Despite occasional swoons amid numerous warnings that “trees don’t grow to the sky,” the aging bull market continues to press on. From March 9, 2009 through August 31 of this year, the S&P 500 produced an annualized return of 19.1% (including dividends), according to a recent report from S&P Dow Jones Indices.

The index shop noted that, on the same basis, mid-cap (20.5%) and small-cap (22.4%) benchmarks did even better.

Advisors who position their clients in total market ETFs get some benefit from the performance of smaller issues. But in all capitalization-weighted funds, the smaller stocks remain a minor factor. For example, in the Vanguard Total Stock Market ETF (VTI, expense ratio: 0.04%), the 10 largest holdings are more than 18% of the portfolio weight. And that’s in a fund of more than 3,600 stocks.

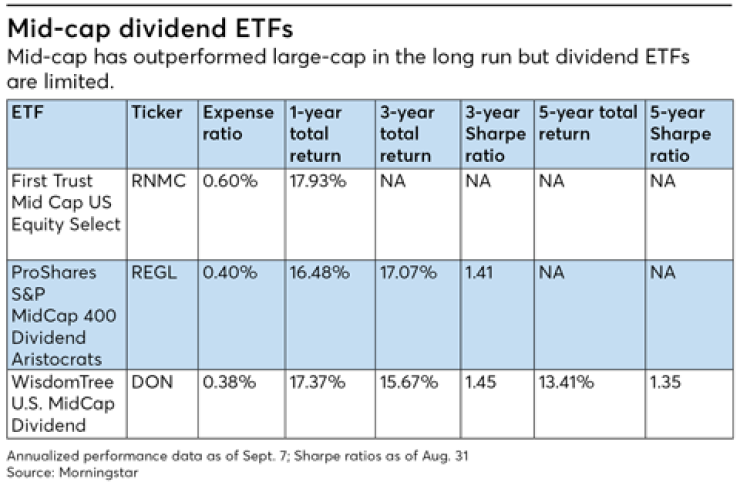

You can add smaller-capitalization emphasis by including mid-cap and small-cap ETFs to the mix, but if you also want a dividend focus, choices are limited. Next month, we’ll look at small-cap dividend ETFs, but now, here’s a look at the three mid-cap ETFs that feature dividend-paying stocks:

First Trust Mid Cap US Equity Select (RNMC, 0.60%) is the newest of the dividend-based mid-cap ETFs. Launched in June 2017, RNMC is based on the Nasdaq Riskalyze US Mid Cap Index and holds 370 stocks. Index components must be members of the Nasdaq US 600 Mid Cap Index and must have paid a dividend in the trailing 12 months. Sector weights are equal to those in the Nasdaq US 600. Within sectors, stocks are equally weighted. First Trust’s website listed the top sectors in early September as financials (16.8%), industrials (16.4%), and consumer discretionary (15.5%).

Morningstar projects the forward dividend yield of the ETF at 2.28%. For the 12 months ended Sept. 7, RNMC had a total return of 17.93%.

ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL, 0.40%) holds 50 issues from the S&P MidCap 400 that have increased their dividend payments for at least 15 years in a row. It is the only one of the mid-cap dividend portfolios that requires dividend growth.

The fund must contain a minimum of 40 stocks. If fewer than 40 issues qualify, the underlying index can include companies with shorter dividend growth histories. Stocks are equally weighted. Top sectors are financials (26.2%), utilities (17.5%) and industrials (14.5%). A sector may not exceed 30% of the index’s weight. Morningstar sees the portfolio’s forward dividend yield at 2.10%.

For the year ended Sept. 7, total return for REGL was 16.48%.

WisdomTree U.S. MidCap Dividend Fund (DON, expense ratio 0.38%) is the oldest of the mid-cap dividend ETFs, having been launched in June 2006. The fund contains 395 positions weighted by each stock’s percentage of the regular cash dividends expected to be paid by all the companies in the index in the coming year.

WisdomTree starts by eliminating the 300 largest-cap stocks in its base index of all domestic dividend payers. Issues that constitute the top 75% of the remaining market capitalization are included in MidCap Dividend portfolio. Consumer discretionary (22%), real estate (16.1%), and industrials (15.1%) are the three top sectors. Morningstar expects that the forward dividend yield for DON will be 3.02%.

Through Sept. 7, the ETF had a 12-month total return of 17.37%.

Although the First Trust portfolio is off to a strong start, many advisors will consider its short trading history and higher expense ratio as reasons to avoid this ETF. In choosing between REGL and DON, performance, risk, and cost are similar. If you prefer dividend growth, REGL might be for you. Those seeking broader diversification will give strong consideration to DON.