The dominant growth of ETFs in wealth management is no secret, and according to a 2016 survey conducted by the Journal of Financial Planning and the FPA Research and Practice Institute, their popularity among financial advisers is showing no signs of slowing.

For the second year in a row, ETFs topped the list as the investment product of choice, with 83% of survey respondents indicating that they currently hold ETFs in client portfolios or are recommending ETFs to their clients, a modest increase from last year’s 80%.

The survey had 17 other investment options, including mutual funds (two types), cash and cash equivalents, individual stocks/ bonds, different varieties of annuities, REITs and insurance offerings.

“Index funds including ETFs have really become dominant in the industry,” says Dave Yeske, practitioner editor of the Journal of Financial Planning.

“It’s a reassuring confirmation of the general trend in the last 10 to a dozen or so years of placing a greater emphasis on passive investment strategies, as advisers start to embrace the academic evidence that passive leads to more consistent and reliable results in the long run.”

Although ETFs took the top spot, mutual funds (non-wrap) came a close second, with 80% of the 283 advisers who responded to the Journal of Financial Planning’s annual “Trends in Investing” survey using or recommending it. Cash and cash equivalents followed at 74%.

Last year marked the first time ETFs surpassed its perennial rival since the first survey was conducted a decade ago in 2006. Back then only 40% of advisers said they used or recommended ETFs, compared to 85% for mutual funds (non-wrap).

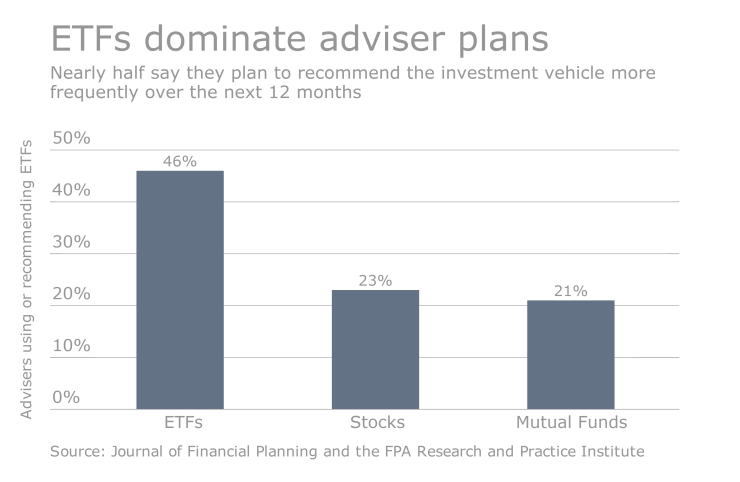

Not only are advisers actively employing ETFs as a core strategy in portfolio building, they also expect to expand on that approach, according to the Journal’s report. Close to half of the respondents, most of whom identified as independent IARs/RIAs and almost all held CPF designations, stated that they plan to increase the use/recommendation of ETFs in the next year. Other investment vehicles showed far less expected usage; individual stocks came in second at 23%.

Mutual funds did even worse; for both wrap and non-wrap programs, only about a fifth of advisers declared that they will use/recommend the investment more.

“Lower costs” were cited as the principal advantage of ETFs over mutual funds, with 75% of advisers supporting the view. Tax efficiency, trading flexibility and transparency of holdings were some other notable reasons.

Yeske, who started as a financial planner in 1990 and was the chairman of the Financial Planning Association in 2004, added that in addition to those reasons and the general shift toward passive management, the dramatic growth in the variety of ETFs is also a chief contributor to their enduring popularity.

“ETFs track every kind of index now… which leads to greater exposure and a rising propensity for advisers to be more creative in their management approach.”

In contrast to regular ETFs, smart beta ETFs did not receive nearly as much support from advisers. According to the Journal of Financial Planning’s analysis, “although the concept of “smart beta” continues to get media attention, and fund providers continue to release new ETFs products in this category, survey results indicate that only 24% of advisers have used smart beta ETFs with clients in the last 12 months.” Nevertheless, that figure is a slight 2% increase from last year.

For Yeske, this finding is no surprise. He attributes it to the fact that “smart beta” methods of tweaking the index weight so it’s skewed more towards value stocks is nothing new. He says it’s just a new term for an old strategy, and advisers know this.

Looking ahead, Yeske believes ETFs are here to stay and will not be easily outdone by other products. In his view, most other investment vehicles introduced in the past that reached the same level of popularity as ETFs have done today were mere fads.

“Other things will come along, but they won’t surpass ETFs,” says Yeske.