUA less valuable. Similarly, even with a small cost basis, a very sizable stock position could drive up the ordinary income tax rate on the cost basis. For instance, even at 10 cents on the dollar of cost basis, a $1 million employer stock position would generate $100,000 of ordinary income, which is potentially enough

And because the trade-off is the upfront tax hit at lower rates in exchange for tax deferral, the higher the overall tax impact up front, the harder it is to recover. This can include the impact of state taxes, which apply equally to ordinary income and capital gains. In fact, even though the IRA is ultimately taxed at higher rates later, the higher upfront tax burden can still be enough to bring the breakeven point even closer — where it’s better to simply roll over to the IRA and skip the NUA strategy.

By contrast though, if the individual can actually hold the stock rather than sell it — for instance, if there’s not a pressing need to liquidate and diversify after the NUA distribution — the decision to hold defers the NUA capital gain, and can greatly improve the long-term outcome. However, as a study by

BEST PRACTICES

Fortunately, the NUA distribution strategy is a choice, not an obligation or a requirement. In other words, the investor doesn’t have to do it, and even if he/she does, the NUA strategy doesn’t have to be executed with all of the stock. As long as there are records to identify the share lots in the first place, and those lots were assigned to an individual employee’s account, it’s permissible to cherry-pick them, whether from a profit-sharing plan or ESOP. This means that it often will be worthwhile to delve through the historical purchase transactions just to identify which lot(s) may be appealing for NUA.

Fortunately, the NUA distribution strategy is a choice, not an obligation or a requirement.

One straightforward approach is simply to set a cost basis threshold — for instance, don’t do NUA for any stock with basis more than 20 cents on the dollar. So if the company currently trades for $80/share, only do NUA on the shares with cost basis of $16 or less, and roll over the remaining shares to an IRA, along with anything else in the employer retirement plan, per the lump-sum distribution requirement.

And for those who want to liquidate the stock after distribution but spread out the tax impact, it may be feasible to do the NUA distribution — triggering taxes on the cost basis — late in one tax year, and then complete the subsequent sale with long-term capital gains rates on the NUA gain early in the subsequent tax year. It might even be worth hedging the risk during the intervening period with a short-term put option. And notably, the NUA gain may even be eligible for the

However, it is still important to ensure full compliance with the rules. This means not forgetting that the NUA distribution has to be a full lump-sum distribution in that year, where the end-of-year account balance must read zero. The retiree can roll what he/she doesn’t want to NUA distribute, but it all must leave the account. In addition, an NUA distribution can only occur after a triggering event, which means it’s necessary to wait until a triggering event occurs, and it’s important that when any distribution occurs after the triggering event, that must be the year for the NUA distribution. Otherwise, the opportunity is lost until the next triggering event.

Example 5. Sheila retired from her employer at age 56 in early 2016, after spending 30 years with the company. She has a 401(k) plan with profit-sharing and a total account balance of $1.2 million, including $400,000 of employer stock with a cost basis of $45,000. During the summer of 2016 after she retired, Sheila took a $10,000 distribution for an around-the-world trip to celebrate her retirement, which she was able to do without any early withdrawal penalties thanks to the rule allowing retirees who separate from service after age 55 to take a distribution from their employer retirement plan. In 2017, she sits down with an advisor to plan her retirement, and explore the NUA distribution strategy for the $400,000 of employer stock.

However, Sheila’s retirement was her triggering event, and her distribution in the summer of 2016 meant that was her first distribution year after a triggering event. And she did not do a lump-sum distribution or any in-kind distribution of employer stock that year. As a result, any attempt to do an NUA distribution in 2017 will not qualify, as it will no longer be a lump-sum distribution after a triggering event since a non-lump-sum distribution already occurred after the triggering event. Thus, Sheila will not be eligible for an NUA distribution.

Fortunately though, because the triggering events include death, disability, separation from service and reaching age 59 ½, Sheila will have a second chance for an NUA distribution in 2019, once she actually turns 59 ½, and can take advantage of the NUA rules then. That’s only as long as she makes certain that once she does take a distribution after age 59 ½, that is the year she does a full lump-sum distribution and takes the employer stock in kind.

Notably, if Sheila had separated from service after age 59 ½ — meaning the separation-from-service and age-59 ½ triggering events would have passed, and the disability trigger being a moot point once retired — then the NUA strategy would be totally lost to her, and the only opportunity would be for her heirs to do an NUA distribution from the inherited employer retirement plan, given death is a triggering event too. That would, however, require her to keep the employer retirement plan and hold the stock without using it until the day she dies — which may not be feasible due to both investment risk and her retirement income needs.

