An insurer and wealth manager has tapped a veteran executive who will be the first woman, Black person or member of any minority group to be its CEO.

The 111-year-old Ohio National Financial Services is promoting Barbara Turner from COO, effective Jan. 1, after the retirement of current CEO Gary “Doc” Huffman, the firm

Her hiring stands out in the industry. Just 1% of the more than 100,000 executives, senior-level officials and managers in finance and insurance were Black women in 2018,

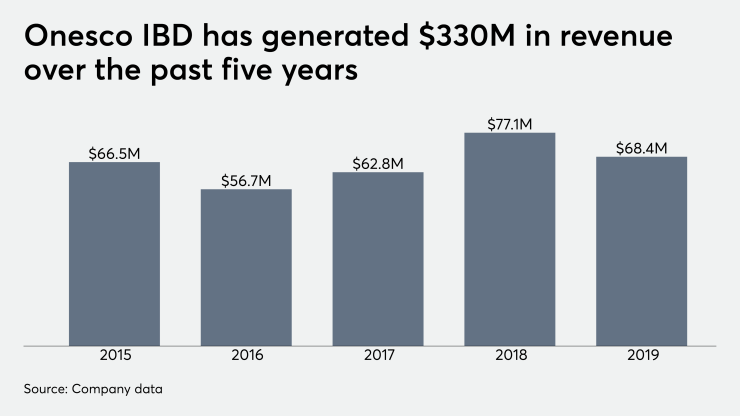

Although Onesco is one of the smaller of the midsized IBDs with annual revenue of $68 million in 2019, it’s one of

“Our financial advisors should know that the role that they serve is a critical role, a noble role,” Turner says. “Investors and policyholders need them now more than ever.”

In 2019, the firm generated $171.1 million in earnings on direct life insurance premiums and fee revenue of $1.14 billion,

While the firm has won dismissal of at least two putative class action claims, it still faces other cases involving commission trails filed by IBDs and financial advisors in multiple jurisdictions, the legal news website

“We will continue to evaluate whether we want to expand those offerings depending on market demand and the overall environment,” Turner says.

Huffman will have served as her predecessor in the CEO role for a decade when he steps down at the end of the year. He remains chairman of the company’s board.

One thing was made clear at the annual event: There’s more work to be done.

"Our view must be focused on the future, and the seamless transition of leadership is critical to our policyholders, customers and associates," Huffman said in a statement. He added that Turner has “the talent, focus and energy to lead” the firm, as well as “a deep passion and respect for the positive difference insurance and financial services make in the lives of others.”

In addition to being COO and CEO of the IBD, Turner has been the firm’s chief administrative officer, chief compliance officer and the head of O.N. Investment Management. She started her financial career in banking and later moved on to Reynolds DeWitt Securities before joining Ohio National.

“I feel I've made a meaningful contribution to the success of the organization, so it's very nice to be recognized,” Turner says. The appointment, she added, brings “a sense of pride and a sense of obligation to make sure I'm really lifting as I climb.”