Mutual funds logged another brutal week, posting its third outflow this year, according to the Investment Company Institute.

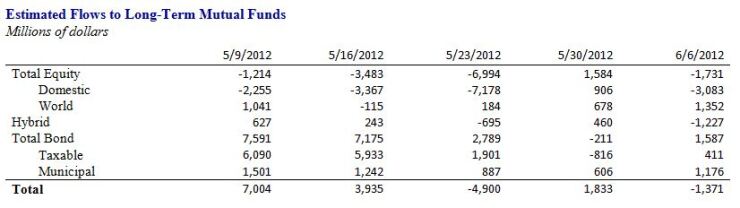

In the week ended June 6, investors withdrew an estimated $1.37 billion from long-term mutual funds, the third largest outflow this year.

The year’s biggest outflows took place the weeks ended January 4 and May 23, when $5.38 billion and $4.90 billion, respectively, were pulled from mutual funds.

Once again, U.S. equity funds took the brunt of the most recent drubbing, losing an estimated $3.08 billion in outflows, a sharp reversal from the previous week’s $906 million inflow. The outflow was less than half the $7.2 billion outflow the week ended May 23.

Non-U.S. stock funds, meanwhile, attracted $1.35 billion in inflows in the week ended June 6, almost double the $678 million inflow a week earlier.

Hybrid funds — those that invest in both stocks and fixed income securities — also took a beating, losing an estimated $1.23 billion in outflows for the week. They took in $460 million the previous week.

Bond funds helped save the day, claiming an estimated $1.59 billion in inflows, the biggest infusion of any fund category that week. Of the $1.59 billion, $1.18 billion went to municipal bond funds with the remaining $411 million going to taxable bond funds.

The weekly fund flow estimates are derived from data covering more than 95% of industry assets, according to ICI. The statistics cover long-term mutual funds, those the ICI defines as investing in long-term instruments.