It’s also notable that the NUA strategy may be appealing for those who separate from service prior to age 59 ½, even if they’re not eligible for the age-55 exception to the early withdrawal penalty.

For instance, a 52-year-old who separates from service can still do an NUA distribution. The cost basis of the shares will be subject to ordinary income taxes, plus the 10% early withdrawal penalty. However, if the cost basis is low enough, the penalty may be so small that the NUA strategy is still worthwhile for the overall tax savings. And once the shares are distributed from the account, they’re freely available to use — unlike with an IRA rollover, where all of the retirement account would still face the early withdrawal penalty, with only more limited exceptions such as 72(t) being substantially equal periodic payments.

Example 6. Charlie retired from his company at age 52, with an ESOP holding nearly $650,000 of employer stock, which had an internal cost basis of just $45,000. Charlie decides to do an NUA distribution of his ESOP shares, even though the distribution will subject him to the early withdrawal penalty, because he doesn’t want to wait until age 59 ½ to diversify his concentrated stock position. However, since the cost basis is only $45,000, the early withdrawal penalty will only be 10% of that amount, or $4,500, which is a mere 0.7% of the value of the stock — a cost that Charlie decides is quite worthwhile to diversify and still otherwise take advantage of the NUA rules. And going forward, Charlie has access to the entire $650,000 of employer stock, without needing to worry about further early withdrawal penalties.

On the other hand, it’s also important to recognize that it is an option to do the NUA distribution and keep the employer stock. Doing so allows the NUA gain to be deferred, and if the cost basis is low enough, the immediate tax impact on just the cost basis may be small or negligible.

Clearly, holding a concentrated stock position just to defer taxes can be risky from an investment perspective, and also may not be feasible simply due to a need to use the asset for retirement income purposes.

Nonetheless, in scenarios where the employer stock actually is a small portion of the retiree’s total net worth, or where the risk of the stock can be reasonably hedged — e.g., with put options — continuing to hold the stock may be both economically feasible and still reasonable from an investment perspective as a modest portion of the overall portfolio, while also allowing the retiree to reap the tax benefits of the NUA strategy by still enjoying the preferential capital gains tax rate on the NUA gain in the future, but being able to defer it. In addition, stock held in a brokerage account can also be margined — unlike in an IRA, which cannot be loaned against — providing a securities-based lending option for further liquidity without actually selling the stock.

Conversely, for those who need to diversify, who don’t need the liquidity outside of a retirement account, and who truly don’t want to absorb the immediate tax impact, it’s always an option to simply roll over the employer stock to an IRA, and sell and diversify there without any immediate tax consequences, while continuing to enjoy subsequent tax-deferred growth.

One of the biggest caveats of the Specifically, the NUA rules under strategy is simply recognizing that cost basis inside an employer retirement plan actually matters. Given that employer retirement plans and rollover IRAs are taxable on all distributions as ordinary income, basis costs of stock inside the accounts are normally ignored. But it matters in the case of a potential NUA distribution, and can have substantial consequences for those who don’t bear it in mind while managing their employer retirement plan.

Example 7. Johnny had worked at his company for almost 40 years, and collectively had $900,000 of employer stock with an original cost basis of just $120,000. In the financial crisis though, the valuation of the company crashed by 40%, and rumors abounded that the company could even go under, despite its decades of success. To avoid the risk, Johnny had sold the stock back then at $550,000. Once the rumors passed, he had bought back in at $600,000, only causing limited damage due to bad market timing, and allowing his shares to recover to their current $900,000 value.

However, because Johnny sold the stock inside the plan and bought it back, the transaction reset his cost basis on all the shares to $600,000, the value on the day he re-purchased. As a result, his old cost basis of $120,000 was completely overwritten, eliminating the value and potential benefit of the NUA strategy now that he is preparing for retirement.

It ultimately remains to be seen how long the NUA strategy will remain available. President Obama’s budget proposals in 2015 and 2016 characterized it as a

As long as it’s still around, it remains an appealing strategy. Any potential excitement, however, must be met with equal caution when weighing the NUA rules, as there’s still a real trade-off to consider given the upfront tax impact versus being able to defer taxes until later, tempered by how quickly the investor does or doesn’t want to keep the stock in the first place.

So what do you think? Are the downsides of NUA distribution strategies often overlooked? How do you help clients evaluate NUA strategies? Are NUA strategies a tax loophole that will be closed in the future? Please share your thoughts in the comments below.