The writing was already on the wall for Charles Schwab, which yesterday zeroed-out trading costs for ETFs and U.S. stocks on its platform.

“It has seemed inevitable that commissions would head towards zero, so why wait?” Peter Crawford, the San Francisco-based retail brokerage and custodian’s CFO, said in a commentary posted to the firm’s website.

It took approximately eight hours for competitor TD Ameritrade to replicate the announcement — and try to one-up the firm by saying it will roll out its new offer by Oct. 3 — four days ahead of Schwab.

Other custodians will have no choice but to follow Schwab’s lead, says Matt Cooper, president of RIA Beacon Pointe Advisors, which custodies at both Schwab Advisor Services and TD Ameritrade Institutional.

“The last thing a custodian wants is enormous flows to another custodian because of a trading price spread,” says Cooper. “That would be a really bad thing mid and long term.”

TD Ameritrade’s stock price fell after Schwab made its announcement — down nearly 26% at close on Tuesday. Schwab's stock price was down 5% at close. A TD Ameritrade spokesman declined to comment on whether its move was a response to Schwab’s.

After 12 hours in which two industry giants that collectively custody assets for over 14,500 RIAs both dropped commissions, advisors are naturally wondering who will be next.

“Fidelity will almost certainly follow any day now — or minute,” Cooper says. "My guess is they have all had this modeled out for a while."

Wei Ke, a managing partner at pricing consultancy Simon-Kucher & Partners, agrees. “Fidelity was making headlines already with no-fee ETFs, following Vanguard,” he said in an email. “They are known to be very aggressive in their pricing strategy in recent years to squeeze out competition. In this case, they are not a leader in moving to $0, but could be a fast follower.”

“The value offered at Fidelity is unmatched and we will always look for ways to leverage our scale to deliver even more value,” said a Fidelity spokeswoman. “Our customers benefit from industry-best order execution and price improvement, the industry’s lowest index mutual fund expense ratios, more than 500 commission-free ETFs, an award-winning brokerage platform, and access to choice on our cash sweep offering.”

It’s unclear whether Pershing, whose model serves both broker-dealers and RIAs and offers no retail brokerage, will follow suit.

A spokeswoman at Pershing didn’t comment on whether or not they were considering dropping commissions. In an email, she said, “We constantly evaluate our pricing schedule in light of the trends in the industry, which are moving more toward transparency, unbundling fees, acting in the best interests of investors, and a fiduciary standard. Our goal is — and will always be — to provide our clients with an open platform that offers one of the broadest product choices in the industry so they can best meet investors’ needs.”

MILLION-DOLLAR PRICE TAGS

TD Ameritrade and Schwab have acknowledged that this move comes with a revenue cut — a price tag of hundreds of millions of dollars.

“We expect this decision to have a revenue impact of approximately $220 to $240 million per quarter, or approximately 15% to 16% of net revenues,” Steve Boyle, TD Ameritrade’s CFO, said in a statement.

Schwab will also see a cut in revenue, albeit less than half of TD Ameritrade’s.

“We estimate that this pricing reduction is equivalent to approximately $90 million to $100 million in quarterly revenue, which roughly translates to 3% to 4% of total net revenue,” Schwab’s Crawford said in the commentary.

An analyst at William Blair wrote in an equity research report Wednesday that the lack of commissions could cut 9% from his firm’s net income estimate of Schwab — and 32% to 35% from TD Ameritrade’s net income.

“We expect [TD Ameritrade] management to make some cost reductions,” wrote Chris Shutler, “but it is hard to see how those reductions would be a major offset, especially since management has historically run a tight ship.”

TD Ameritrade and Schwab made statements that their moves will make them more competitive in the market.

But if competition follows, the two large custodians may not find the moves to be the long-haul generator of assets they are hoping for. While it’s possible that zero commissions could lead to a spike in trading volume, “it’s temporary as most big competitors of theirs are probably going to follow suit very quickly, thereby restoring market equilibrium,” Ke said.

Shutler echoed the sentiment in his report. “We would expect most e-brokers to migrate to zero or near-zero commissions quite soon, mitigating any market share gains from e-broker peers,” he wrote, noting there would be temporary benefit.

