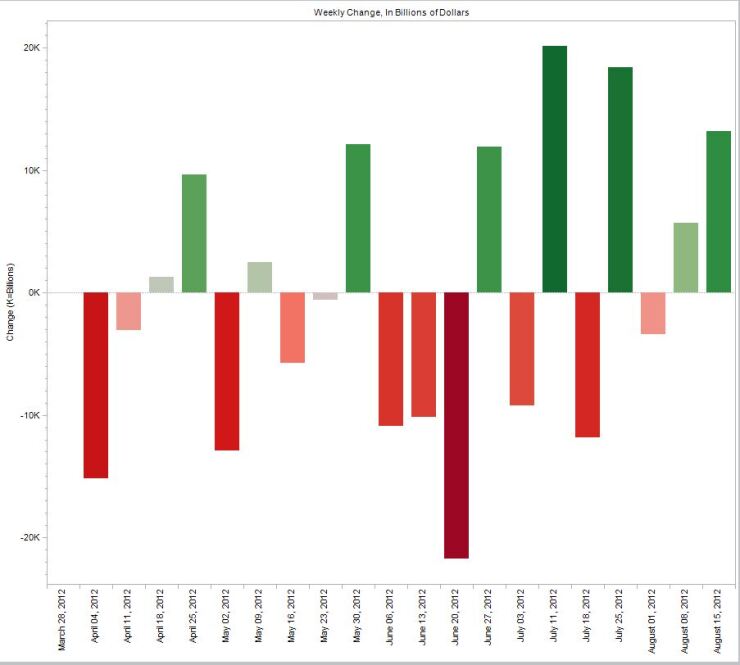

Assets of institutional money market funds increased by $13.17B to $1.68T in the week ended Aug. 15, the third largest inflow of institutional money since the end of March.

Among institutional funds, taxable non-government money market fund assets increased by $6.80B to $915.71B, taxable government money market fund assets decreased by $6.61B to $687.40B, and tax-exempt fund assets decreased by $240M to $83.91B, according to the Investment Company Institute.

Retail assets declined by $1.4B to $886.55B, the ICI said.

The notable institutional inflow occurs as the Securities and Exchange Commission considers requiring money funds to allow their net-asset values to float rather than remain fixed at $1 per share, or set aside capital to protect against losses while holding back a portion of shareholders’ cash for 30 days when they seek to withdraw all of their money.

The agency has reportedly set a public vote for Aug. 29 on the matter. An SEC spokeswoman declined to comment.