The nation’s largest independent broker-dealer is learning how to get bigger better.

LPL Financial secured commitments from advisors serving 95% of Waddell & Reed’s wealth management client assets, compared to

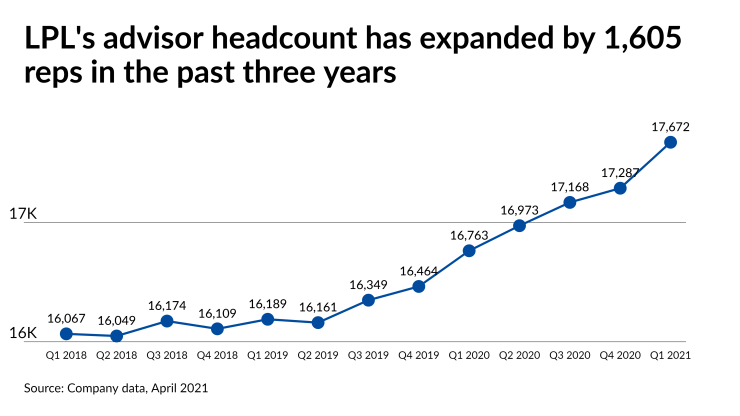

More than 900 Waddell & Reed financial advisors will add to LPL’s rising headcount of 17,672 representatives in coming months, along with

“If you look at the drivers of the difference in these two transactions, I think most of it [was] activities that we control or drive — where we maybe didn't do them as well back in 2017, ‘18 and we did them much better today — things like being able to automate and streamline the transition of assets and advisors moving from one place to the next,” Arnold said,

“Our ability to take a strategy,” he continued, “and go deliver it in a simple articulate manner to help advisors understand what that experience would be like — what their structure, what their economics will be like on the other side of that transaction — and do it at pace and clear, you begin to create the right dialogues very quickly that lead to good outcomes.”

In light of the lessons from the two deals, he added that, with respect to whether the firm will make more deals, “based on our strategy, the absolute answer would be yes.”

LPL also disclosed other metrics from its acquisition of the Overland Park, Kansas-based wealth manager that prompted CFO Matt Audette to update the company’s forecasts after the first quarter. The company now expects to spend $110 million worth of onboarding costs including transition assistance on top of the price tag. Its first estimate was $85 million. Due to the 95% retention, though, the annual EBITDA from the deal is $80 million — up from $50 million.

The “better-than-expected” retention and growing use of LPL’s portfolio management technology and services among advisors led analyst Pauline Bell of CFRA Research to boost the firm’s 12-month price target by $10 to $175 per share, Bell said in a note.

LPL’s last onboarding after a big acquisition didn’t go quite as smoothly: the firm

The 95% retention from Waddell and Reed matches the level of production that rival Advisor Group kept in its fold when its largest IBD, Royal Alliance Associates,

LPL competitors like Advisor Group and

“Waddell & Reed advisors are seasoned and well-regarded throughout the industry and are a strong cultural and strategic fit with us,” Arnold said in a statement after the close of the deal. “Waddell & Reed and Macquarie have been strong partners throughout the process, and we look forward to our ongoing collaboration.”