“We are seeing new firms trying to enter our market — using zero or low equity commissions as a lever,” Crawford said in the commentary. “We’re not feeling competitive pressure from these firms … yet. But we don’t want to fall into the trap that a myriad of other firms in a variety of industries have fallen into and wait too long to respond to new entrants.”

On the retail brokerage side, Interactive Brokers announced it would go commission-free at the end of September. The firm has not yet determined whether it will extend the offer to the clients of the RIAs on its custody platform, according to a spokeswoman.

Investment app Robinhood, which has has $862 million in funding, according to Crunchbase, has been doing commission-free trading since it launched in 2013.

There’s a brand new, technology-focused entrant on the custodial side. Altruist — which was launched in beta last month by Jason Wenk — doesn’t charge commissions on ETFs, mutual funds and equities.

Wenk aimed to have 50 advisors collectively managing about $1 billion in assets on the Altruist’s beta platform. "We hit that in less than five minutes,” he told Financial Planning in September, noting that it will take the firm months to onboard all the advisors on the waitlist.

COMMISSIONS IN THE SPOTLIGHT

Schwab and TD Ameritrade’s commission cuts are indicative of how custodial and brokerage pricing models have shifted over time. Commissions aren’t the revenue driver they once were:

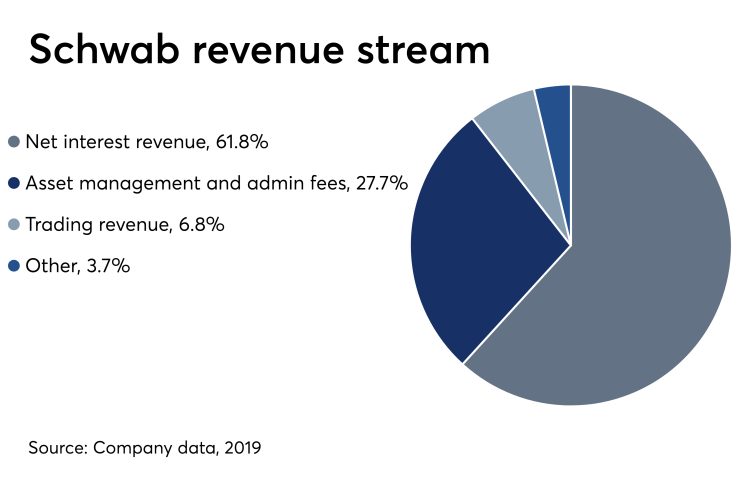

While they made up 50% to 60% of total revenue in the early 1990s at Schwab, it only equated to 8% of the company’s annual revenue in both 2017 and 2018, according to company reports.

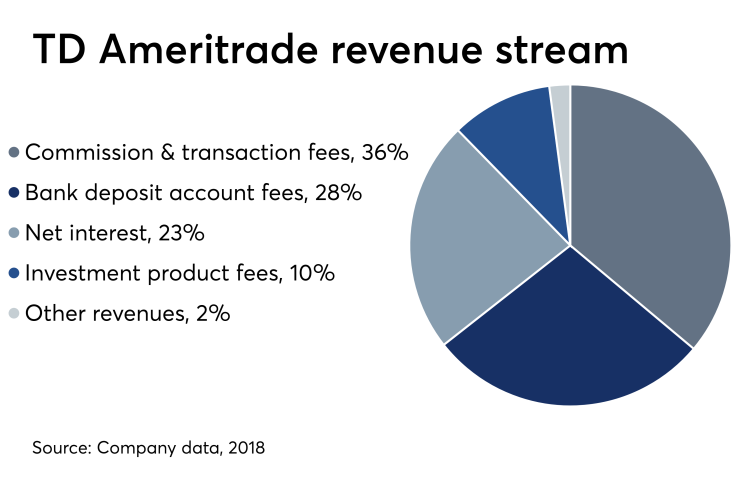

Commissions still matter — especially at TD Ameritrade. About 36%, or almost $2 billion, of the custodian and retail brokerage’s annual revenue at TD Ameritrade comes from both commissions and transaction fees, according to its report. (The firm did not respond to a query about whether it would also cut transaction fees for mutual fund trading.)

Today’s growing revenue driver for many custodians and brokerages is cash. Interest revenue is the biggest revenue driver, by far, at Schwab, making up 57% of the firm’s net revenue and generated nearly $5.8 billion in net revenue for the firm in 2018. As for TD Ameritrade, about 26% of its net revenue comes from cash arrangements with TD Bank, which owns approximately 42% of TD Ameritrade’s common stock, according to the company’s 2018 annual report.

