Should its E-Trade deal go through, Morgan Stanley will have purchased almost 3 million new leads it hopes to turn into wealth management clients — and bought itself a seat as a major player in the stock plan administration business.

Similar to its competitors, the wirehouse is readying itself to take on every portion of a client’s financial needs — and wallet.

With the purchase of E-Trade, Morgan Stanley is delving into the discount brokerage, custody and digital banking business. It’s also on track to gain a significant foothold in the stock plan administration business.

“We have all the tools and capabilities to support the entire spectrum of wealth management customers,” Jonathan Pruzan, CFO Morgan Stanley, said during a Credit Suisse investor presentation Thursday.

In just 12 months, Morgan Stanley has made moves to purchase two of largest stock plan administration software companies — E-Trade, which includes its Equity Edge Online software, and

“It does make them a very, very dominant player in this space,” says Barbara Baksa, executive director at NASPP, an association for professionals who oversee company stock plans. She was also manager of educational programs at E-Trade’s stock plan administration division for six years.

Morgan Stanley’s goal is to turn these employee plan accounts into brokerage clients, something it has struggled with in years past, according to

Of course, it faces competition from other players. Certent and Global Shares, for example, offer their own software as a service technology, which allows corporate sponsors to internally handle things like planning, tracking and sharing equity performance results with employees.

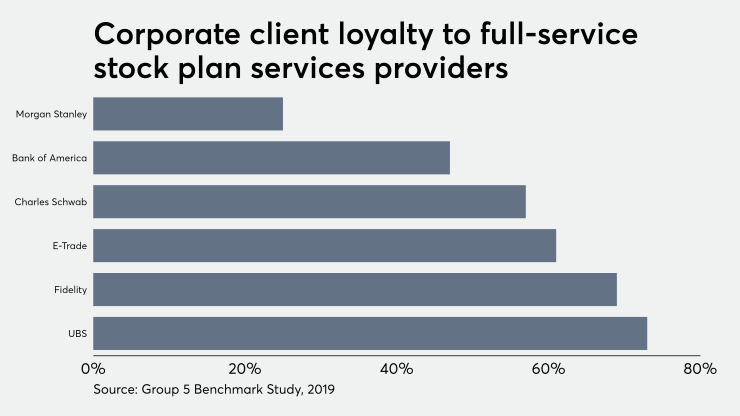

Companies like UBS, Bank of America, Schwab and Fidelity are key providers of outsourced solutions, according to the most recent stock plan administration benchmark

Last year, UBS achieved the top scores in terms of customer loyalty, overall client satisfaction and support. Fidelity ranked second in loyalty and satisfaction, and tied for second with Schwab in support.

Consolidation has been shrinking the market — particularly so since discount brokerages dropped trading commissions on equities

“It’s a fairly significant loss of revenue,” he says.

After the commission changes, E-Trade estimated its annual revenue would shrink by approximately

Schwab, which ignited the commission price war in October, made its plans to purchase TD Ameritrade soon after. Both companies offer their own outsource stock plan administration solutions.

Partnerships are also abundant. TD Ameritrade worked with the stock plan software companies

As the market shifts, so does the value proposition. Similar to custodians, which are

E-Trade

Companies are also working to consolidate the employee’s financial picture into one single location, whether its their company equity, 401(k) plan or HSA, according to Alden.

For wealth management or brokerage firms, these moves can help capture more wallet share of clients — a strategy of which Morgan Stanley’s Gorman has

Right now, E-Trade is capturing about 10% of its clients’ wallet, according to a

Wirehouses generally operate their stock plan services divisions with their wealth management units in mind, Alden says.

“Education for participants will be done by a local financial advisor with the firm,” he says. Discount brokerages will also send out representatives, but typically not advisors.

After its purchase of E-Trade, Morgan Stanley will have two stock plan services software platforms — E-Trade’s Equity Edge Online and Shareworks, which is the rebranded Solium software.

“It will be interesting to see whether they keep them both alive or try to merge them,” Alden says, adding that they are robust and user-friendly, but share similar functions.

While Alden was confident that consolidation was enhancing the end participant’s experience, and incentivizing firms to provide more services, Baksa was more skeptical.

“The more consolidation you see — and I think this goes for almost any market — that means that there are fewer choices for customers, and they may not get the level of service that they were hoping for,” she says. “On the other hand, it does mean that Morgan Stanley has a lot more resources at their disposal.”