A dozen years after launching her independent RIA, financial advisor Zaneilia Harris is glad she made the decision to drop any brokerage affiliation.

“A lot of opportunities opened up that I just wasn't aware of,” said the founder of Upper Marlboro, Maryland-based Harris & Harris Wealth Management. “I know that if I had stayed on the broker-dealer side, then I would have been cramped in regards to how I built my practice.”

Harris noted, however, that she isn’t fee-only because she has retained her insurance license and said that the decision about whether to work with a BD when going independent depends on the structure of each individual practice now and into the future.

It’s a significant choice that’s part of the several hundred breakaway moves to the independent channel each year. The balance between an advisor’s need for flexibility in their business plan and the burden of tasks like practice compliance presents complex questions that planners answer differently. Some detect shifts among BDs that are tipping the pendulum back in their favor after it swung so far to the RIA side in recent years.

Amid the recruiting and retention threat to independent BDs, the firms are becoming more open to, for example, working with multiple custodians, said Kashif Ahmed of Bedford, Massachusetts-based American Private Wealth.

“A lot of these companies are saying, ‘Hey, let's not just be one thing. Let's be whatever the advisor wants us to be,’” said Ahmed, who’s been affiliated with LPL Financial for 10 years. “Ask anybody who's ever changed firms: No matter how smooth it is, it's always disruptive. The conversation for a period of time became, ‘All the cool kids are going full RIA.’”

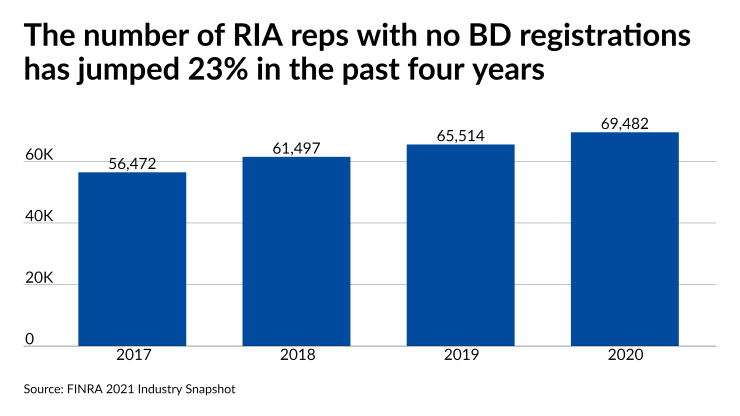

The available data offers more subtlety than may be immediately apparent from the momentum of RIAs. The number of planners and other professionals registered only as investment advisor representatives is rising by several thousand a year, as are those who are dually registered with an RIA and a BD. Advisors going independent are, technically speaking, either one or the other. The RIA-only reps are growing faster, but from a much smaller base: they surged by 13,010 to 69,482, or 23%, in the past four years. In the same span, dually registered reps increased by 12,814 to 299,613, or 4%, despite the amount of registered reps, BDs and dually registered firms slipping each year. Many advisors are still opting to work with BDs.

Many full RIAs are happy with their choice, though. The idea of BD affiliation was “very fleeting if it crossed my mind” Danika Waddell said of when she started Seattle-based Xena Financial Planning. To help reduce the drain on time from operational duties, she works with a compliance coach and just hired a junior advisor to be a paraplanner. Conflicts of interest from proprietary products and platforms were the “biggest component” making her balk at BDs, she said.

“I have a lot more flexibility to do what I want to do in the RIA space,” Waddell said. “That's the flip side of not having a compliance department. I don't have to get approval before writing my latest blog post or posting something on social media.”

Other RIA-only advisors say they feel a similar lack of constraints in their businesses. Harris’ fully independent RIA enabled her to find and share her voice as a Black woman while helping her to identify and develop her practice’s focus on professional women as clients, she said. At the same time, advisors who have commission business should think carefully about “the pay structure you have now and the pay structure that you envision in the future,” Harris said.

“I know that our industry is changing in that area, even at your big brokerage institutions as well, but you have to look at that because you have to eat,” she said. The need to provide for your family, she added, doesn't simply “go away because of an idealistic approach of being in this business.”

Existing commission business, the ability to offer more kinds of products and services to clients, and upfront bonus money often draw advisors to a BD relationship when going independent, recruiter Mark Elzweig said. Higher potential selling multiples down the line and easier regulatory supervision from the SEC compared to FINRA attract others to the full RIA side. Despite some regulators, advisors and others decrying commission business “as somehow illegitimate or implying it's a ripoff,” the decision depends on the practice, he said.

“When you're an RIA, you basically have the freedom to choose your own technology stack,” Elzweig said. “Some people think, ‘This is great, I can mix and match.’ Some people feel, ‘Wow this is a tedious distraction. Give me something turnkey so I don't have to deal with this.”

Consultant Jeffrey Czajka, the former head of LPL’s Independent Advisor Institute, launched San Diego-based Advisor Growth Solutions this year with an eye toward helping planners make such decisions for their practices. He advises them to conduct a cost-benefit analysis about the value that a BD could potentially add to a practice by removing compliance burdens.

The question of using a BD or going full RIA is “a popular conversation topic” among advisors going independent, but not one that’s likely to change the mission of their practices, he said.

“You're still there to serve your clients and help them achieve their financial goals,” Czajka said. “That doesn't change in either of the two structures.”

For Ahmed, advising clients on 529 plans or insurance products has always been the better option than sending them elsewhere. He gets tired of division in the industry between the BD and RIA channels and discussions of whether advisors are fee-only or fee-based, he said.

“It further confuses people even more,” Ahmed said. “If one works for you, you don't need to demonize others.”