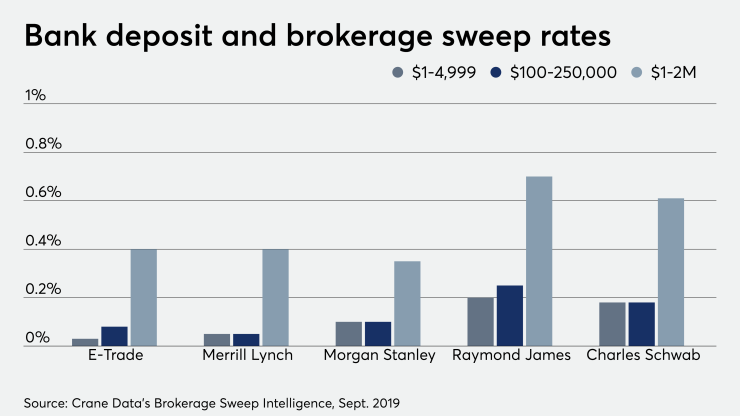

As commissions fall, firms like Robinhood gain revenue through means such as

“Robinhood and other brokers have proven that it’s a great sales practice to label trading as ‘free,’ even when we all know the money has to come from somewhere,” Tyler Gellasch, executive director of Healthy Markets Association, said in an email.

TD Ameritrade continues to face a class action lawsuit from 2014 around whether or not the company sought best execution, or instead routed clients' orders to market centers that pay TD Ameritrade the most, according to the firm’s 2018 annual report.

The company “intends to vigorously defend against this lawsuit,” according to the report. The company spokesman said the company wouldn’t comment on pending litigation.

Gellasch contemplated whether trade execution would adjust at Schwab as a result of them dropping commissions.

"The very interesting question will be for Schwab's customers: How does their execution quality change? How will Schwab change, if at all, how it routes customers' orders?" he said.

ADVISORS NEXT?

As custodial fees compress, it’s possible that custodians may start charging advisors for services.

Mark Tibergien, CEO of Pershing Advisor Solutions, said he found it “inevitable” that advisors will have to pay for at least some of custody at some point in the future in an interview with Financial Planning in June.

“If costs keep coming down, there now is really only one place to look for it,” Tibergien said.

David Canter, head of Fidelity’s RIA segment, agreed in a July interview with Financial Planning.

“With all the changes in the industry, whether it's commission prices going lower, the level of payments that product sponsors will pay. ... Revenue is compressing as a custodian, and it’s all connected,” he said. “The model is going to have to shift.

Until then, custodians and brokerages that decide to cut commissions will continue to take the revenue hit.

“We expect [TD Ameritrade] management to make some cost reductions, but it is hard to see how those reductions would be a major offset, especially since management has historically run a tight ship,” Shutler wrote in his report, speculating that TD Bank “will quite possibly look to take a more active role in the company’s strategy moving forward, especially with CEO Tim Hockey on his way out the door.”

While it’s a small possibility, William Blair’s Shutler said he is not ruling out the possibility of a TD Ameritrade sale down the line, citing the scarcity of scaled brokerage platforms, the quality of its technology, positioning in the RIA custody space and cross-sell potential with either a banking or asset management partner, according to the William Blair report.

The TD Ameritrade spokesman did not respond to a request for comment on the matter.

Shutler also noted that zero commissions could put pressure on traditional broker-dealers like LPL Financial, too.

Yet even as fee compression continues to sway the industry, there seems to be an optimistic reaction among advisors for what this will mean for clients.

“Anything that lowers the end cost to our clients is a positive,” Cooper said.

Still others are doubtful of the significance it will play in their own practices.

“In terms of our business, I don’t anticipate an effect,” says Lori Zager, an advisor of a practice at Ingalls & Snyder, an RIA that custodies at Schwab. She says, “$4.95 per trade on a stock is de minimis to the costs of our positions.”

While Wenk of Altruist was heartened to see other custodians drop their commissions, he says it might not be a good thing for clients on the retail side.

“It will likely make people trade more, which is usually a bad idea,” he said yesterday, in an email.