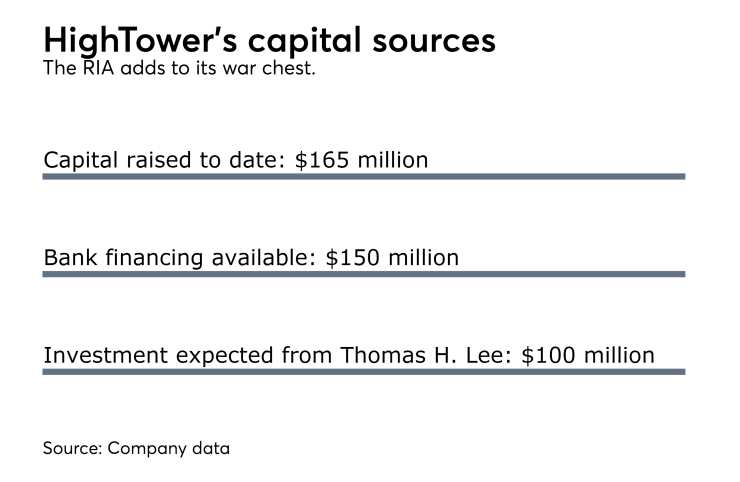

Upending months of speculation that HighTower Advisors would be sold, the Chicago-based RIA aggregator is now armed with a cool $100 million to spur growth.

The aggregator and platform provider, which has

"It's an exciting deal," says M&A consultant David DeVoe. "It's a vote of confidence in HighTower and the RIA model by an experienced and well-respected PE firm. And it gives HighTower a substantial war chest to continue what they're doing and accelerate their M&A activity."

Industry analyst Chip Roame agreed.

"This is a great capital raise by HighTower and allows it to grow much further," Roame says. "It's also a powerful endorsement of the wealth management market by Thomas H. Lee and a great strategy on their part."

THL, whose financial holdings include First Bancorp, "proactively sought out HighTower as [an] ideal partner," managing director Ganesh Rao said in a statement, "because the private equity firm wants "to be at the forefront of the changes disrupting the wealth management space."

WHERE THE MONEY WILL GO

The deal provides capital for HighTower's "next phase of growth," the firm said, as well as liquidity for advisors with vested shares and some of HighTower's large institutional investors.

David Pottruck, the former CEO of Charles Schwab and the chairman of HighTower's board, will remain one of the largest individual investors in the company, HighTower said in a statement.

Elliot Weissbluth, HighTower's co-founder and CEO, and Doug Brown of DLB Capital, HighTower's first large institutional investor, are not selling any equity in the transaction, "reflecting their continued confidence in HighTower's future," the company said.

HighTower advisors with vested shares will be able to sell their shares to HighTower on the same terms as the RIA's institutional investors, a spokeswoman said.

"Advisors are going to compare Lee's valuation of HighTower with the value of their own business," one partner who did not want to be identified says. "If the firm is valued at a higher price than its most recent valuation [estimated to be approximately $500 million] advisors are likely to stay. If not, they are more likely to leave."

The deal is THL's first investment in the RIA space. However, the firm's founder, Thomas Lee, left in 2006 to form Lee Equity Partners, which once owned Edelman Financial Services and, more recently,